Locating Your Checking Account Number: A Comprehensive Guide

Ever been in a situation where you urgently needed your checking account number, but couldn't find it? It's a common scenario, and knowing how to quickly access this vital information is crucial for managing your finances. This comprehensive guide will explore various methods to locate your checking account number, ensuring you're never caught off guard.

Your checking account number is a unique identifier assigned to your account by your financial institution. It's essential for various transactions, from setting up direct deposits and online bill payments to receiving wire transfers and even verifying your identity. Misplacing or not knowing where to find this number can cause delays and frustration.

Historically, checking accounts evolved from simple paper ledgers to the complex digital systems we use today. Initially, account numbers were primarily used for internal tracking by banks. However, with the advent of electronic banking, the importance of the checking account number has grown exponentially. Today, it serves as a key component in facilitating seamless financial transactions in our interconnected world.

One of the main issues surrounding checking account numbers is security. It's crucial to keep this information confidential and protect it from unauthorized access. Sharing your account number with untrusted sources can lead to fraud and identity theft. Therefore, understanding secure methods of accessing and storing your account number is paramount.

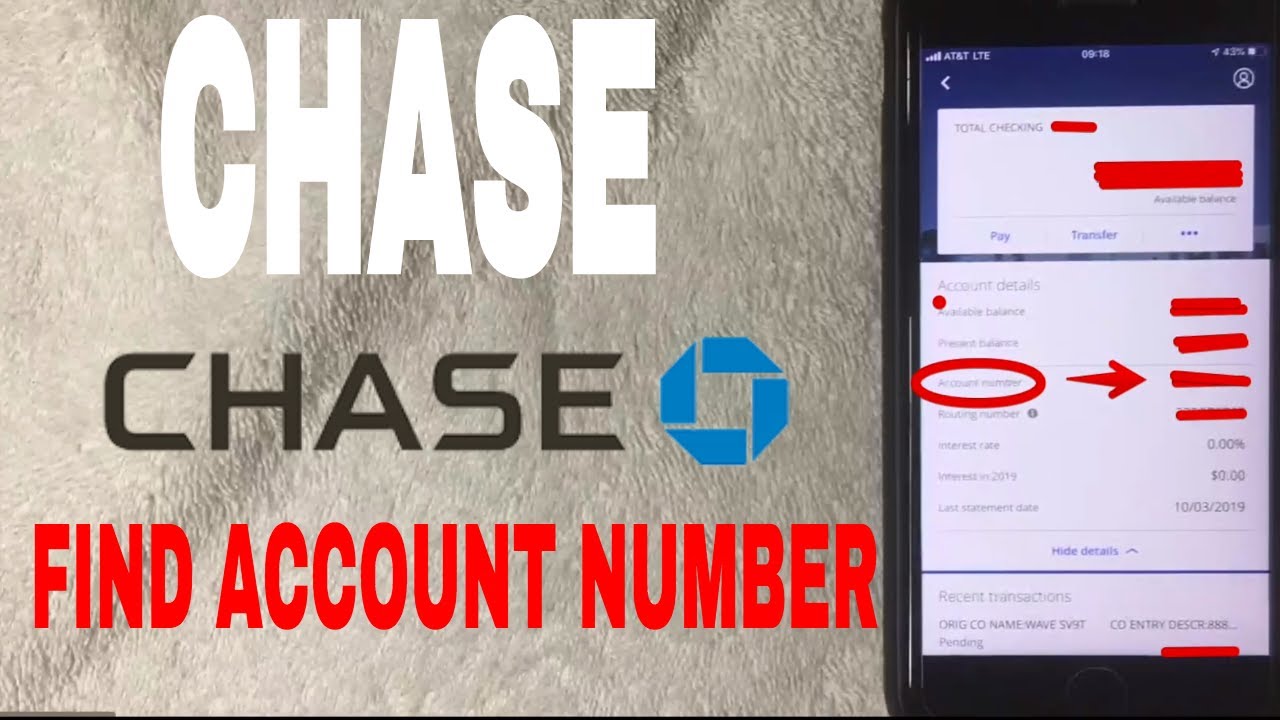

Locating your checking account number is often easier than you might think. There are several accessible methods, each with its own advantages. From the convenience of online banking to the physical evidence of your checkbook, we'll delve into the various ways you can retrieve your checking account number quickly and efficiently.

One simple way to find your checking account number is by looking at your checks. The number is typically printed at the bottom, usually along with the routing number. Another common place to find your account number is on your monthly bank statements, whether paper or electronic. Online banking platforms also provide easy access to your account details, including the account number.

If you're still unable to locate your account number, contacting your bank directly is always an option. A customer service representative can verify your identity and provide you with the necessary information. Remember, prioritizing the security of your checking account number is vital for protecting your financial well-being.

Advantages and Disadvantages of Different Methods for Finding Your Checking Account Number

| Method | Advantages | Disadvantages |

|---|---|---|

| Online Banking | Convenient, quick access | Requires internet access and login credentials |

| Checks | Readily available for most account holders | Might not have checks on hand |

| Bank Statements | Provides a record of transactions | May require searching through files |

| Contacting Bank | Direct access to information | Can be time-consuming |

Best Practices:

1. Keep your checks and bank statements in a secure location.

2. Memorize your account number if possible, but avoid writing it down in easily accessible places.

3. Regularly review your bank statements for any discrepancies.

4. Use strong passwords for online banking and avoid accessing your account on public Wi-Fi.

5. Contact your bank immediately if you suspect any unauthorized activity on your account.

FAQ:

1. What if I lose my checks? - Contact your bank for replacements.

2. Is my checking account number the same as my debit card number? - No, they are different.

3. Can I find my checking account number on my mobile banking app? - Yes, most mobile banking apps display your account number.

4. What should I do if I suspect someone has my checking account number? - Contact your bank immediately and report the potential fraud.

5. How often does my checking account number change? - It typically remains the same unless there are specific circumstances.

6. Is it safe to store my checking account number on my phone? - While possible, it's generally safer to avoid storing sensitive financial information on your phone in case of loss or theft.

7. What is the difference between a checking account number and a routing number? - The checking account number identifies your specific account, while the routing number identifies your bank.

8. Can I use my checking account number to make international transfers? - Yes, but you'll likely need additional information like the SWIFT code.

Tips and Tricks:

Consider using a password manager to securely store your account number and other sensitive information.

In conclusion, knowing where to find your checking account number is essential for managing your finances effectively. Whether you prefer the convenience of online banking, the readily available information on your checks, or the detailed records provided by your bank statements, there are various methods to quickly access this crucial information. By understanding the importance of security and utilizing the tips and best practices outlined in this guide, you can ensure the safety of your financial information and navigate the world of banking with confidence. Taking proactive steps to manage your account details empowers you to control your finances and avoid potential issues. Remember to prioritize security, utilize available resources, and contact your bank whenever necessary for assistance and peace of mind. Don't hesitate to reach out to your financial institution for any clarification or support. Your financial well-being is a priority, and staying informed is the first step towards achieving financial success.

Decoding your health journey navigating nj diagnostic imaging centers

Cute ghost drawing tattoo ideas from spooky to sweet

Navigating your auto loan finding the right contact at jpmorgan chase

/AccountNumber-56b140e23df78cdfa000eb8b.jpg)

:max_bytes(150000):strip_icc()/where-is-the-account-number-on-a-check-315278_final-30e94da21d1644329716939bef5107ac.png)