Say Goodbye to Lines: Your Guide to Wells Fargo Mobile Check Deposit Endorsement

Remember the days of carving time out of your day just to visit a bank branch? We waited in lines, sometimes long ones, just to deposit a check. Thankfully, those days are fading fast. Now, we have the power of technology in our pockets, and Wells Fargo mobile check deposit is changing the game. It's convenient, it's fast, and it allows us to deposit checks whenever and wherever we are.

But how exactly does it work? What do you need to know to make the most of this service? Let's dive into the world of Wells Fargo mobile check deposit endorsement and find out.

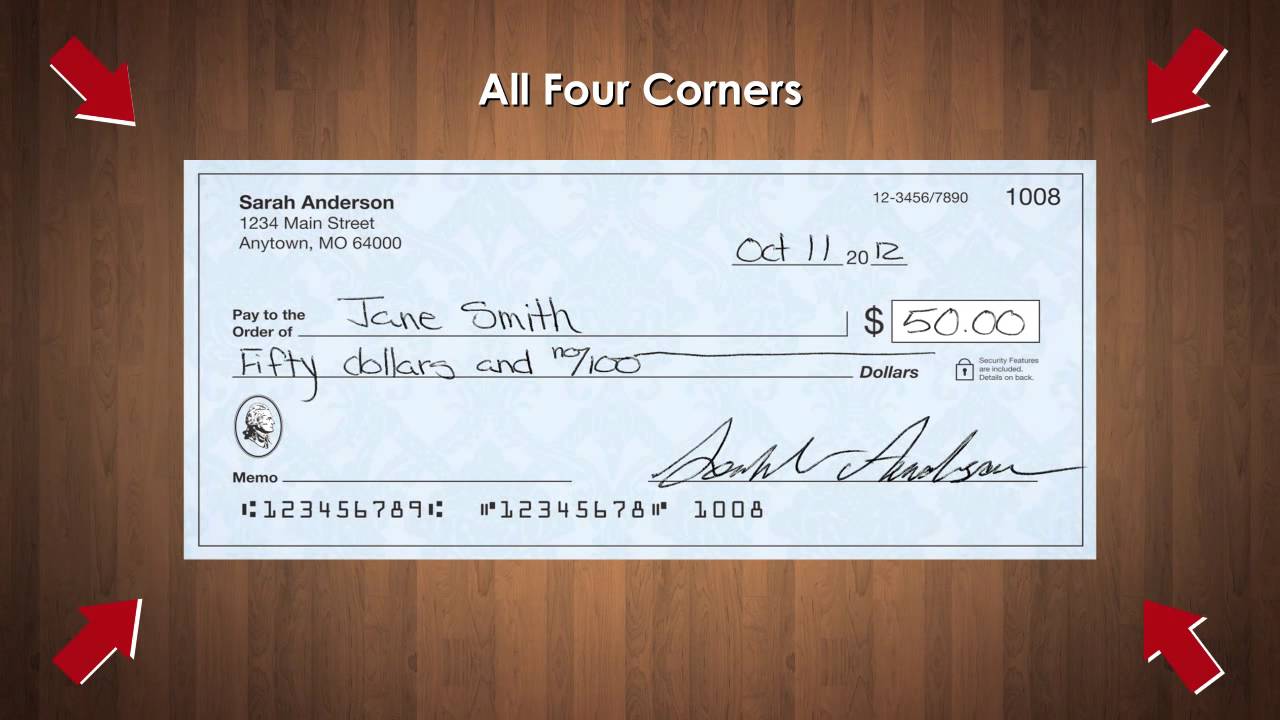

Wells Fargo mobile check deposit endorsement essentially allows you to deposit a check using just your smartphone or tablet. You don't need to physically go to a bank or ATM. Instead, you simply take a picture of your check through the Wells Fargo mobile app and follow a few easy steps. The app will guide you through the process, which includes entering the check amount and endorsing the check electronically.

The rise of mobile banking has been phenomenal, and features like mobile check deposit are a key reason why. For Wells Fargo customers, this service offers incredible convenience. Imagine receiving a check on a weekend getaway, or late at night when your local branch is closed. With mobile check deposit, you can deposit that check instantly, no matter where you are or what time it is.

This innovative feature isn't just about convenience, it's also incredibly secure. Wells Fargo employs advanced security measures to protect your information during the mobile deposit process. Encryption, secure servers, and multi-factor authentication are just some of the ways Wells Fargo works to ensure your money is safe.

Advantages and Disadvantages of Wells Fargo Mobile Check Deposit Endorsement

| Advantages | Disadvantages |

|---|---|

| Convenience: Deposit checks anytime, anywhere. | Potential for technical issues: App glitches or poor internet connectivity. |

| Speed: Deposits are typically processed quickly. | Check deposit limits: There may be restrictions on the amount you can deposit daily or monthly. |

| Security: Wells Fargo uses advanced security measures to protect your information. | Learning curve: Some users may need time to familiarize themselves with the app and process. |

While mobile check deposit is largely beneficial, it's important to be aware of potential downsides. Technical glitches, while rare, can occur. It's also crucial to endorse your check correctly and follow all instructions to prevent any delays in processing.

Ultimately, Wells Fargo mobile check deposit endorsement is a game-changer for managing your finances on the go. Its convenience, speed, and security features make it a valuable tool for anyone who wants a more streamlined banking experience. As with any financial tool, understanding its ins and outs is key to using it safely and effectively.

Unleash the sonic beast your guide to the pioneer 1000 watt 2 channel amplifier

Boost your malay vocabulary teka silang kata for form 2

Navigating guanajuato city a comprehensive guide