Navigating Tukar Hak Milik Rumah: A Comprehensive Guide

The concept of owning a home is deeply ingrained in many cultures, symbolizing stability, security, and personal achievement. In Indonesia, the process of acquiring and transferring property ownership, known as "tukar hak milik rumah," is a significant life event. While the phrase itself might sound formal, it encapsulates a process that touches upon legal, financial, and even emotional aspects. This comprehensive guide aims to demystify tukar hak milik rumah, providing clarity and guidance for anyone navigating this important transaction.

Imagine this: you've found your dream home, a place where you envision building a future with your loved ones. Or perhaps, life has taken an unexpected turn, requiring you to relocate and pass on your current home to a new family. These scenarios highlight the essence of tukar hak milik rumah, encompassing both the acquisition and transfer of property ownership. While exciting, these transitions can feel daunting without a clear understanding of the process.

Historically, property ownership in Indonesia was deeply tied to customary laws and traditions, often passed down through generations. Over time, a formal legal framework emerged, establishing clear procedures for tukar hak milik rumah. This evolution reflects the country's growth, urbanization, and the need for standardized practices in property transactions. Understanding this historical context allows us to appreciate the significance of a well-defined legal system in ensuring transparency and fairness.

At its core, tukar hak milik rumah is more than just a legal transaction—it's a transition that holds both practical and symbolic weight. For sellers, it might mean letting go of a place filled with memories, while for buyers, it signifies a fresh start and a place to call their own. The process involves various stakeholders, including buyers, sellers, real estate agents, notaries, and government agencies, each playing a crucial role in ensuring a smooth and legally sound transfer of ownership.

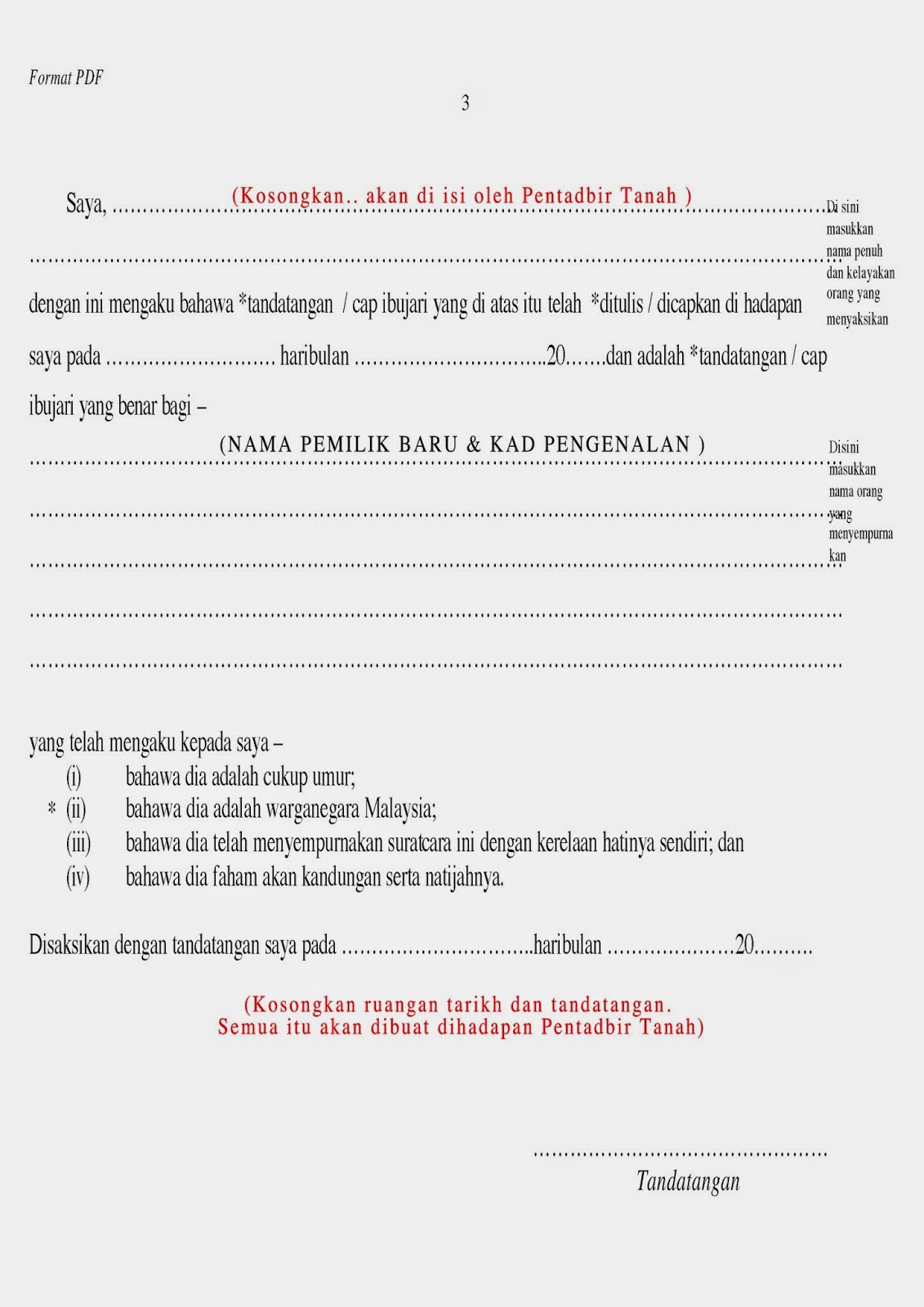

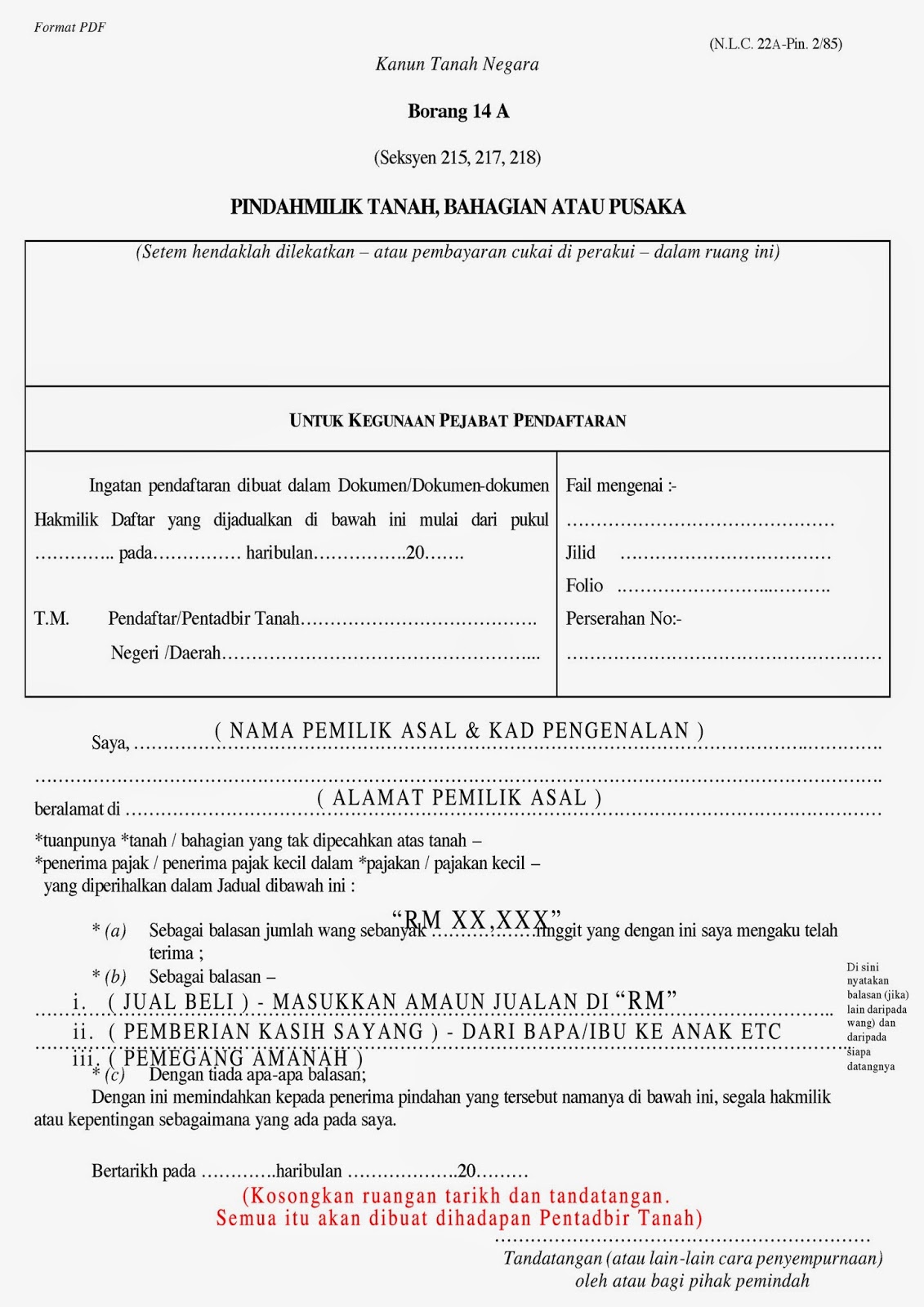

Navigating the intricacies of tukar hak milik rumah requires a thorough understanding of the legal framework, documentation requirements, and potential challenges. From conducting due diligence to understanding tax implications, being well-informed is key to avoiding pitfalls and ensuring a successful property transaction. This guide will delve deeper into these aspects, providing practical insights and actionable steps to guide you through every stage of the process.

Advantages and Disadvantages of Tukar Hak Milik Rumah

Like any significant transaction, tukar hak milik rumah comes with its own set of advantages and disadvantages. Understanding these can help you make informed decisions and approach the process with a realistic perspective.

| Advantages | Disadvantages |

|---|---|

| Security and Legal Ownership: Provides legal protection and security over your property. | Complexity and Time: The process can be time-consuming and involve navigating legal and administrative procedures. |

| Investment Potential: Real estate is often considered a stable investment, and property ownership can appreciate in value. | Financial Implications: Involves significant financial investment, including purchase price, taxes, and fees. |

| Personalization and Control: Ownership allows you to customize and modify your property according to your preferences. | Maintenance and Responsibilities: Owning a property comes with ongoing maintenance costs and responsibilities. |

Best Practices for Tukar Hak Milik Rumah

To ensure a smooth and legally sound property transfer, consider these best practices:

- Due Diligence: Conduct thorough research on the property, including verifying ownership, checking for encumbrances, and understanding zoning regulations.

- Legal Expertise: Engage an experienced property lawyer to guide you through the legal processes, draft contracts, and ensure all documents are in order.

- Financial Planning: Secure financing, if required, and factor in all costs, including taxes, fees, and potential renovation expenses.

- Transparency and Communication: Maintain open and clear communication with all parties involved, including the seller/buyer, agent, and legal representatives.

- Secure Payment Methods: Utilize secure and traceable payment methods to minimize risks associated with large financial transactions.

While this guide provides a general overview, always consult with legal and financial professionals for personalized advice tailored to your specific circumstances.

Bewitching monikers exploring classic witch names

Navigating the digital campus your guide to e pelajar mrsm kt

Chasing golden hour unveiling tomorrows sunset time