Decoding Wells Fargo Check Images: A Digital Frontier

Remember the satisfying *thwack* of a checkbook? The ink, the signature, the tangible proof of transaction? In today's digital age, that physicality is often replaced by pixels. Enter: the world of Wells Fargo check images. These digital representations of paper checks are now the backbone of modern banking, enabling everything from remote deposits to fraud prevention. But what exactly are these digital doppelgangers, and what do you need to know about navigating this increasingly image-based financial landscape?

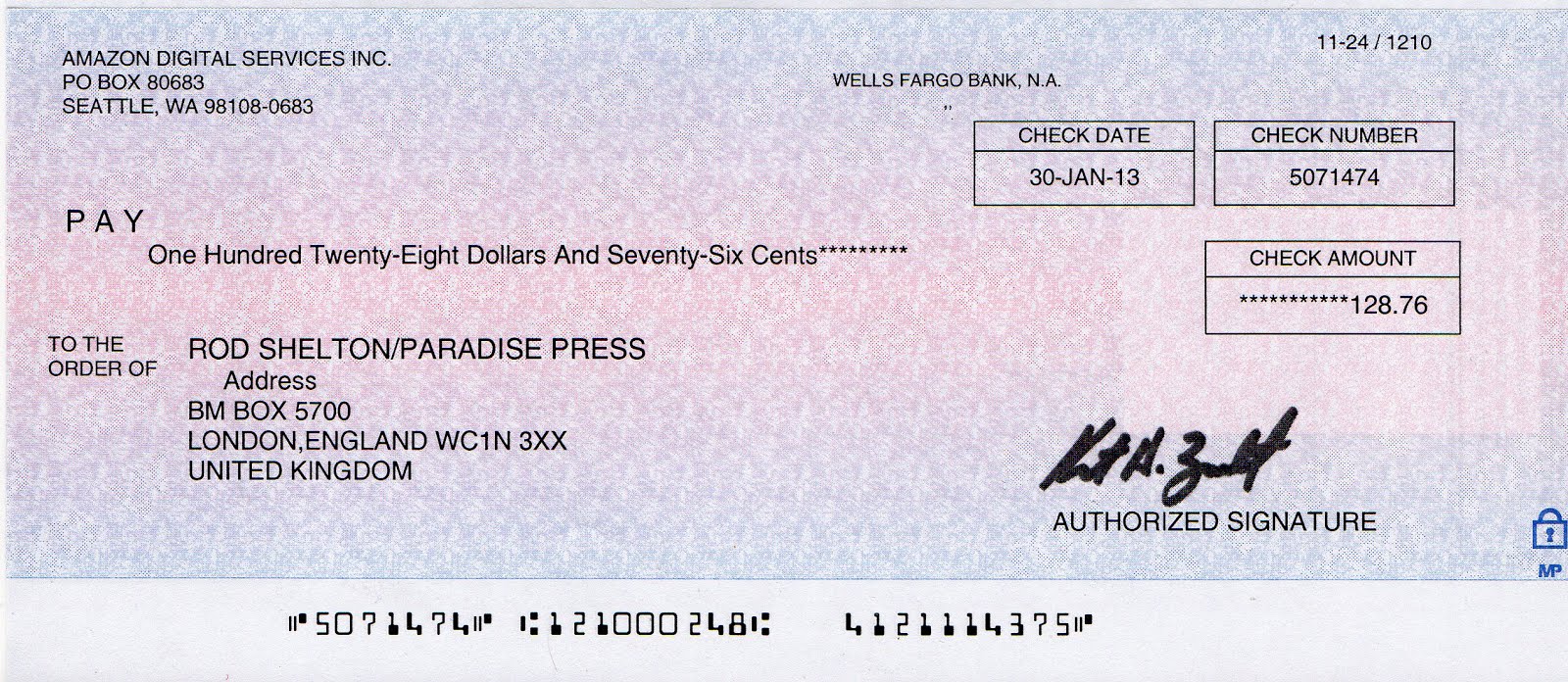

Wells Fargo check images, simply put, are digital photographs or scans of physical checks. They allow you to conduct banking transactions without the need for the original paper document. Think of them as stand-ins for the real deal, carrying all the vital information – account number, routing number, amount, and signature – needed to process a payment. This shift towards digital checks has been a slow burn, gaining momentum with the rise of online and mobile banking.

The journey of the check image began with the advent of Check 21, a federal law passed in 2004. This legislation paved the way for the legal use of "substitute checks," essentially digital reproductions of original checks, for processing and clearing. This opened the floodgates for innovations like mobile check deposit, allowing customers to snap a photo of their check and deposit it directly from their smartphones. Wells Fargo, as a major banking institution, has been at the forefront of adopting and implementing these technologies.

The importance of Wells Fargo check images can't be overstated. They are the cornerstone of digital banking, facilitating speedy transactions and reducing reliance on paper. Imagine having to physically mail every check you receive! Check images make online banking, mobile deposits, and bill pay possible, offering convenience and efficiency in our increasingly fast-paced world. Furthermore, these images play a crucial role in fraud prevention, providing a digital record for tracking and verification.

While the digitization of checks has brought many advantages, it has also presented new challenges. The quality of the check image is paramount. A blurry, incomplete, or poorly lit image can lead to processing delays or even rejection. Understanding best practices for capturing clear and legible check images is crucial for a smooth banking experience.

Benefits of utilizing Wells Fargo check images include the speed of transactions, the convenience of depositing checks from anywhere, and the enhanced security provided by digital records. For example, if you lose a physical check, having a digital image can be invaluable for recovering the funds. Mobile deposit allows you to deposit checks anytime, anywhere, simply by taking a picture with your phone.

Advantages and Disadvantages of Wells Fargo Check Images

| Advantages | Disadvantages |

|---|---|

| Convenience (mobile deposit) | Potential for image quality issues |

| Faster processing times | Requires compatible devices and internet access |

| Enhanced security and record keeping | Learning curve for some users |

Best Practices for Capturing Wells Fargo Check Images:

1. Ensure adequate lighting: Avoid shadows and glare.

2. Use a dark, non-reflective background.

3. Hold your phone steady and directly above the check.

4. Endorse the check before capturing the image.

5. Review the image for clarity and completeness before submitting.

Frequently Asked Questions about Wells Fargo Check Images:

1. What if my check image is rejected? Contact customer service.

2. How long does it take for a mobile deposit to clear? Typically 1-2 business days.

3. Can I deposit international checks using mobile deposit? Check with Wells Fargo for specific guidelines.

4. What happens to the original check after a mobile deposit? You should store it securely for a period of time, then shred it.

5. Are there limits on the amount I can deposit via mobile deposit? Yes, check with Wells Fargo for their current limits.

6. Can I view images of my deposited checks online? Yes, usually through your online banking portal.

7. What if I accidentally deposit the same check twice? Contact customer service immediately.

8. How secure are Wells Fargo check images? Wells Fargo employs advanced security measures to protect your information.

Tips and Tricks for Wells Fargo Check Images: Keep a dedicated folder on your phone for check images before depositing them. Use a checkbook cover or a solid, dark surface as a background for capturing images.

In conclusion, Wells Fargo check images represent a significant evolution in the financial landscape. While physical checks may become increasingly rare, their digital counterparts are here to stay. Understanding the ins and outs of these digital representations is crucial for navigating the modern banking world. By following best practices for capturing clear images and staying informed about the latest technologies, you can harness the power of Wells Fargo check images to simplify your financial life. From the convenience of mobile deposit to the enhanced security of digital records, the benefits are clear. Embracing these digital tools will undoubtedly empower you to manage your finances with greater efficiency and control. Take advantage of the resources available and stay informed about best practices to make the most of this increasingly digital banking environment. The future of banking is in the palm of your hand, quite literally, thanks to the power of the check image.

Decoding your mfr body code a comprehensive guide

Mastering the art of formal requests a guide to contoh surat permohonan pegawai

Paris street scenes in oil paintings a timeless romance