Contoh Surat Permohonan Permintaan Cek Giro: A Comprehensive Guide

In the world of financial transactions, ensuring clarity and security is paramount. Whether you're a business owner dealing with large sums or an individual making a significant purchase, having the right tools at your disposal can make all the difference. This is where understanding the concept of "contoh surat permohonan permintaan cek giro" comes in, particularly if you're navigating financial processes in Indonesia.

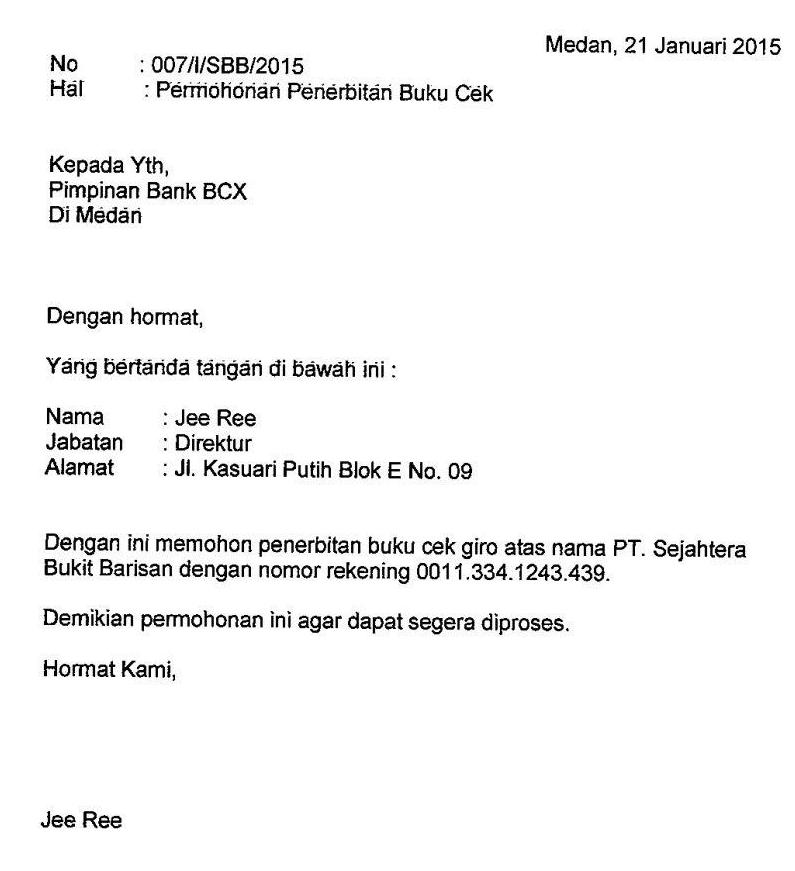

Let's break down this phrase. "Contoh" translates to "example," "surat" means "letter," "permohonan" signifies "request," "permintaan" implies "demand" or "asking," "cek" refers to a "check," and "giro" indicates a "demand draft" or a type of check that offers a higher level of security. In essence, this phrase refers to an example of a formal letter used to request a cashier's check or a demand draft.

Why is this important? Unlike a regular personal check, a cashier's check is drawn directly from the bank's funds, providing a guarantee of payment to the recipient. This makes it a preferred method of payment for large transactions where trust and security are essential, such as real estate purchases, business deals, or other significant financial obligations.

Now, imagine needing to request such a check. You'd want to ensure your request is clear, professional, and leaves no room for misinterpretation. This is where having access to a "contoh surat permohonan permintaan cek giro" becomes invaluable. It provides a structured template that you can adapt to your specific needs, ensuring you include all the necessary details and present your request formally and correctly.

Understanding the nuances of financial transactions can be daunting, especially when dealing with unfamiliar terms and processes. However, having the right resources at your disposal, like a "contoh surat permohonan permintaan cek giro," can empower you to navigate these complexities with confidence, ensuring your financial dealings are smooth, secure, and efficient.

Advantages and Disadvantages of Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Less Convenient |

| Increased Security | Potential Fees |

| Faster Processing | Limited Availability |

Best Practices for Using Cashier's Checks

While having a template for your request is helpful, there are broader best practices to keep in mind when dealing with cashier's checks:

- Verify Details: Before submitting your request, double-check all information on the check, including the recipient's name, amount, and date. Errors can lead to delays and complications.

- Secure Handling: Treat the cashier's check as you would cash. Keep it in a safe place and avoid damage or loss.

- Timely Deposits: Deposit the check as soon as possible to avoid potential issues with expiration dates or holds.

- Maintain Records: Keep copies of the check request, receipt, and any communication related to the transaction for your records.

- Communicate Clearly: Inform the recipient about the method of payment and provide them with the check details to ensure a smooth transaction.

Navigating financial processes in any language can seem complicated, but having a solid understanding of the tools and best practices can make a significant difference. Whether you're a seasoned business owner or an individual making a large purchase, remember that resources and information are your allies in ensuring your transactions are secure, efficient, and successful.

Boost your brain large print word searches for seniors

Small bathroom designs 5x5 big ideas for tiny spaces

Stitch up some style the cutest background wallpapers for your tablet