Navigating Your Finances: Understanding Your Bank of America Account Details

Ever find yourself rummaging through drawers, searching for that elusive piece of paper with your Bank of America account number? In today's fast-paced world, quickly accessing your financial information is more crucial than ever. This guide will walk you through various aspects of understanding and retrieving your Bank of America account details, providing practical tips and addressing common questions.

Knowing where to find your Bank of America account number is essential for numerous banking tasks. Whether you're setting up direct deposit, making a wire transfer, or simply balancing your checkbook, having this key piece of information readily available can save you time and hassle. This guide aims to empower you with the knowledge you need to navigate your Bank of America account with ease.

Retrieving your Bank of America account details isn't just about finding a number; it's about understanding the tools and resources available to manage your finances effectively. From online banking to mobile apps, Bank of America provides several convenient methods for accessing your account information. This article will explore these options, offering insights into how you can leverage technology to streamline your banking experience.

In the past, locating your Bank of America account number often involved a trip to the bank or a painstaking search through paper statements. Today, digital banking has revolutionized the way we manage our finances, offering instant access to account information at our fingertips. However, understanding how to navigate these digital platforms is crucial for efficiently retrieving your account details.

While accessing your Bank of America account information is often a straightforward process, certain circumstances can make it more challenging. For example, if you've lost your debit card or forgotten your online banking credentials, retrieving your account number may require additional steps. This guide will address these potential challenges, offering solutions and guidance for navigating complex situations.

Your Bank of America account number is a unique identifier assigned to your specific account. This number is crucial for various transactions, such as deposits, withdrawals, and transfers. Understanding the significance of this number is essential for maintaining accurate records and managing your finances effectively.

Benefits of Easily Accessing Your Account Number

1. Streamlined Transactions: Quickly accessing your account number simplifies various banking tasks, such as setting up direct deposit or making online payments. For example, having your account number readily available when enrolling in online bill pay saves you the time and effort of searching for it.

2. Improved Financial Management: Knowing where to find your account number allows you to monitor your transactions and balance your checkbook efficiently. For instance, you can easily reconcile your account statements by referencing your account number on each transaction.

3. Enhanced Security: Being able to quickly locate your account number allows you to report any suspicious activity promptly. If you notice an unauthorized transaction, having your account number on hand helps you quickly contact Bank of America and resolve the issue.

Tips for Locating Your Account Number

Check your checkbook, online banking platform, or mobile app.

Advantages and Disadvantages of Online Account Access

| Advantages | Disadvantages |

|---|---|

| Convenience | Security Risks |

| Speed | Technical Issues |

Frequently Asked Questions

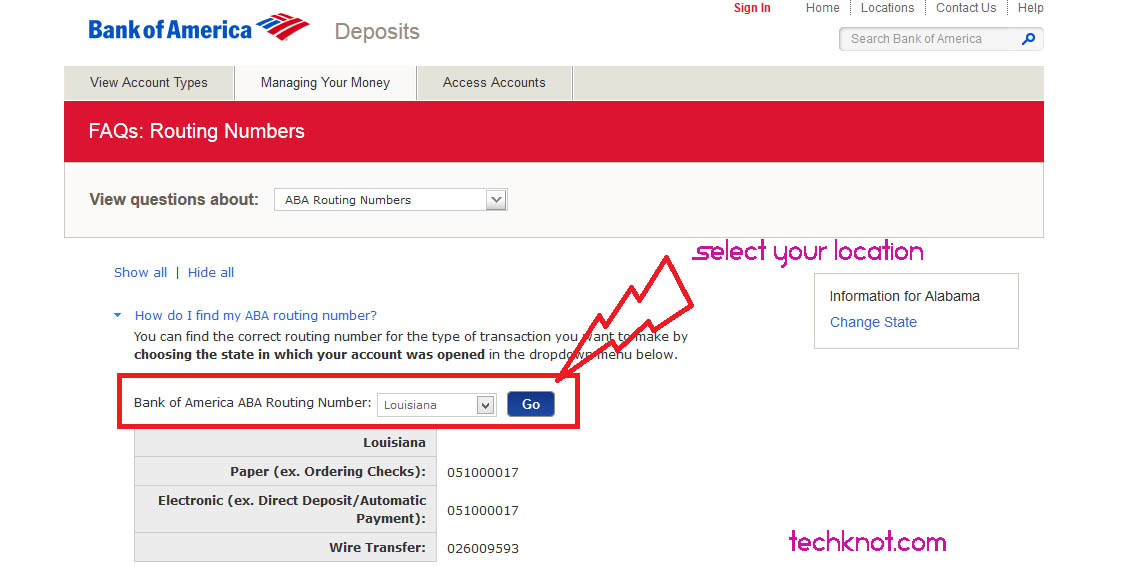

1. How do I find my Bank of America account number online? Answer: Log in to your online banking account.

2. What if I forgot my online banking password? Answer: Use the "forgot password" feature.

3. Can I access my account number on the mobile app? Answer: Yes, the mobile app provides access to your account details.

4. What should I do if I lose my debit card? Answer: Contact Bank of America immediately to report the lost card.

5. How can I ensure the security of my online banking account? Answer: Use strong passwords and be cautious of phishing scams.

6. What information do I need to provide to verify my identity? Answer: Typically, your name, address, date of birth, and social security number.

7. Can I access my account information over the phone? Answer: Yes, you can contact Bank of America customer service to access your account information.

8. What are the different types of Bank of America accounts? Answer: Bank of America offers various account types, including checking, savings, and money market accounts.

Tips and Tricks: Store your account number securely and keep your online banking credentials confidential.

In conclusion, efficiently managing your finances requires easy access to your Bank of America account information. Understanding how to locate your account number, whether through online banking, your checkbook, or contacting customer service, is essential for seamless banking. Leveraging these resources and tips empowers you to take control of your financial well-being. By staying informed and proactive, you can effectively manage your accounts, ensuring smooth transactions and financial peace of mind. Take advantage of the available tools and resources to simplify your banking experience and achieve your financial goals. Remember to prioritize security, protect your account information, and contact Bank of America customer service if you encounter any issues. By following these best practices, you can navigate your financial journey with confidence and ease.

Indonesias protected plants a vital conservation effort

Unveiling the elegance of voltage in phasor form

Rocking your 60s the ultimate guide to fashionable looks for women over 60