Free Home Accounting Excel Spreadsheets: Master Your Finances

Are you tired of feeling lost when it comes to your personal finances? Do you want to take control of your money and build a stronger financial future? A free home accounting Excel spreadsheet can be the perfect tool to help you achieve these goals. By tracking your income and expenses, you can gain a clear understanding of where your money is going and identify areas where you can save. This empowers you to make informed financial decisions and work towards your financial aspirations.

Managing your personal finances doesn't have to be complicated or expensive. Free home accounting Excel spreadsheets offer a simple yet powerful solution for organizing your financial data. These customizable templates allow you to track everything from daily expenses to monthly income, providing a comprehensive overview of your financial health. With the right spreadsheet and a little dedication, you can transform your financial habits and gain peace of mind.

Using a free personal finance Excel template allows you to categorize your spending, create budgets, and visualize your progress over time. Whether you're saving for a down payment on a house, planning a dream vacation, or simply trying to get a better handle on your daily spending, a home accounting spreadsheet can be an invaluable asset. It's like having your own personal financial advisor right at your fingertips.

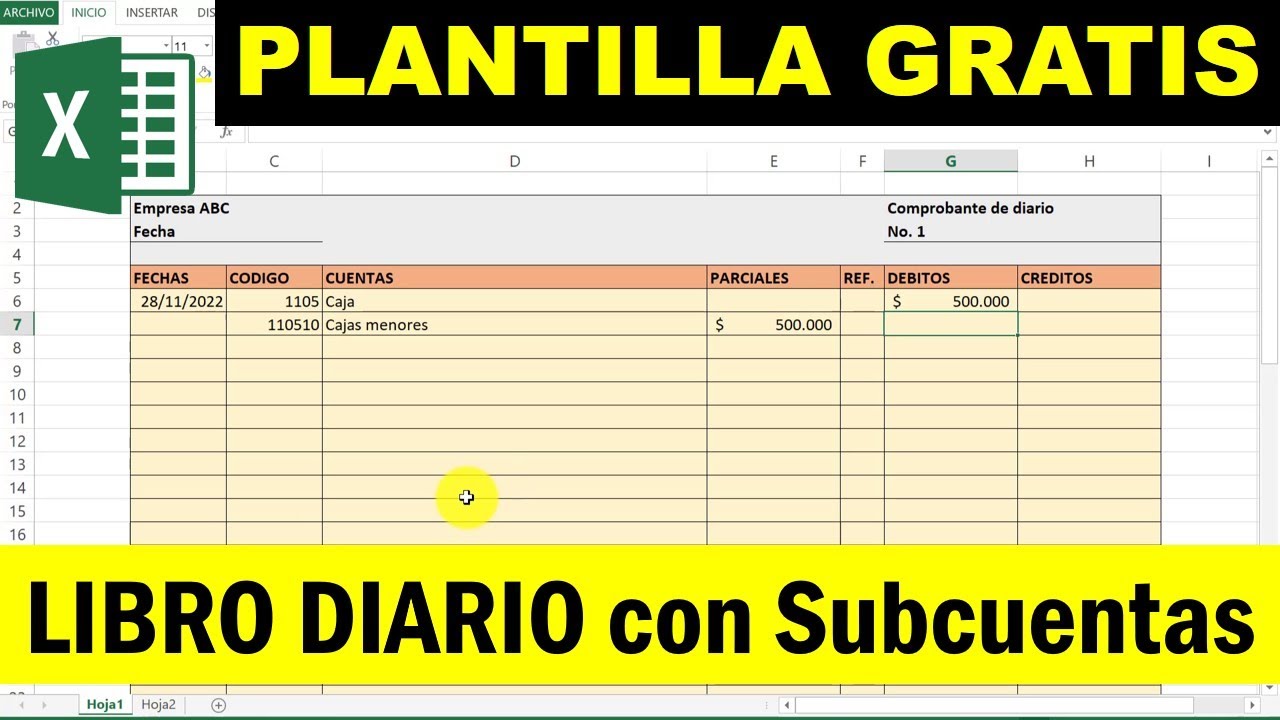

While there are numerous personal finance apps and software available, many people find that a free Excel template for home accounting offers greater flexibility and customization. You can tailor the spreadsheet to your specific needs, adding or removing categories as needed. This level of control allows you to create a system that perfectly aligns with your financial goals and preferences. Plus, you don't have to worry about subscription fees or data privacy concerns that can come with using third-party apps.

The concept of tracking finances using spreadsheets has been around for decades, evolving from basic paper ledgers to the powerful digital tools we have today. Excel's versatility has made it a popular choice for personal finance management, with countless free templates readily available online. One of the main issues related to using free spreadsheets is the potential for errors, especially if you are not familiar with Excel formulas. However, with a little practice and careful data entry, you can easily overcome this challenge. Another concern is security, particularly if your spreadsheet contains sensitive financial information. It's crucial to protect your files with strong passwords and store them securely.

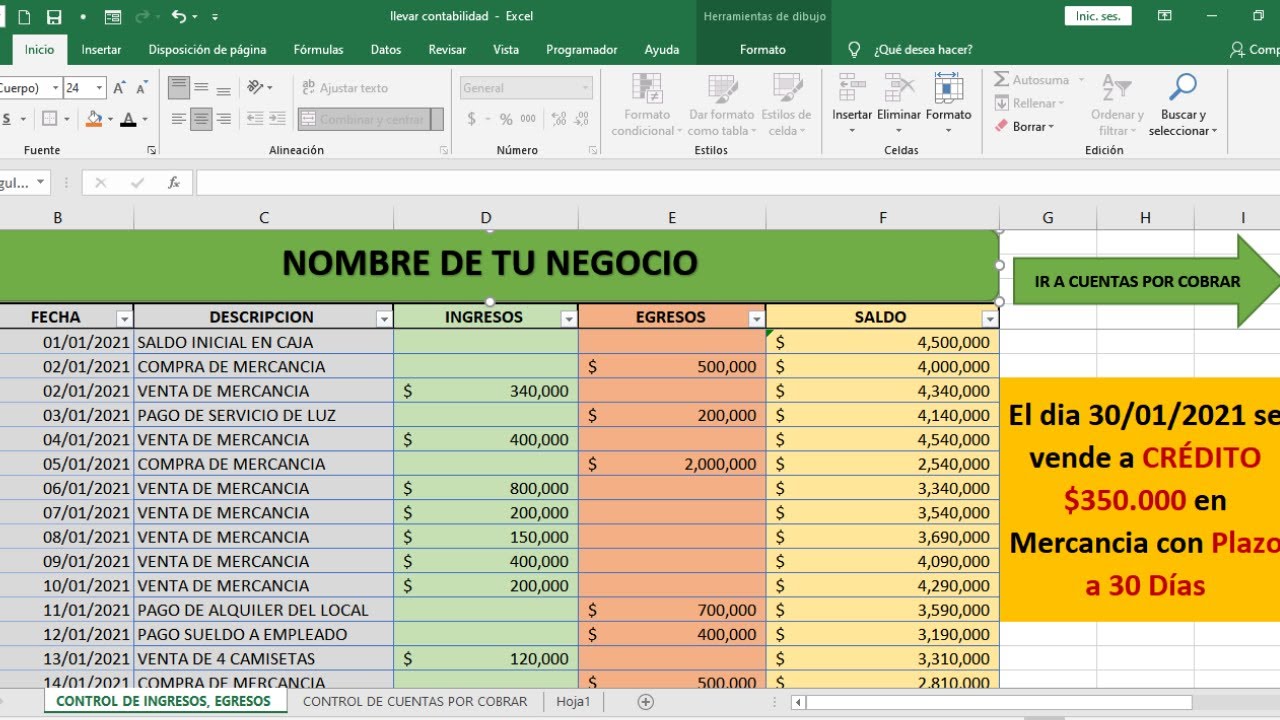

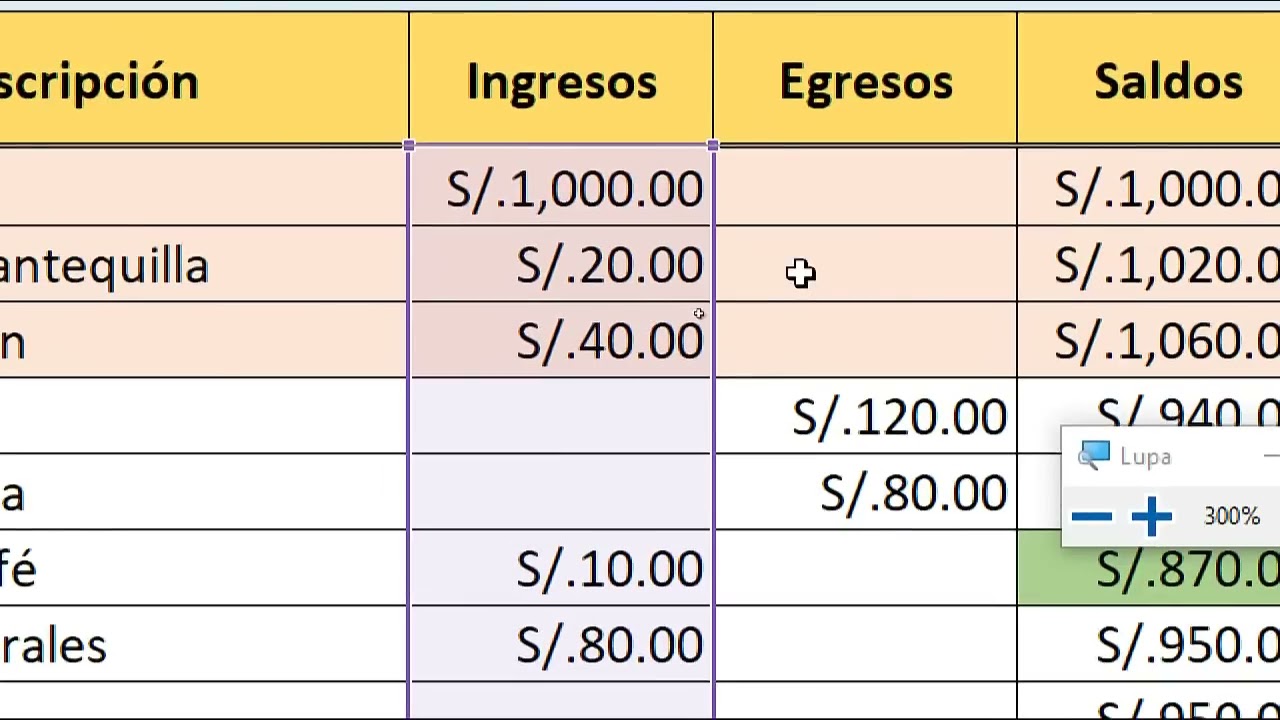

A home accounting Excel spreadsheet is simply a digital document designed to track income and expenses. It can be as simple or complex as you need it to be, ranging from a basic list of transactions to a sophisticated system with automated calculations and charts. A simple example would be listing your monthly salary in the "Income" column and your rent payment in the "Expenses" column. The spreadsheet can then automatically calculate your net income.

Benefits of using a free home accounting spreadsheet include: increased financial awareness, improved budgeting, and the ability to identify areas for saving. For example, by tracking your grocery spending each month, you might realize that you're spending more than you thought. This awareness can motivate you to create a grocery budget and stick to it.

To start using a home accounting spreadsheet, download a free template, customize it to your needs, and begin entering your income and expenses regularly. Review your spreadsheet periodically to identify trends and make adjustments as needed.

Your home accounting checklist: download a template, customize categories, enter income and expenses regularly, review and analyze data, adjust budget as needed.

Advantages and Disadvantages of Using a Free Home Accounting Spreadsheet

| Advantages | Disadvantages |

|---|---|

| Free and readily available | Requires manual data entry |

| Customizable to your specific needs | Potential for errors |

| Provides a clear overview of your finances | Security concerns if not stored securely |

Best practices for using a spreadsheet include: regular data entry, consistent categorization, utilizing formulas for calculations, backing up your data regularly, and protecting your spreadsheet with a password.

Real-world examples include tracking monthly grocery expenses, budgeting for a vacation, managing debt repayment, monitoring investment returns, and planning for retirement.

Challenges include data entry errors, inconsistent tracking, difficulty analyzing data, lack of advanced features, and security concerns. Solutions include using formulas for calculations, creating a consistent schedule for data entry, utilizing charts and graphs for visualization, exploring add-ons for advanced features, and password-protecting your files.

FAQs: What is a home accounting spreadsheet? How do I create one? Where can I find free templates? How do I use formulas in Excel? How can I protect my spreadsheet? How often should I update my spreadsheet? What are the benefits of using a spreadsheet? How can I analyze my data?

Tips: Use conditional formatting to highlight important data. Create charts and graphs to visualize your spending. Use formulas to automate calculations. Regularly back up your data.

In conclusion, a free home accounting Excel spreadsheet is a powerful tool for taking control of your personal finances. By diligently tracking your income and expenses, you can gain valuable insights into your spending habits, create effective budgets, and make informed financial decisions. While there are some challenges associated with using spreadsheets, the benefits far outweigh the drawbacks. From increasing your financial awareness to empowering you to achieve your financial goals, a free home accounting spreadsheet can be a game-changer. Start today by downloading a free template and begin your journey towards a more secure financial future. Take control of your money and build the financial life you deserve. Remember, consistent effort is key to seeing real results. Don't wait, start tracking your finances today and unlock your financial potential!

Unlock the power of five letter words with u in the middle

Good morning memes funny for her making her smile every morning

Fake tattoos glow in the dark the future of body art