Delegating Dollars: Navigating the Nuances of Payment Authorization

Ever found yourself in a sticky wicket, needing someone else to handle your finances? Maybe you're out of town, swamped with deadlines, or simply prefer delegating the dollar dance. Enter the authorization letter for payment on behalf, your trusty sidekick in the realm of delegated finances. It's the official nod, the financial power of attorney, the key to letting someone else access your funds – responsibly, of course.

Imagine this: you're lounging on a beach, sipping a ridiculously overpriced coconut drink, when suddenly, a crucial bill pops into your mind. Panic sets in. But wait! You've already empowered your super-organized best friend with a payment authorization letter. Crisis averted. This seemingly simple document holds the power to streamline your financial life, offering a blend of convenience and control.

But what exactly *is* a payment authorization letter? Essentially, it's a formal document granting someone else the authority to make payments on your behalf. This could be for anything from settling utility bills and rent to handling business transactions and online purchases. It's like giving someone a temporary key to your financial kingdom, with clearly defined boundaries and limitations.

The history of these letters likely traces back to the very origins of banking and commerce, evolving alongside the increasingly complex ways we manage money. From handwritten notes to digital authorizations, the core principle remains the same: empowering a trusted individual to act as your financial representative. This practice becomes even more crucial in our digital age, where online transactions and remote access to accounts are the norm.

Now, before you hand over the financial reins, it's essential to understand the potential pitfalls. An improperly drafted letter can lead to misunderstandings, unauthorized access, and even financial fraud. Therefore, crafting a clear, concise, and legally sound authorization is paramount. Think of it as a legal contract, protecting both you and the authorized party.

A simple example? Imagine you need your sibling to pay your credit card bill while you’re traveling. Your authorization letter should clearly state their name, the credit card number, the amount to be paid, and the payment deadline. Specificity is key to avoiding any confusion or potential misuse.

Benefits abound when utilizing payment authorization letters. Firstly, they offer unparalleled convenience, allowing you to manage your finances even when you're unavailable or preoccupied. Secondly, they provide a crucial safety net for unexpected situations, such as medical emergencies or travel disruptions. Finally, they can empower family members or business partners to handle financial matters efficiently, streamlining operations and minimizing delays.

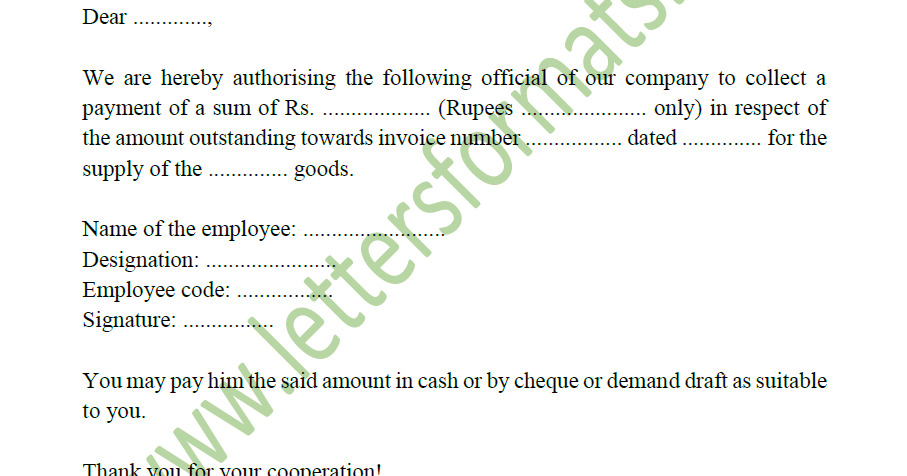

Crafting an effective authorization letter is a straightforward process. Start by clearly identifying yourself and the authorized party. Specify the account details, payment amount, and purpose. Include any relevant dates or deadlines. Finally, both parties should sign and date the document. Simple, right?

While a formal legal consultation isn’t always necessary, reviewing sample letters or templates online can be immensely helpful. Numerous resources offer pre-written templates that can be adapted to your specific needs. This ensures your letter includes all the necessary elements and adheres to legal best practices.

Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Convenience and flexibility | Potential for misuse if not properly drafted |

| Enables financial management in various circumstances | Risk of unauthorized access if security measures are not in place |

Best practices include clearly defining the scope of authorization, setting clear limits on the amount and type of transactions, regularly reviewing authorized transactions, and revoking authorization when it’s no longer needed. These practices minimize potential risks and ensure responsible financial management.

One real-world example involves a business owner authorizing an employee to make payments to suppliers. Another could be a parent authorizing a child to pay household bills during their absence. The scenarios are diverse, highlighting the versatility of this financial tool.

Challenges may arise if the authorized party misinterprets the instructions or if the letter lacks sufficient detail. The solution? Clear communication and meticulous drafting. Always double-check the details and ensure the authorized party understands their responsibilities.

FAQs often revolve around the legality of these letters, the required information, and the potential risks. Consulting legal resources or financial professionals can provide clarity and address any concerns.

A crucial tip: always keep a copy of the authorization letter for your records. This provides a crucial reference point should any discrepancies or disputes arise.

In conclusion, the authorization letter for payment on behalf is a powerful tool in the modern financial landscape. It offers convenience, flexibility, and a crucial safety net for managing finances in various circumstances. By understanding the key elements, best practices, and potential challenges, you can harness the power of delegated payments while safeguarding your financial well-being. So, the next time you find yourself needing a financial stand-in, remember the power of this simple yet effective document. It's your key to financial freedom, even when you're sipping that coconut drink on a faraway beach. Empower yourself with the knowledge to navigate the nuances of payment authorization, and you'll be well-equipped to handle any financial curveball life throws your way. Take control, delegate wisely, and enjoy the peace of mind that comes with knowing your finances are in capable hands.

Upm logo png the ultimate guide to snagging that sweet graphic

Will kingdom of the planet of the apes rule the box office

Sichuan yuanxing rubber co ltd a deep dive into the chinese rubber giant