Bank of America Certified Bank Check: A Secure Payment Solution

In an era dominated by digital transactions, it's easy to forget about the traditional methods of payment. Yet, certain situations call for a higher level of security and guarantee, especially when large sums of money are involved. Enter the Bank of America certified bank check, a reliable and time-tested financial instrument.

Imagine you're about to close on your dream house. You need to provide a substantial payment, and a personal check just won't cut it. This is where a certified bank check, sometimes referred to as a cashier's check, steps in. It acts as a promise from the bank itself, guaranteeing the funds are available, offering peace of mind for both you and the recipient.

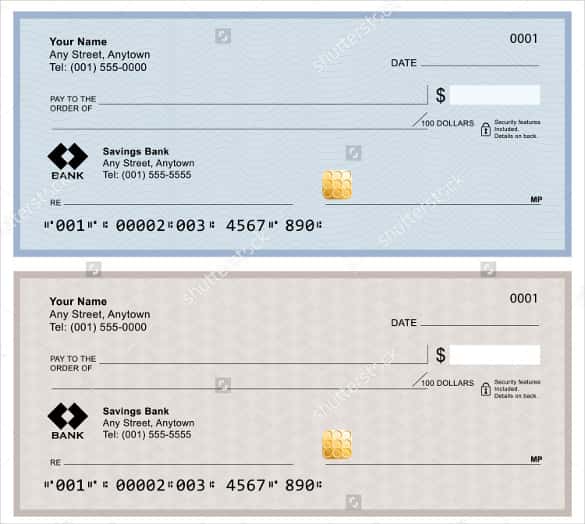

The beauty of a Bank of America certified bank check lies in its simplicity and security. Unlike a personal check that draws funds from your account upon deposit, a certified check sees the bank immediately debit your account for the specified amount. These funds are then held specifically for the check, ensuring its clearance upon presentation. This mechanism eliminates the risk of insufficient funds and provides a level of assurance that personal checks simply can't match.

But the benefits don't stop there. A Bank of America certified bank check carries the weight and reputation of the bank itself. This enhances its credibility, making it a preferred payment method for transactions where trust is paramount, such as real estate deals, legal settlements, and high-value purchases.

However, like any financial tool, it's crucial to understand the nuances before using a Bank of America certified bank check. This article delves into the intricacies of this payment method, exploring its benefits, drawbacks, and how it can be a valuable asset in your financial toolkit.

Advantages and Disadvantages of Bank of America Certified Bank Check

| Advantages | Disadvantages |

|---|---|

| Guaranteed Funds | Potential Fees |

| Increased Security | Limited Availability |

| Enhanced Credibility | Risk of Loss or Theft |

While Bank of America certified bank checks offer a secure way to make payments, they may not be readily available at all branches. It's best to contact your local branch or check online for availability and requirements.

Bank of America certified bank checks are generally safe; however, they are still susceptible to loss or theft. If you lose a certified bank check, it's crucial to contact Bank of America immediately to initiate a stop payment and potentially obtain a replacement.

Common Questions About Bank of America Certified Bank Checks

1. How do I get a certified bank check from Bank of America?

You can obtain a certified bank check by visiting your local Bank of America branch. It's advisable to call ahead to confirm availability and required documentation.

2. What information do I need to provide to get a certified bank check?

You will need to provide your account information, valid identification, the exact amount for the check, and the payee's name.

3. How much does a Bank of America certified bank check cost?

Fees for certified bank checks can vary. It's best to check with Bank of America directly for current fees.

4. Can I cancel a Bank of America certified bank check?

While canceling a certified bank check can be complex, it might be possible under certain circumstances. Contact Bank of America as soon as possible if you need to explore canceling a certified check.

5. How long is a Bank of America certified bank check good for?

Certified bank checks generally do not have an expiration date; however, it's wise to use them within a reasonable timeframe.

6. What happens if a Bank of America certified bank check is lost or stolen?

If your certified bank check is lost or stolen, contact Bank of America immediately to report the issue. They can guide you through the process of potentially obtaining a replacement.

7. Can I track a Bank of America certified bank check?

While tracking a certified bank check directly might not be possible, you can confirm if it has been deposited by contacting Bank of America or checking your account statements.

8. What is the difference between a Bank of America certified bank check and a money order?

Both are secure payment methods; however, certified checks are issued by banks, while money orders are typically available at post offices, retail stores, and some financial institutions.

Conclusion

In the world of financial transactions, security and trust remain paramount. While digital payment methods continue to rise, certain scenarios call for the assurance that only a Bank of America certified bank check can offer. Understanding its benefits, drawbacks, and how to obtain one empowers you to navigate high-value transactions with confidence. Remember, responsible financial management involves selecting the appropriate tool for the job, and in specific situations, a Bank of America certified bank check might just be the perfect fit.

Bust a move in style your guide to party 80s mens fashion

Skelly tequila reposado review a toast to flavor

The power of filipino love poems exploring tula tungkol sa pag ibig sa kapwa