Decoding the Bank of America Cashier's Check Mystery

Ever found yourself staring at a cashier's check from Bank of America and feeling utterly bewildered? Like, is this real life? Is this just fantasy? Caught in a landslide, no escape from reality? Okay, maybe not that dramatic, but let's be honest, cashier's checks can be a bit of a head-scratcher. Especially when you need to verify it or have questions. So, let's dive into the enigmatic world of Bank of America cashier's checks and how to navigate the process.

First things first, a cashier's check is essentially a guaranteed form of payment from a bank. Unlike a personal check, the funds are drawn directly from the bank's account, not yours. This makes them more secure and generally accepted for larger transactions like buying a car or making a down payment on a house. But what happens when you need more information? What if you need to verify the check's authenticity? That's when knowing how to contact Bank of America regarding their cashier's checks becomes crucial.

Historically, cashier's checks provided a safer alternative to carrying large sums of cash. Today, their function remains largely the same, offering a secure payment method for significant purchases. However, the rise of digital payment methods adds another layer of complexity. While contacting Bank of America directly might seem like the obvious solution, the specific process can sometimes be a bit of a puzzle. There's no single, universally advertised "Bank of America cashier's check phone number." This often leads to a scavenger hunt across the bank's website or a series of phone calls.

The importance of understanding how to handle Bank of America cashier's checks cannot be overstated. It’s crucial to protect yourself from fraud and ensure smooth transactions. Think of it as adulting 101 – knowing how to deal with these financial instruments is just part of navigating the grown-up world. But where do you even start? How do you find the right information without getting lost in a maze of automated phone menus and online FAQs?

Let’s talk strategy. One approach is to contact the specific Bank of America branch that issued the cashier's check. Their number can often be found on the check itself or through the bank's online branch locator. Alternatively, contacting Bank of America's general customer service line can be a starting point, though you may need to navigate through various prompts to reach the appropriate department. Utilizing the bank’s official website is another valuable resource. Searching for "cashier's check verification" or similar terms often yields helpful information. Remember, staying informed is your best defense against potential issues.

One benefit of using a cashier's check is its perceived security. It's generally accepted as a guaranteed form of payment, unlike a personal check which can bounce. Another advantage is its traceability. Since it's issued by the bank, there's a clear record of the transaction. Finally, it provides a degree of anonymity compared to other forms of payment, as it doesn't necessarily reveal your personal banking information to the recipient.

Advantages and Disadvantages of Bank of America Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Potential for Scams if not handled carefully |

| Traceability | Less convenient than digital payment methods |

| Relative Anonymity | Fees associated with obtaining a cashier's check |

Best practices include verifying the check's authenticity directly with Bank of America, never accepting a cashier's check for more than the purchase price, and being wary of unsolicited cashier's checks.

Frequently Asked Questions:

1. How do I verify a Bank of America cashier’s check? Contact the issuing branch or Bank of America customer service.

2. Where can I find the phone number for a Bank of America branch? Use the bank's online branch locator.

3. What should I do if I suspect a cashier's check is fraudulent? Contact Bank of America immediately.

4. Can I get a refund on a cashier's check? Typically, yes, but it requires a specific process.

5. How much does a Bank of America cashier's check cost? Fees vary; contact your local branch for details.

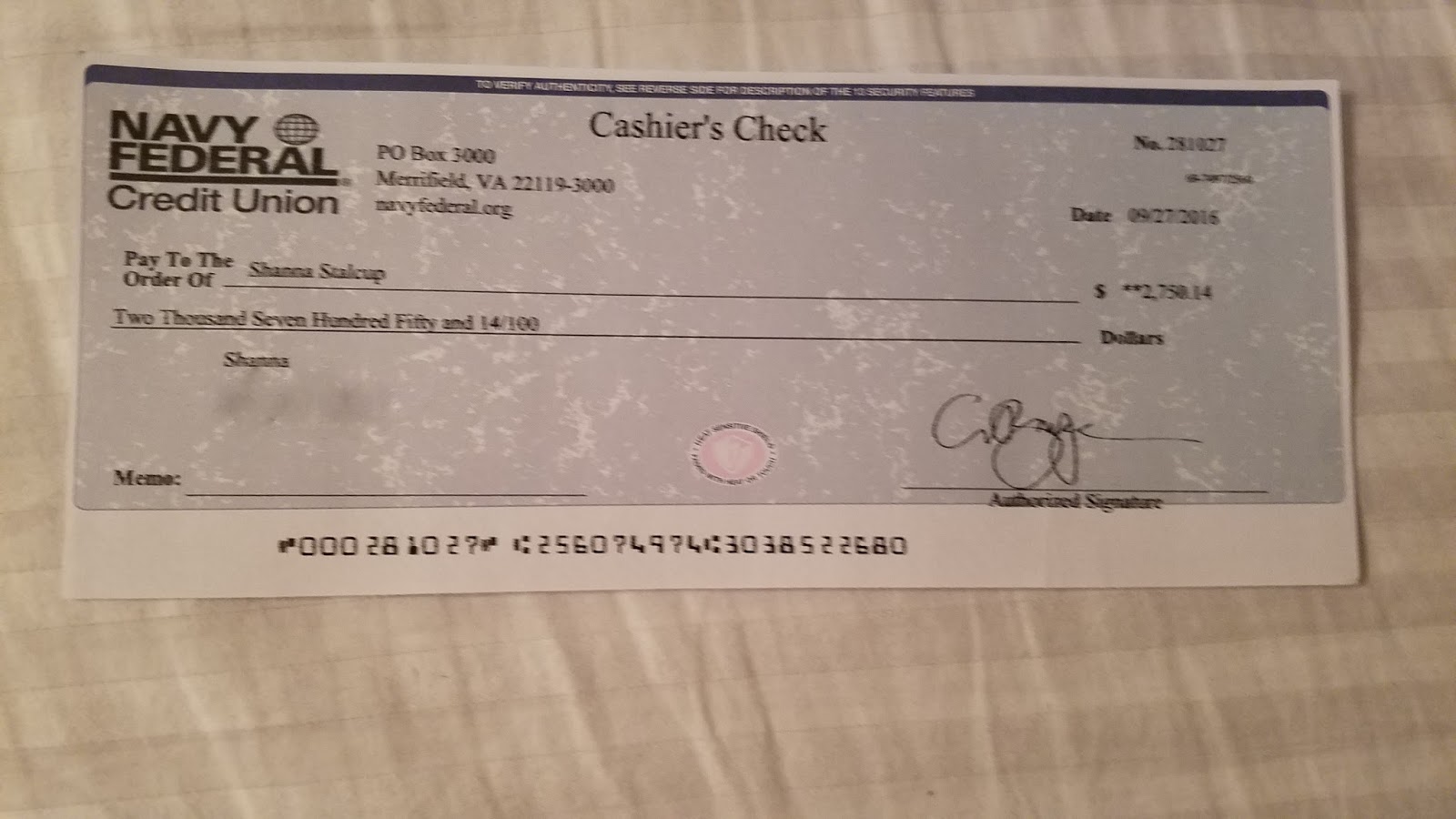

6. What information is typically on a cashier’s check? The bank’s information, the check number, the payee, and the amount.

7. Can I stop payment on a cashier’s check? Yes, contact the bank immediately.

8. What is the difference between a cashier’s check and a money order? Cashier's checks are issued by banks, while money orders are usually available at post offices and retail stores.

In conclusion, while the quest for a "Bank of America cashier's check phone number" might seem like a daunting task, understanding the various avenues available to obtain the necessary information is key. By being proactive and utilizing the resources provided by the bank, you can navigate the world of cashier's checks with confidence and avoid potential pitfalls. Remember, staying informed and being aware of best practices is crucial for ensuring safe and secure transactions. Don’t be afraid to reach out to Bank of America directly for assistance – after all, it’s their job to help you navigate these sometimes confusing financial instruments. By understanding the intricacies of cashier's checks, you'll be well-equipped to handle them like the financial guru you are.

Navigating the idaho department of corrections a guide for families

The ultimate guide to shower doors how to select the perfect one for your tub

Unlocking financial growth simple vs compound interest