Navigating Life's Crossroads: Understanding Qualifying Life Event OPM

Life, in its vast and unpredictable expanse, often throws us curveballs. We find ourselves at crossroads, where decisions made in a heartbeat can have lasting ripples. Some of these crossroads, while deeply personal, intersect with the intricate tapestry of our federal benefits, particularly for those covered by the Office of Personnel Management (OPM). These pivotal junctures are known as Qualifying Life Events.

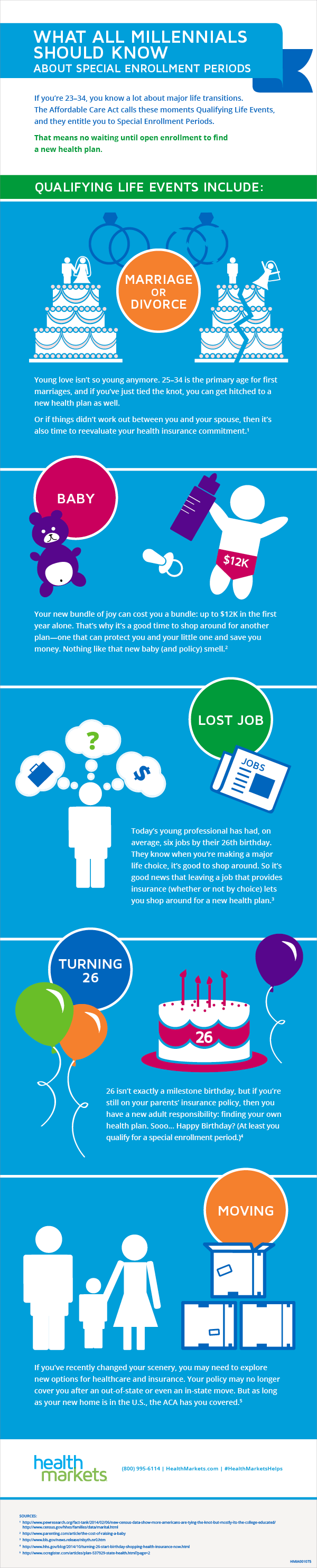

Imagine the birth of a child, the joy of welcoming a new life into the world, yet also a time of significant adjustments, both personal and financial. Or perhaps, a change in marital status, a union formed or dissolved, leading to a cascade of emotional and logistical considerations. These life events, while momentous in their own right, also act as triggers, prompting us to reevaluate and potentially adjust our federal benefits.

Understanding Qualifying Life Events (QLEs) and their implications is crucial for any individual or family covered under OPM. It's not just about paperwork; it's about ensuring you have the right coverage, at the right time, to navigate these life transitions with a sense of security. This exploration aims to shed light on the often-overlooked aspects of QLEs, empowering you with the knowledge to make informed decisions during those times when life takes an unexpected turn.

Think of QLEs as unique windows of opportunity. Unlike the rigid confines of annual open enrollment periods, these events grant you the flexibility to make changes to your federal benefits outside the typical timeframe. These changes can range from enrolling in a health insurance plan for the first time, adding a new family member, or perhaps switching to a different plan that better suits your evolving needs.

Navigating the realm of QLEs, however, requires a keen understanding of its intricacies. What constitutes a qualifying event? What are the deadlines for making changes? What documentation is required? These are just a few of the questions we'll delve into, unraveling the complexities to empower you to make choices that resonate with your unique circumstances. Remember, knowledge is power, especially when it comes to securing your financial well-being during life's most significant chapters.

Advantages and Disadvantages of Qualifying Life Event OPM

| Advantages | Disadvantages |

|---|---|

| Flexibility to adjust benefits outside open enrollment | Strict deadlines for making changes |

| Opportunity to enroll in a plan or add dependents when eligible due to a QLE | Requires careful documentation and understanding of eligibility rules |

| Potential for cost savings by switching to a more suitable plan | Changes made during a QLE are generally irreversible until the next open enrollment |

As with any system that intersects life's complexities, navigating Qualifying Life Event OPM requires vigilance and proactive planning. It's about recognizing those pivotal moments, understanding your options, and ultimately, making choices that align with your individual journey. By arming yourself with knowledge and embracing the opportunities presented by QLEs, you can ensure that your federal benefits evolve in tandem with the ebb and flow of your own unique story.

The ultimate guide to awesome beer gifts for dads

The subtle allure of small lower back tattoos for women

Scoring the perfect pre owned wakeboard boat