Decoding the JPMorgan Chase Domestic Wire Transfer Address

Moving money quickly and securely is crucial in today's fast-paced financial world. Wire transfers offer a reliable method for transferring funds electronically, and JPMorgan Chase, a leading financial institution, provides domestic wire transfer services for its customers. But navigating the process can be confusing, especially when it comes to locating the correct information. This comprehensive guide breaks down everything you need to know about JPMorgan Chase's domestic wire transfer address and procedures.

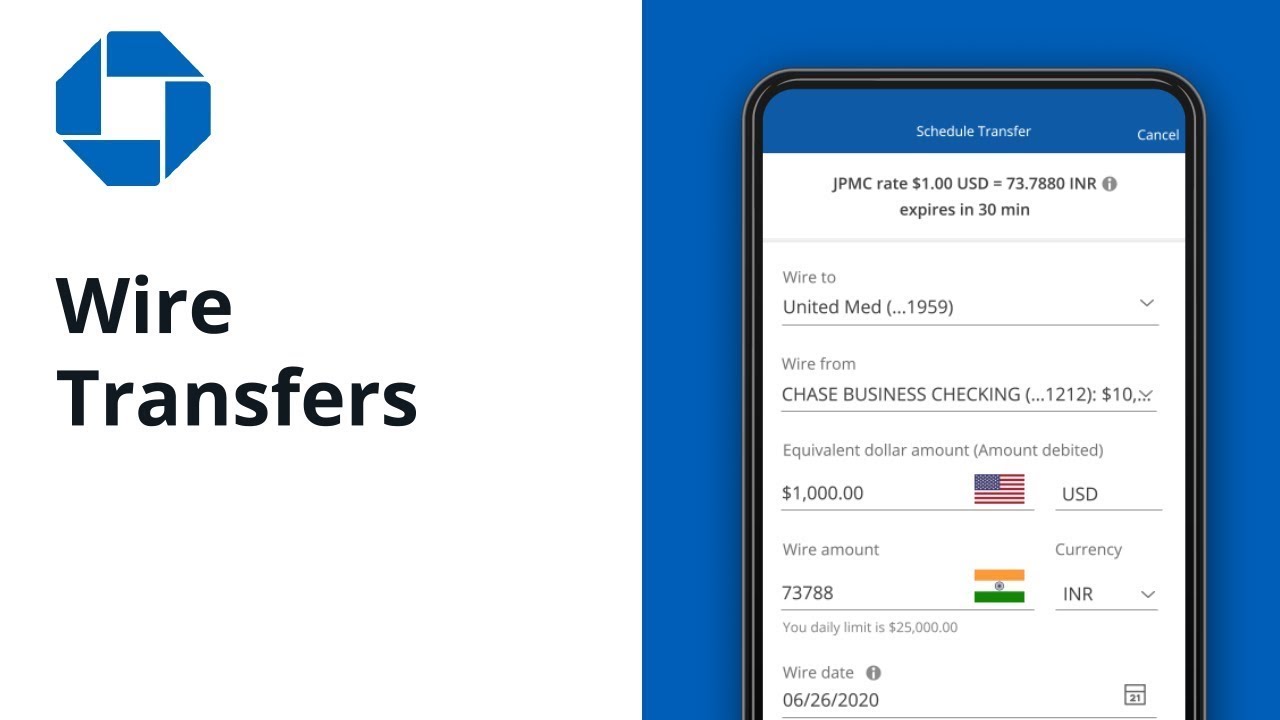

Understanding the specifics of a JPMorgan Chase domestic wire transfer address is vital for a successful transaction. Whether you're sending funds for a down payment on a house, paying a large invoice, or receiving money from a client, having the right information can prevent delays and potential errors. This involves more than just knowing a physical address; it includes routing numbers, SWIFT codes, and account details specific to wire transfers.

The information surrounding JPMorgan Chase domestic wire addresses often seems shrouded in mystery. This isn't intentional; the bank employs robust security measures to protect customer funds. However, this can make it challenging for customers to locate the correct details. This guide aims to demystify the process and equip you with the knowledge you need to confidently initiate and receive wire transfers.

Finding the correct domestic wire transfer details for JPMorgan Chase involves understanding the difference between regular mailing addresses, branch addresses, and the specific codes required for electronic transfers. This article will explain these differences and guide you toward the resources where you can locate this vital information. We'll explore how to access this information through your online banking portal, by contacting customer service, and by visiting a branch.

Wire transfers with JPMorgan Chase, like those with other major banks, require specific procedures. Understanding these steps is paramount for a smooth and efficient transfer. We'll cover important aspects such as required documentation, potential fees, processing times, and security measures to keep your funds safe. Let's dive into the specifics and empower you to handle domestic wire transfers with JPMorgan Chase efficiently.

JPMorgan Chase's history is intertwined with the development of modern banking, including wire transfers. As technology has evolved, so too have the methods for transferring money. Understanding this history provides context for the current processes.

The importance of accurate JPMorgan Chase domestic wire transfer information cannot be overstated. Incorrect information can lead to delays, returned funds, and even potential loss of money. Using the correct details ensures that your funds reach the intended recipient securely and efficiently.

One crucial aspect to understand is the difference between a JPMorgan Chase branch address and the information required for a wire transfer. Your local branch's street address isn't used for wire transfers. Instead, specific electronic routing and account numbers are necessary.

Benefits of using JPMorgan Chase for domestic wire transfers: 1. Security: JPMorgan Chase employs robust security measures to protect your funds during the transfer process. 2. Speed: Domestic wire transfers are typically completed within one business day. 3. Reliability: Wire transfers are a reliable method for sending and receiving large sums of money.

Action plan for initiating a domestic wire transfer with JPMorgan Chase:

1. Gather the necessary information: Recipient's name, account number, bank's routing number, and your account information.

2. Contact JPMorgan Chase: Visit a branch, call customer service, or log in to your online banking portal to initiate the transfer.

3. Provide the required information accurately.

4. Confirm the details and authorize the transfer.

Advantages and Disadvantages of Wire Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Security | Irreversible |

| Large sums | Requires accurate information |

Best Practices for JPMorgan Chase Domestic Wire Transfers:

1. Double-check all recipient information for accuracy.

2. Verify the fees associated with the transfer.

3. Keep records of your transaction.

4. Use strong passwords and security measures for your online banking account.

5. Be wary of potential fraud and scams related to wire transfers.

Frequently Asked Questions:

1. What is a JPMorgan Chase domestic wire transfer address? (Answer: It's not a physical address but rather a combination of routing and account numbers.)

2. How do I find my JPMorgan Chase domestic wire transfer instructions? (Answer: Contact customer service or access your online banking account.)

3. How long does a domestic wire transfer take? (Answer: Typically one business day.)

4. What are the fees associated with a JPMorgan Chase domestic wire transfer? (Answer: Varies depending on the type of account and transfer amount. Contact Chase for specifics.)

5. How can I ensure the security of my wire transfer? (Answer: Verify recipient information carefully.)

6. What should I do if my wire transfer doesn't go through? (Answer: Contact JPMorgan Chase customer support immediately.)

7. Can I cancel a domestic wire transfer? (Answer: Potentially, if it hasn't been processed yet. Contact Chase immediately.)

8. What information do I need to receive a wire transfer? (Answer: Your account number and JPMorgan Chase's routing number.)

Tips and Tricks for smoother wire transfers: Initiate the transfer early in the business day to avoid delays. Always keep a record of your confirmation number.

In conclusion, navigating JPMorgan Chase's domestic wire transfer process can initially seem complex. However, with a clear understanding of the required information and procedures, you can send and receive funds efficiently and securely. Remember to double-check all details, keep records of your transactions, and leverage the available resources, such as your online banking portal and customer support, for assistance. The benefits of fast and reliable fund transfers through wire transfers make them a valuable tool in managing your finances effectively. By following the best practices outlined in this guide and staying informed about the latest security measures, you can confidently utilize JPMorgan Chase's domestic wire transfer services to meet your financial needs. Take advantage of the speed and security offered by wire transfers, and remember to always prioritize accuracy and security when conducting these transactions.

Level up your digital domain the ultimate guide to anime wallpaper for boys

Irish jig mania youtube takes over the dance floor

Unlocking your homes equity navigating bank of america heloc requirements