Navigating Loan Applications: Understanding 'Contoh Surat Permohonan Pinjaman'

Life often throws unexpected expenses our way – a sudden home repair, a medical bill, or maybe an opportunity to invest in a dream project. When these situations arise, seeking a loan can be a practical solution. But navigating the world of loans can feel overwhelming, especially in a foreign language. If you've found yourself searching for "contoh surat permohonan pinjaman," you're in the right place.

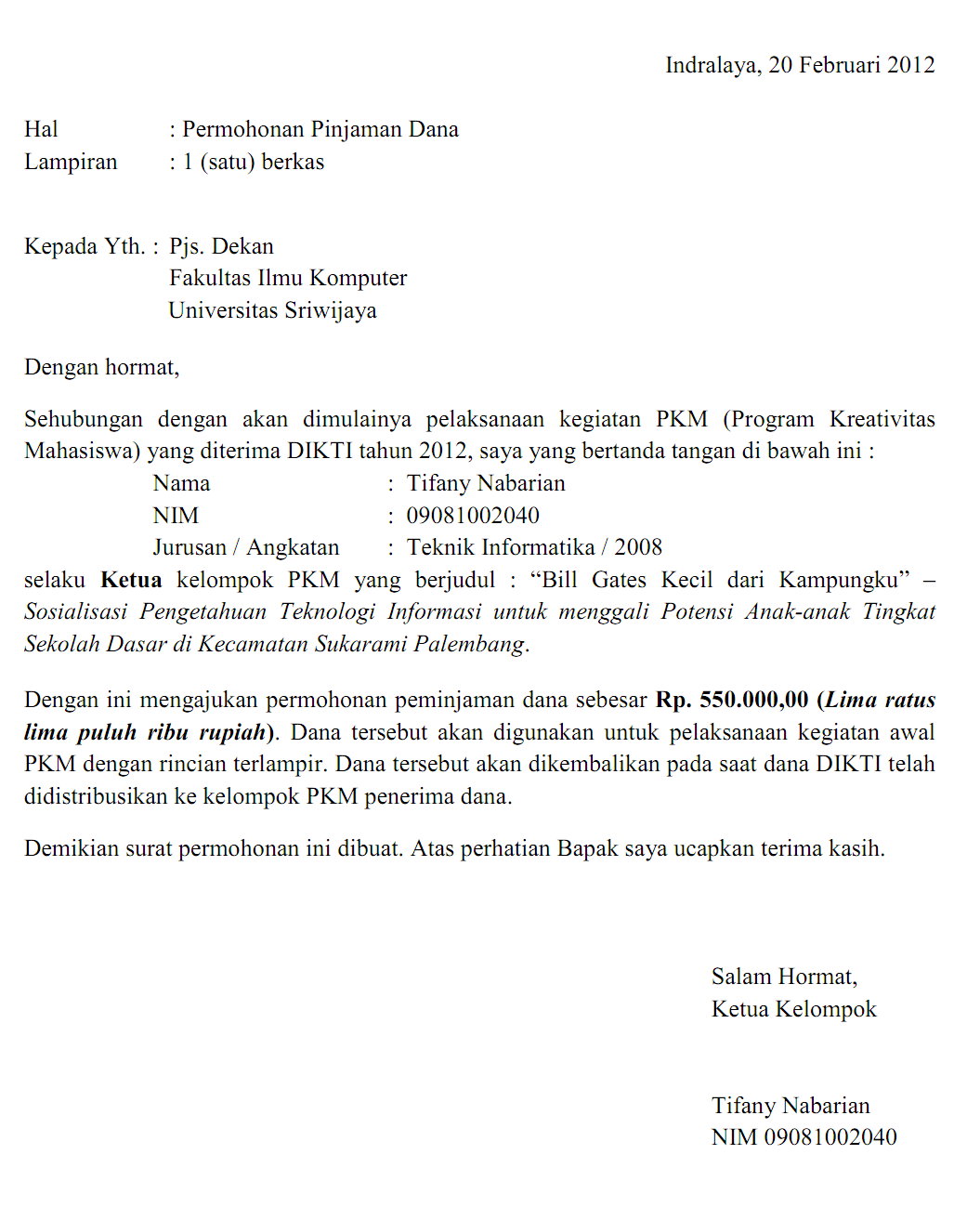

In Indonesia, a "surat permohonan pinjaman," or loan application letter, is a crucial document for anyone seeking financial assistance. It's a formal way to communicate your needs to a lender, whether it's a bank, institution, or even an individual. Think of it as your introduction, your chance to make a good first impression and clearly articulate why you deserve their support.

While the thought of writing a formal letter might seem daunting, especially when dealing with financial matters, it's more approachable than you might think. This type of letter is simply a well-structured way to communicate your request. It's about being clear, concise, and respectful while providing all the necessary information for the lender to make an informed decision.

You might be wondering why a formal letter is necessary in our digital age. While online applications are becoming increasingly common, many institutions, especially in Indonesia, still rely heavily on traditional communication methods. A well-written letter demonstrates professionalism, respect for tradition, and a genuine commitment to your request. It allows you to personalize your application, highlighting your unique circumstances and building a stronger case for your loan approval.

In essence, understanding "contoh surat permohonan pinjaman" is about more than just knowing the right words; it's about confidently navigating a cultural norm in Indonesia and increasing your chances of securing the financial support you need. In the following sections, we'll delve deeper into the structure, essential elements, and tips for crafting a compelling loan application letter.

Advantages and Disadvantages of Traditional Loan Application Letters

| Advantages | Disadvantages |

|---|---|

| Personalizes your application | Can be time-consuming to write |

| Shows professionalism and respect for tradition | Requires a formal writing style |

| Provides space for detailed explanation of your needs | May not be required by all lenders |

Best Practices for Writing a "Surat Permohonan Pinjaman"

Here are five key tips for crafting an effective loan application letter:

- Be Clear and Concise: Use formal language, avoid slang, and get straight to the point. Clearly state the purpose of your letter, the loan amount you are seeking, and the intended use of the funds.

- Provide Necessary Details: Include your personal information (name, address, contact details), employment status, income details, and any relevant financial history. Be transparent and accurate in your disclosure.

- Explain Your Need: Clearly articulate why you need the loan. Provide context for your request. Are you facing an unexpected medical bill? Is this loan for a business investment? The more specific you are, the better.

- Outline Repayment Plans: Demonstrate your ability to repay the loan. Mention your intended repayment period and any existing financial obligations you might have.

- Proofread Carefully: Before submitting your letter, carefully proofread it for any grammatical errors or typos. A polished letter reflects positively on your application.

Remember, while the process of requesting a loan might seem formal, it's ultimately about communication. By approaching your "contoh surat permohonan pinjaman" with clarity, honesty, and a touch of personal touch, you'll be well on your way to securing the financial assistance you need.

Unlocking nyc real estate secrets your guide to acris nyc deed search

Behind bars to building skills navigating employment opportunities in correctional facilities

The curious case of the unchanging pdf navigating dd beyond export issues