Deed of Transfer of Shares Agreement: What You Need to Know

The air crackles with tension. A lone figure sits across the table, a thin folder clutched in their hand. Inside? A document that could reshape an entire company's destiny. This isn't a scene from a corporate thriller; it's the reality of a deed of transfer of shares agreement.

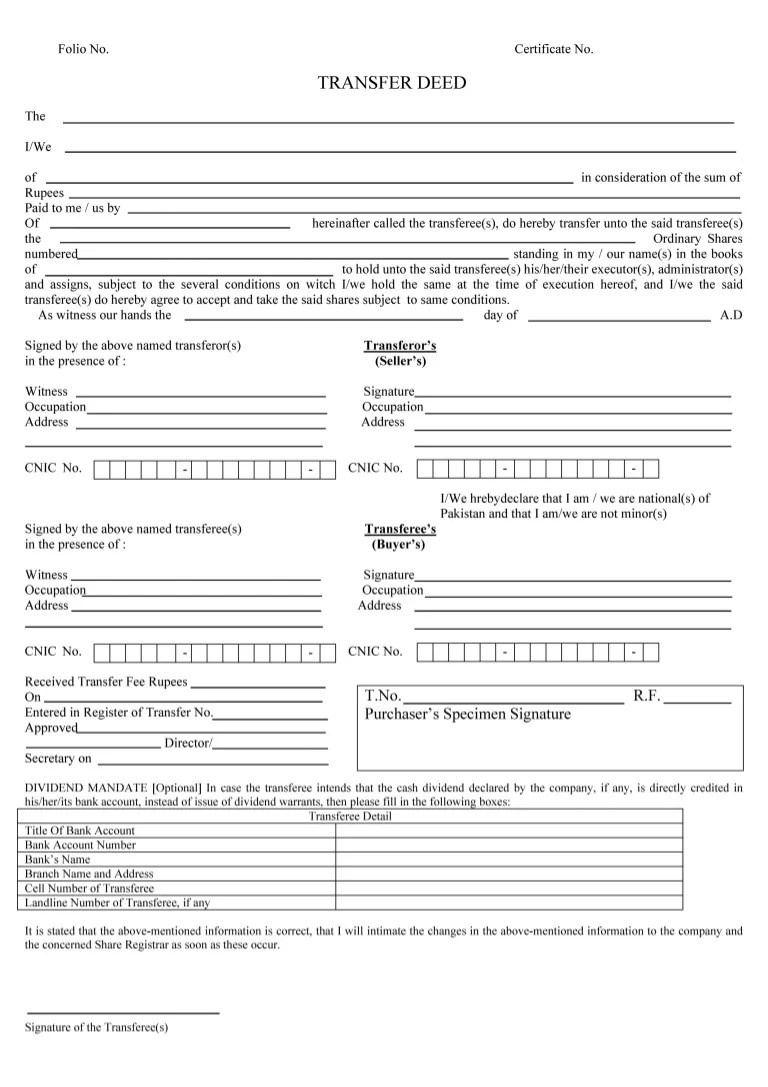

Ownership, in the world of business, isn't just a concept—it's power. And when it comes to transferring this power, the deed of transfer of shares agreement emerges as the ultimate legal instrument. It's the bridge between a company's past and its future, dictating who holds the reins and steers the ship.

This document, often laden with legalese and clauses, is more than just paperwork. It's the embodiment of a transaction, a testament to the changing tides within a company's structure. But its significance goes beyond the boardroom. For entrepreneurs, investors, and anyone with a stake in the game, understanding this agreement is crucial.

Whether you're a seasoned investor navigating a complex acquisition or a startup founder bringing new partners on board, this agreement is non-negotiable. It's the bedrock upon which ownership shifts, alliances are forged, and the future of a company takes shape.

So, what exactly does this agreement entail? How does it function in the real world, and why is it so critical for businesses of all sizes? Let's break it down, demystifying the jargon and exploring the intricacies of this essential document.

Advantages and Disadvantages of a Deed of Transfer of Shares Agreement

While the deed of transfer of shares agreement is a powerful tool, it's crucial to understand both its strengths and limitations.

| Advantages | Disadvantages |

|---|---|

| Provides a clear record of ownership transfer | Can be complex and require legal expertise to draft and execute |

| Protects the rights and interests of all parties involved | May involve significant costs, including legal fees and stamp duty |

| Ensures a smooth and legally compliant transfer process | Can be time-consuming, especially for complex transactions |

Best Practices for Deed of Transfer of Shares Agreements

Navigating the world of share transfers requires a strategic approach. Here are some best practices to ensure a smooth and legally sound process:

- Seek Professional Advice: Engage experienced legal counsel to draft or review the agreement. Their expertise ensures the document aligns with your specific needs and complies with relevant regulations.

- Due Diligence is Key: Before signing, conduct thorough due diligence on the company and the shares being transferred. This includes reviewing financial statements, understanding the company's structure, and assessing any potential risks.

- Clearly Define Terms: Ensure all terms and conditions are clearly defined, leaving no room for ambiguity. This includes the purchase price, payment terms, transfer date, and any warranties or indemnities.

- Consider Tax Implications: Understand the tax implications of the share transfer. Consult with a tax advisor to ensure compliance and explore potential tax optimization strategies.

- Maintain Proper Records: Keep meticulous records of all documents related to the share transfer, including the agreement, share certificates, and any correspondence. This documentation is crucial for legal and tax purposes.

In the intricate dance of corporate ownership, the deed of transfer of shares agreement stands as a pivotal document. It's more than just a legal formality; it's a testament to the evolving narrative of a company. By understanding its nuances, adhering to best practices, and seeking expert guidance, businesses and individuals can navigate this process with confidence, ensuring a seamless transfer of ownership and a secure foundation for the future.

The shadow of virality exploring the dark side of tiktok

The silent thermostat unraveling the amazon thermostats unresponsiveness

Rav4 hybrid showdown eco crossover battle royale