Navigating Your Finances: A Comprehensive Guide to Wells Fargo Bank Personal Checks

In today's fast-paced digital world, it's easy to forget about the enduring power of the humble paper check. While electronic payments dominate transactions, Wells Fargo bank personal checks remain a relevant and essential tool for many. Whether you're paying rent, settling a bill with a small business, or gifting money to a loved one, understanding the ins and outs of using checks can empower you to manage your finances effectively.

So, why are checks from Wells Fargo, or any bank for that matter, still important? They provide a tangible record of payment, offer a level of security in certain situations, and are readily accepted by a vast majority of businesses and individuals. This comprehensive guide delves into the world of Wells Fargo Bank personal checks, offering a nuanced understanding of their history, usage, benefits, and potential pitfalls.

From their historical origins as a simpler form of currency exchange to their modern-day applications, Wells Fargo Bank checks have evolved alongside the financial landscape. This evolution has seen changes in design, security features, and the methods used to process them. Understanding this history offers context for their current role in personal finance.

Managing your Wells Fargo checking account and using personal checks effectively is crucial for maintaining healthy finances. By tracking your check usage, you can gain a clearer picture of your spending habits and avoid overdraft fees. Moreover, understanding the reconciliation process, where you compare your check register with your bank statement, ensures accuracy and can help you identify any discrepancies or fraudulent activity.

This guide serves as a roadmap for anyone seeking to navigate the world of Wells Fargo Bank personal checks. Whether you're a seasoned check user or just starting out, you'll find valuable insights and practical tips to help you maximize the benefits and avoid potential issues. From ordering checks to understanding check fraud prevention, we'll cover all the essential aspects.

Wells Fargo, as a financial institution, has a long and rich history intertwined with the development of the American West. Personal checks, as a payment method, have similarly evolved over centuries, from their earliest forms as handwritten promissory notes. While the specifics of the very first Wells Fargo personal check are lost to the mists of time, understanding the bank's historical commitment to serving its customers sheds light on the importance they place on providing reliable and accessible financial tools like personal checks.

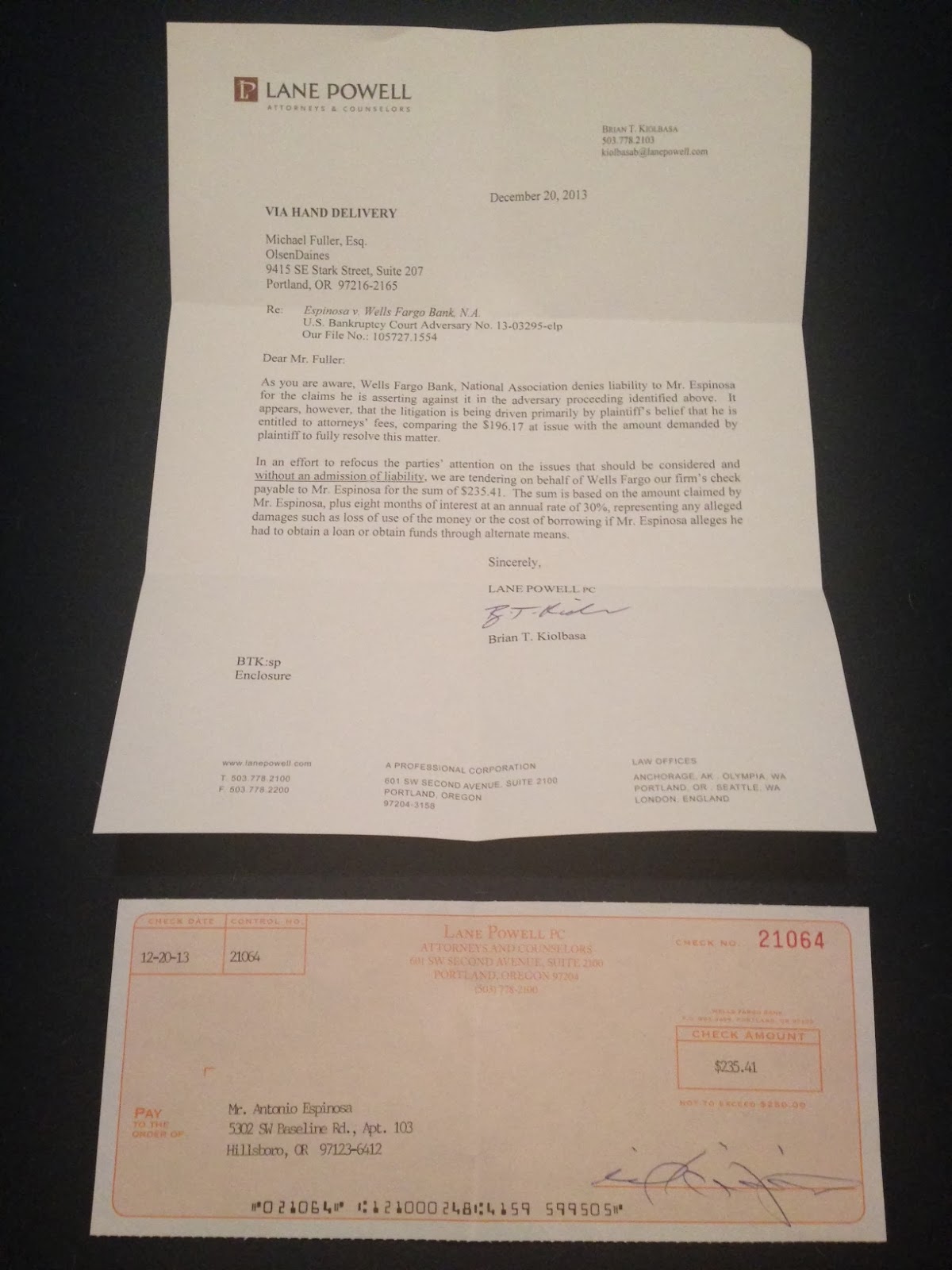

Ordering checks from Wells Fargo is a straightforward process. You can typically order them online through your Wells Fargo online banking account, by phone, or by visiting a local branch. When ordering, you'll be asked to provide your account number and potentially some identifying information. You can often customize your checks with different designs and add features like duplicate checks for easier record keeping.

Benefits of using Wells Fargo checks include having a physical record of your transactions, the ability to send payments by mail, and wide acceptance. For example, paying rent with a check provides a tangible receipt of your payment. Sending a check as a gift avoids the need for cash or electronic transfers.

Advantages and Disadvantages of Wells Fargo Bank Personal Checks

| Advantages | Disadvantages |

|---|---|

| Physical record of payment | Processing time can be longer than electronic payments |

| Widely accepted | Risk of loss or theft |

| Can be mailed | Requires manual tracking and reconciliation |

Best Practices: 1. Keep your checks in a secure location. 2. Regularly reconcile your check register. 3. Use a pen with indelible ink. 4. Write the amount in both numerical and written form. 5. Void any mistakes clearly.

Frequently Asked Questions:

1. How do I order checks? - Contact Wells Fargo or order online.

2. What if I lose a check? - Report it to Wells Fargo immediately.

3. How do I stop payment on a check? - Contact Wells Fargo customer service.

4. Can I deposit a check via mobile deposit? - Yes, using the Wells Fargo app.

5. What if my checkbook is stolen? - Report the theft to Wells Fargo immediately.

6. How do I void a check? - Write "VOID" across the check in large letters.

7. How can I track my check usage? - Review your monthly statement and online banking activity.

8. What are the fees associated with checks? - Check with Wells Fargo for current fee schedules.

Tips and Tricks: Use carbon copy checks to maintain a record of every transaction. Consider setting up account alerts to notify you of low balances and potential overdrafts.

In conclusion, while the digital age has revolutionized how we manage our finances, Wells Fargo bank personal checks continue to play a significant role. Understanding their usage, benefits, and potential challenges empowers you to navigate the financial landscape effectively. By following best practices, staying informed about security measures, and utilizing the resources available from Wells Fargo, you can leverage the advantages of personal checks while mitigating potential risks. Take control of your finances today by reviewing your checking account practices and integrating the tips and insights from this guide. Your financial well-being depends on it.

Indias top gel pens a smoother writing experience

Decoding benjamin moore simply white paint an in depth look

Unlocking the secrets of hwaet exploring the old english word for what