Decoding the Cheque Clearing Letter Mystery

Ever found yourself staring blankly at a returned cheque, wondering what arcane ritual is required to get your money? You're not alone. The world of cheque clearing letters can seem like a labyrinth of banking jargon and formality. But fear not, intrepid fund seeker, because we're here to demystify the process and empower you to navigate the murky waters of cheque returns.

Let's face it, in the age of instant transfers and digital wallets, writing a cheque feels almost… quaint. But checks still have their place, and when they bounce, understanding the proper procedure for requesting cleared funds is crucial. This often involves composing a cheque clearing letter to your bank, a formal request to investigate and resolve the issue.

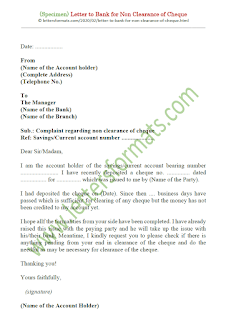

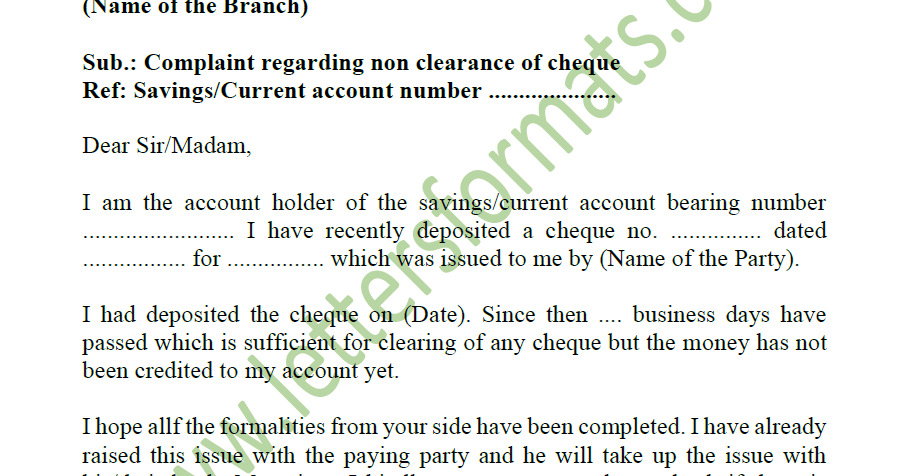

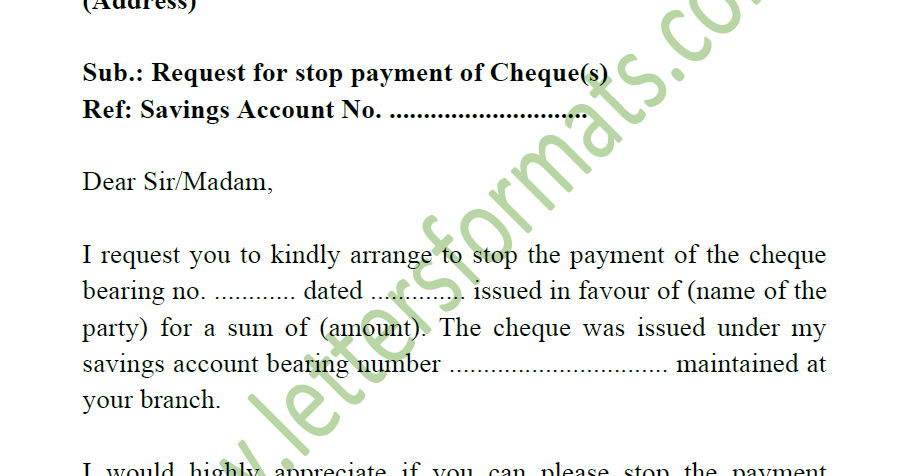

Essentially, a cheque clearing request letter acts as your official communication with the bank, outlining the details of the returned cheque and requesting their intervention. Think of it as your formal plea to the banking gods. This seemingly simple document can be the key to unlocking your rightfully earned cash. But crafting an effective letter requires an understanding of its components and purpose.

Navigating the nuances of bank procedures can be daunting. That’s why understanding the structure and content of a cheque clearing letter is vital. While the specific format may vary slightly between banks, the core elements remain consistent. A well-written letter ensures your request is processed efficiently and effectively. It's like speaking the bank's language, ensuring they understand your needs and can act accordingly.

So, what exactly goes into this magical missive? A typical request for cheque clearing typically includes details like the cheque number, date, amount, payee information, and the reason for the return. It also involves a polite but firm request for the bank to investigate the matter and facilitate the clearing of the cheque. Think of it as presenting your case to the financial judge, laying out all the evidence in a clear and concise manner.

Historically, cheque clearing involved physically transporting cheques between banks. This process was time-consuming and prone to errors. Modern systems leverage electronic clearing, significantly speeding up the process. The letter, while still important, now often serves as a trigger for the electronic investigation and resolution process.

The importance of a well-drafted cheque clearing letter cannot be overstated. It provides a clear and documented record of your request, ensuring accountability and facilitating follow-up. It also helps streamline the process, allowing the bank to quickly identify and address the issue.

One of the main issues related to cheque clearing letters is incomplete or inaccurate information. This can lead to delays and further complications. Ensuring all details are accurate and complete is crucial for a smooth and efficient clearing process.

A simple example: imagine your cheque bounced due to insufficient funds in the payer’s account. Your letter should clearly state this, along with the cheque details, and request the bank to contact the payer to rectify the situation.

While the concept of a specific "format" isn't strictly defined, adhering to business letter conventions ensures clarity. Include your contact information, the date, the bank's address, a clear subject line (e.g., "Request for Cheque Clearing"), and a professional closing. A structured approach is always best.

Advantages and Disadvantages of Using a Cheque Clearing Letter

| Advantages | Disadvantages |

|---|---|

| Provides a formal record of your request | Can be time-consuming compared to digital solutions |

| Facilitates communication with the bank | Requires physical delivery or postal service |

| Helps streamline the clearing process | Effectiveness depends on bank responsiveness |

Best practices include keeping a copy of the letter for your records, following up with the bank if you don’t receive a response within a reasonable timeframe, and ensuring all information is accurate and complete. A proactive approach can significantly expedite the process.

Frequently asked questions include: What if the cheque is lost? What if the signature doesn't match? What if the cheque is post-dated? Contacting your bank directly is always recommended in these specific scenarios.

In conclusion, the cheque clearing letter, though a seemingly archaic tool in the digital age, remains a vital instrument in resolving payment issues. Understanding its purpose, components, and best practices empowers you to navigate the banking system effectively and reclaim your funds with confidence. While the world moves towards digital transactions, mastering the art of the cheque clearing letter remains a valuable skill in the financial landscape. So, next time you encounter a bounced cheque, don’t despair, grab your pen (or keyboard), and craft a compelling letter to your bank. Your funds await!

The language of love exploring the versatile heart emoji

Unmasking i am the villain manga your online guide

Navigating the open road a look at rivians public status

/a06ec230-a1dc-4a4a-bdaf-7bc7f4e6b1d9_1.png)