Cara Semak No Cukai Pendapatan: Your Guide to Malaysian Tax Identification

Navigating the world of taxes can feel like venturing into uncharted territory, especially in a new country. If you're a taxpayer in Malaysia, you know the income tax number, or "No Cukai Pendapatan," is your passport to a smooth tax filing experience. But what if you've misplaced this vital piece of information? Fear not! This article guides you on how to retrieve or verify your Malaysian income tax number.

Imagine this: you're about to file your taxes online, a process designed for speed and convenience. Suddenly, you realize you can't recall your tax number. Panic sets in, right? Knowing how to quickly and easily check your income tax number can save you time, stress, and potential penalties.

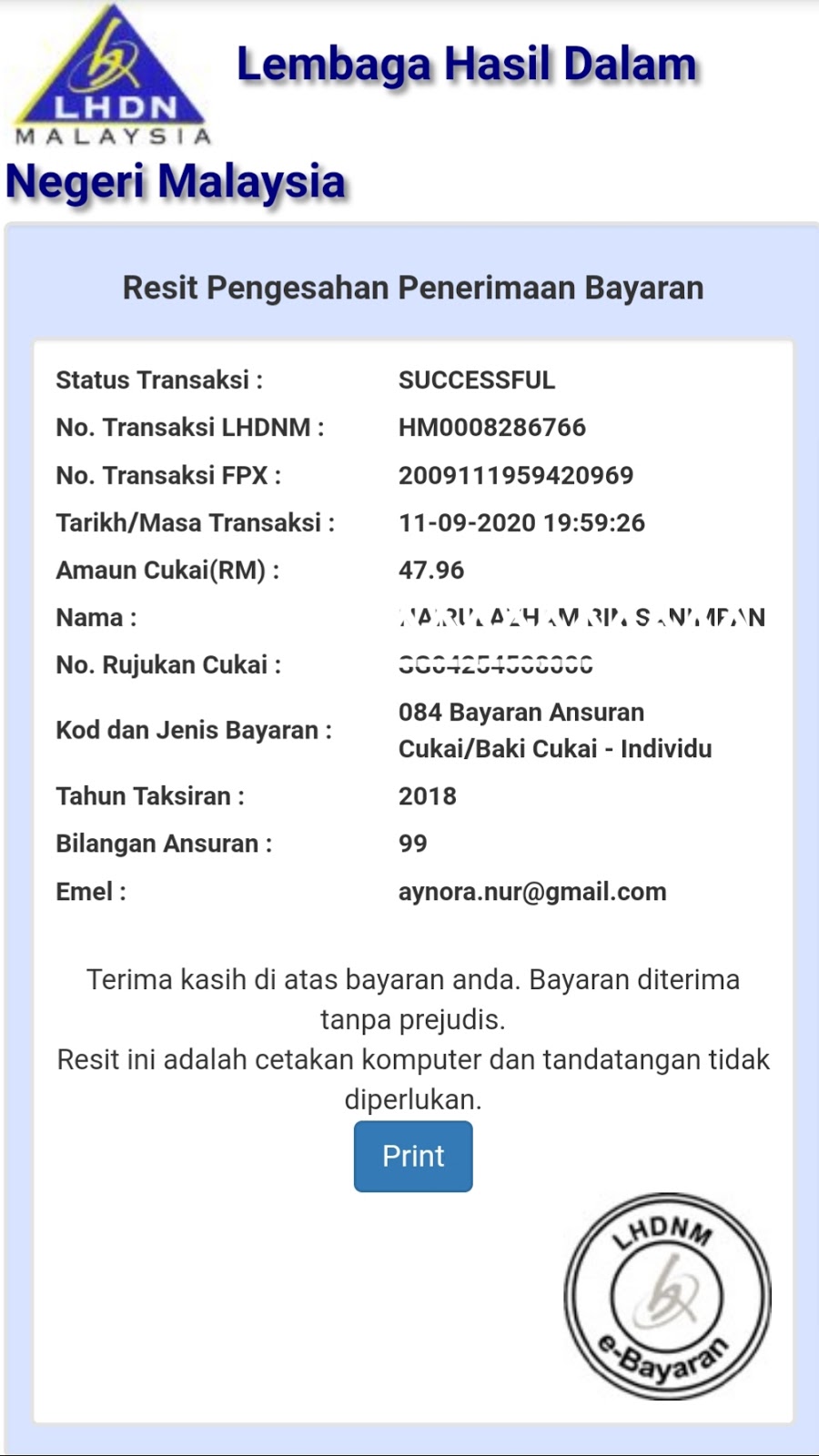

In Malaysia, your income tax number, officially known as "Nombor Cukai Pendapatan," is a unique identifier assigned to every individual or business registered with the Inland Revenue Board of Malaysia (LHDN). This number is crucial for fulfilling your tax obligations, from filing returns to claiming refunds.

Understanding the process of checking your income tax number is essential for every taxpayer in Malaysia. It ensures you have the necessary information readily available, allowing you to navigate the tax system confidently.

While retrieving your tax number might seem like a daunting task, rest assured, it's a relatively straightforward process. The LHDN provides several avenues to access this information, ensuring a hassle-free experience for taxpayers.

Advantages and Disadvantages of Knowing Your Income Tax Number

| Advantages | Disadvantages |

|---|---|

| Essential for filing tax returns accurately and on time. | Misplacing or forgetting your tax number can cause delays and inconvenience. |

| Facilitates seamless online tax filing and payment. | Security concerns if your tax number falls into the wrong hands. |

| Necessary for accessing various tax-related services and benefits. |

Best Practices for Managing Your Income Tax Number

1. Secure Storage: Store your tax number in a safe and easily accessible location, separate from your wallet or identification documents.

2. Digital Copies: Create digital copies of your tax identification documents and store them securely. Password-protected files or encrypted drives are recommended.

3. Memorization: Consider memorizing your tax number to avoid reliance on physical or digital records.

4. Update Contact Information: Inform the LHDN immediately if there are any changes to your contact details, ensuring you receive important tax-related communication.

5. Beware of Phishing: Be cautious of suspicious emails or phone calls requesting your tax information. The LHDN will never solicit personal details through such methods.

Common Questions About Malaysian Income Tax Number

1. What is the format of a Malaysian income tax number?

2. Can I check my tax number online?

3. I've lost my income tax registration certificate. How do I obtain a replacement?

4. I've recently changed my name. Do I need a new income tax number?

5. How long does it take to receive a new income tax number?

6. What should I do if I suspect my tax number has been compromised?

7. Can I use my old income tax number after getting married?

8. Is there a fee for checking my income tax number?

This comprehensive guide provides you with the essential knowledge to confidently manage and verify your Malaysian income tax number, ensuring a smoother tax journey. Remember, staying informed and organized are key to navigating the complexities of the tax system with ease.

Unveiling the mystery your guide to understanding les resultats du quinte

Deciphering the default your guide to standard font sizes for letters

Supercharge your microsoft account the power of adding a phone number