Can You Deposit a Check Signed Over to You at Chase?

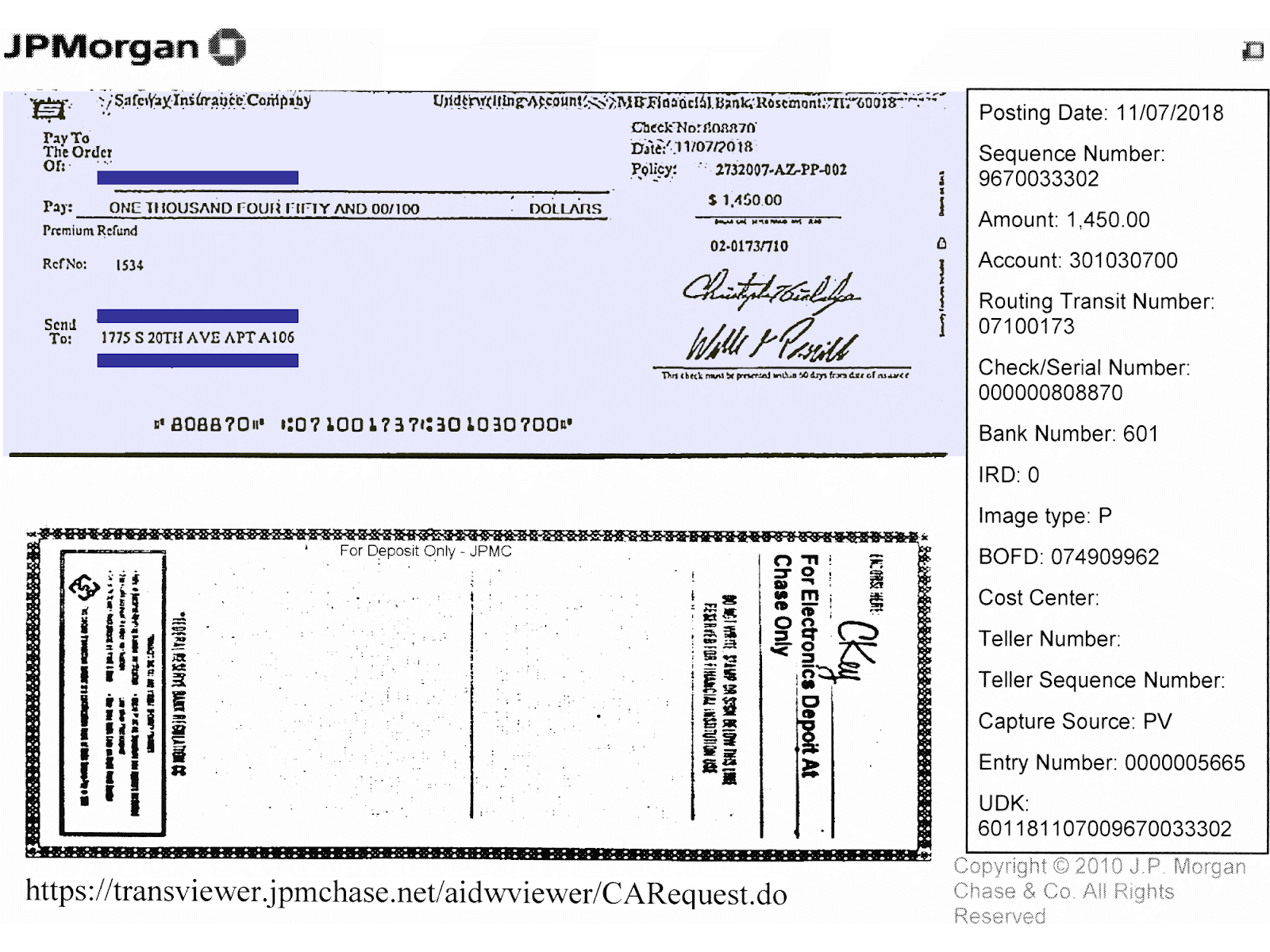

Have you ever received a check made out to someone else, and they've signed it over to you? This is called a third-party check, and it can raise questions about whether you can actually cash or deposit it. If you're holding a check like this and wondering if Chase Bank will accept it, you're in the right place. We'll unravel the ins and outs of depositing a signed-over check at Chase Bank.

It's important to understand that banks are generally cautious about third-party checks due to the heightened risk of fraud. Since the check involves multiple parties, the potential for issues like forgery or disputes increases.

While Chase does not explicitly state on their website whether they accept third-party checks, anecdotal evidence and general banking practices suggest they may allow it on a case-by-case basis. This means that depositing a check signed over to you at Chase might be possible, but it's not guaranteed. Several factors come into play, and the final decision rests with the bank.

Let's explore the factors that could influence Chase's decision and what steps you can take to increase the likelihood of your check being accepted.

One crucial aspect is your relationship with Chase Bank. If you're an existing customer with a good banking history, including regular deposits and a positive account balance, Chase may be more inclined to accept the third-party check. On the other hand, if you're a new customer or have a history of overdrafts or other issues, the bank might be hesitant.

Advantages and Disadvantages of Accepting Signed-Over Checks

| Advantages | Disadvantages |

|---|---|

| Convenient way to receive funds | Higher risk of fraud and disputes |

| May be accepted on a case-by-case basis | Can be subject to delays in funds availability |

Best Practices for Depositing Signed-Over Checks

While there's no guaranteed method to ensure Chase will accept a third-party check, these practices can improve your chances:

- Verify the Check's Authenticity: Before you even consider depositing the check, scrutinize it for any signs of tampering or forgery. Ensure all the information is correct, including the payee's name, the amount, and the signatures.

- Communicate with Chase: It's wise to contact Chase directly or visit your local branch to inquire about their specific policies regarding third-party checks. Explain your situation and ask about their requirements.

- Be Prepared to Provide Documentation: Chase may request additional documentation to verify the check's legitimacy. This could include a valid government-issued ID, proof of address, or even a written statement from the original payee confirming the endorsement.

- Be Aware of Potential Delays: Even if Chase accepts the signed-over check, they might place a hold on the funds for a longer period compared to a regular check. This is because of the increased risk associated with third-party instruments.

- Consider Alternatives: Depending on the situation, it might be worth exploring alternative methods of transferring funds. For instance, the original payee could consider depositing the check themselves and then sending you the money through a bank transfer or a mobile payment app.

Common Questions and Answers

Q: Is it legal to deposit a check signed over to me?

A: Yes, it is generally legal to deposit a check signed over to you, as long as it was endorsed properly by the original payee.

Q: What does it mean to endorse a check?

A: Endorsing a check means signing the back of the check to authorize its negotiation. In the case of a third-party check, the original payee would sign their name on the back.

Q: Can I deposit a signed-over check at a Chase ATM?

A: It's unlikely. Depositing a third-party check through an ATM is generally discouraged due to the increased risk of fraud. It's best to visit a branch or contact Chase for guidance.

Q: How long does it take for a signed-over check to clear at Chase?

A: The clearing time for a signed-over check at Chase can vary depending on factors such as the check amount and your banking history. Be prepared for a longer hold period compared to regular checks.

Q: What happens if there's a problem with the signed-over check?

A: If issues like insufficient funds or a dispute arise with the signed-over check, Chase could reverse the deposit, potentially resulting in fees or negative balances on your account. You might also be required to deal with the original payee and the check writer to resolve the matter.

Tips and Tricks

Here are some additional tips to keep in mind when dealing with signed-over checks:

- If possible, have the original payee accompany you to the bank when depositing the check.

- Maintain clear communication with the original payee throughout the process in case any issues arise.

- Consider the risks and explore alternative methods of receiving funds if you have concerns about accepting a third-party check.

In conclusion, while Chase Bank doesn't explicitly prohibit accepting signed-over checks, their policy seems to be on a case-by-case basis. Following the best practices outlined in this article can increase your chances of a successful deposit. However, always remember that third-party checks come with inherent risks, and exploring alternative payment methods might be a safer and more efficient approach.

Sparkling pontoons your guide to essential cleaning accessories

Gift ideas days out experiences theyll never forget

From street art to screen unleash your creativity with a font generator graffiti text

![Chase ATM & Mobile Check Deposit [Availability and Limits]](https://i2.wp.com/checksforcashnearme.com/wp-content/uploads/2024/03/Chase-bank-mobile-check-deposit-300x200.jpg)

/how-to-endorse-checks-315300-156cf43ec02848b9b6ac30864994d91a.jpg)