Crafting a Valid and Effective Power of Attorney: A Comprehensive Guide

Have you ever considered what would happen if you were temporarily unable to manage your affairs? An accident, illness, or even a planned absence could make it difficult to handle financial transactions, legal matters, or healthcare decisions. This is where a power of attorney (POA) becomes invaluable. A well-drafted POA grants a trusted individual the authority to act on your behalf, ensuring your wishes are respected and your interests are protected.

Creating a valid and effective power of attorney is crucial for safeguarding your future. This comprehensive guide will explore the intricacies of crafting a POA, from understanding its purpose and different types to navigating the legal requirements and avoiding common mistakes. Whether you're planning for the unexpected or simply streamlining your daily life, understanding how to construct a POA is a vital step in personal planning.

The concept of granting legal authority to another person dates back centuries, with historical precedents found in Roman law and throughout medieval Europe. Historically, POAs were often used in situations where individuals were traveling long distances or were otherwise unable to manage their affairs in person. Today, POAs remain a critical tool for managing personal, financial, and legal matters.

The importance of a properly drafted power of attorney cannot be overstated. Without a valid POA, your loved ones may face significant legal hurdles in managing your affairs should you become incapacitated. This can lead to delays in essential decisions, financial complications, and emotional distress for everyone involved. A well-drafted POA provides peace of mind, ensuring your wishes are carried out even when you cannot act for yourself.

Several critical issues can arise if a power of attorney is not prepared correctly. These include ambiguity in the scope of authority granted, questions about the grantor's mental capacity at the time of signing, and potential for misuse or abuse of the granted powers. Understanding these potential pitfalls is essential for crafting a document that is both legally sound and protective of your interests.

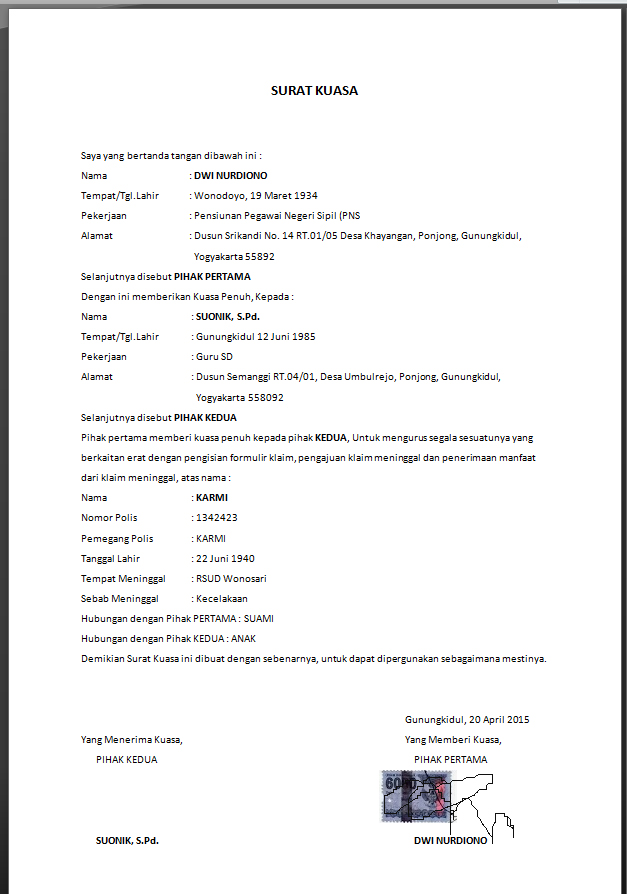

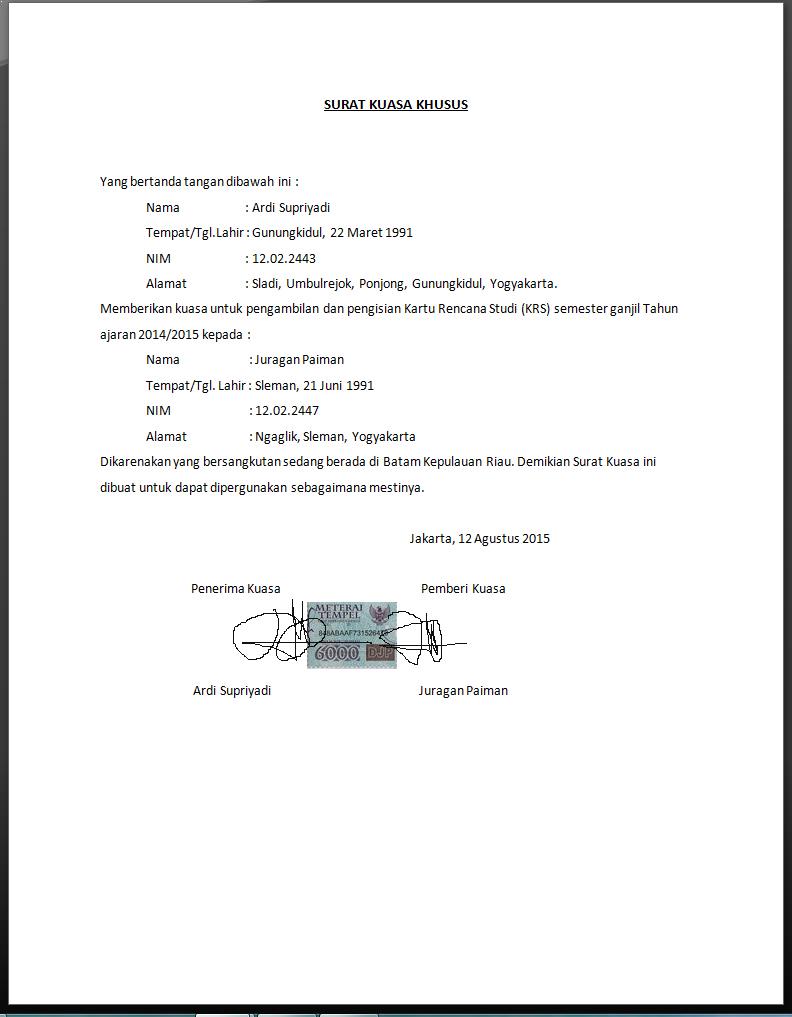

A power of attorney is a legal document that authorizes a designated person, known as the agent or attorney-in-fact, to act on behalf of another person, known as the principal or grantor. The scope of authority granted can range from specific tasks, such as signing a single document, to broad powers encompassing financial, legal, and healthcare decisions. For instance, you could grant your spouse the authority to manage your bank accounts while you're traveling abroad, or you might authorize a family member to make healthcare decisions on your behalf should you become incapacitated.

Benefits of a properly executed POA include ensuring continuity in managing your affairs, preventing financial and legal complications, and providing peace of mind for you and your loved ones. For example, a POA can allow your agent to pay your bills, manage investments, or make healthcare decisions while you are unavailable. This avoids disruptions to your financial stability and ensures your wishes are respected.

Creating a POA involves several key steps. First, consult with an attorney to discuss your specific needs and ensure the document complies with your state's laws. Next, clearly define the scope of authority you wish to grant to your agent. Finally, execute the document according to your state's legal requirements, which may include notarization or witnessing.

Advantages and Disadvantages of a Power of Attorney

| Advantages | Disadvantages |

|---|---|

| Provides for continuity in managing your affairs | Potential for misuse or abuse of power by the agent |

| Ensures your wishes are respected | Requires careful drafting to avoid ambiguity |

| Offers peace of mind | Can be revoked, which might cause complications if not handled properly |

Frequently Asked Questions about Powers of Attorney:

1. What is a durable power of attorney? (A durable POA remains effective even if you become incapacitated.)

2. Can I revoke a power of attorney? (Yes, you can revoke a POA as long as you are mentally competent.)

3. Who should I choose as my agent? (Choose someone you trust implicitly and who is capable of managing your affairs responsibly.)

4. Do I need an attorney to create a POA? (While not always legally required, consulting an attorney is highly recommended.)

5. What happens if my agent is unable or unwilling to act? (You can designate a successor agent in your POA.)

6. How do I ensure my POA is valid? (Follow your state's legal requirements for execution, often including notarization or witnesses.)

7. What are the different types of POAs? (Common types include general, durable, limited, and healthcare POAs.)

8. What should I include in my POA? (Specify the powers granted, duration of the POA, and any limitations or restrictions.)

Tips and tricks for creating a successful POA include being as specific as possible when outlining the powers granted, regularly reviewing and updating the document as needed, and keeping copies of the POA in a safe and accessible location.

In conclusion, creating a valid and effective power of attorney is a crucial step in personal planning. It provides a vital safety net, ensuring your affairs are managed according to your wishes, even when you cannot act yourself. While the process may seem daunting, understanding the key elements and seeking professional guidance can simplify the process and provide immeasurable peace of mind. Taking the time to craft a well-drafted POA is an investment in your future security and well-being, protecting your interests and empowering you to navigate life's uncertainties with confidence. By understanding the purpose, benefits, and legal requirements of a POA, you can make informed decisions and safeguard your future. Don't delay—take the first step today toward securing your peace of mind.

Crack the code mastering your chevy silverados diagnostic trouble codes

What number is the letter w unraveling the alphabets numerical mystery

Unlocking the mystery of skipthedishes skip scores