Mastering the Bill of Exchange: A Deep Dive into 'Como Llenar un Letra de Cambio'

In the intricate dance of global commerce, where transactions transcend borders and currencies intertwine, ensuring secure and reliable payment methods is paramount. Enter the bill of exchange, a financial instrument steeped in history, offering a time-tested solution for facilitating trade and mitigating risks. For those navigating the nuances of international business, particularly in Spanish-speaking regions, understanding "como llenar un letra de cambio" – how to fill out a bill of exchange – becomes essential.

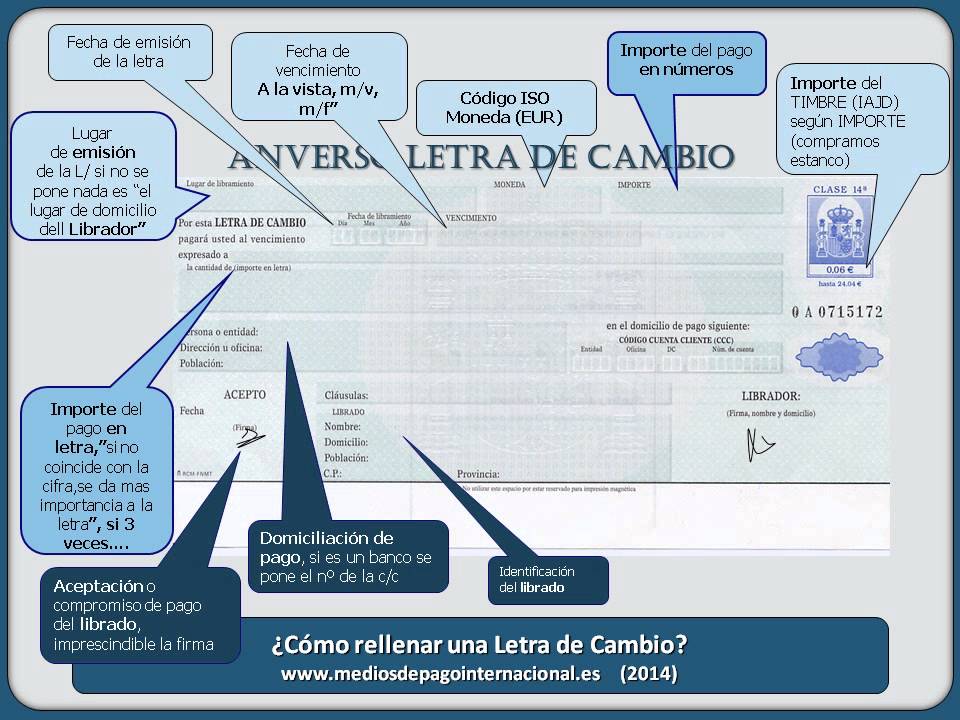

This seemingly straightforward document, often referred to as a "letra de cambio" in Spanish, carries significant weight. It represents a written, unconditional order from one party (the drawer) to another (the drawee) to pay a specified sum of money to a named payee on a predetermined date. Think of it as a formalized IOU with international clout, adding a layer of security and trust to transactions.

The origins of the bill of exchange can be traced back to medieval Italy, a testament to its enduring relevance in the ever-evolving financial landscape. As trade routes flourished, merchants sought reliable instruments to settle accounts across vast distances, leading to the emergence of this ingenious system. Over centuries, it has evolved and adapted to the changing dynamics of global commerce, remaining a cornerstone of international trade.

However, its importance extends beyond mere historical significance. In the present day, "como llenar un letra de cambio" remains a crucial skill, particularly for businesses engaged in international trade. The ability to correctly complete this document can mean the difference between seamless transactions and potential disputes or delays in payment.

While the concept might seem daunting at first, mastering the art of filling out a bill of exchange is an achievable feat. By understanding the key elements, adhering to established procedures, and paying meticulous attention to detail, businesses can navigate this process with confidence, ensuring smooth and secure financial transactions in the global marketplace.

Advantages and Disadvantages of Bills of Exchange

| Advantages | Disadvantages |

|---|---|

| Provides a written record of the debt | Can be complex to fill out correctly |

| Can be used as a form of credit | May not be accepted by all businesses |

| Offers a degree of security for both parties | Can be subject to fraud if not handled carefully |

Best Practices for Bills of Exchange

To ensure clarity and minimize the risk of complications, consider these best practices when dealing with bills of exchange:

- Accuracy is Key: Double-check all details, including names, dates, and amounts, to avoid discrepancies.

- Clear Language: Use concise and unambiguous language when describing the terms and conditions.

- Secure Handling: Treat the bill of exchange as a valuable document, storing it securely and transporting it with care.

- Timely Presentation: Present the bill to the drawee within the stipulated timeframe to avoid delays in payment.

- Maintain Records: Keep thorough records of all bills of exchange, including copies of completed documents and related correspondence.

Navigating the world of international finance can be complex, but understanding "como llenar un letra de cambio" empowers businesses to engage in cross-border transactions with confidence. By embracing this traditional yet relevant instrument and adhering to best practices, companies can mitigate risks and ensure smooth financial operations on the global stage.

Unlocking the power of facebook profile picture sizes medidas de foto de perfil de facebook

Navigating the aftermath finding a saint paul personal injury attorney

Remember aol sports news entertainment a nostalgic dive