Surat Buka Akaun Bank: Your Guide to Understanding Account Opening Letters

Imagine this: you're about to embark on a new financial chapter, opening your very first bank account. It's an exciting step, but navigating the world of banking can feel like learning a new language. One phrase you might encounter is "surat buka akaun bank," which simply translates to "account opening letter" in Malay. Understanding this document and its significance is crucial for a smooth banking experience, especially in Malaysia and other Southeast Asian countries.

While the process might seem straightforward, there are intricacies within the realm of "surat buka akaun bank" that can impact your financial journey. From the types of accounts you can open to the necessary documentation, understanding the nuances of this seemingly simple letter can empower you to make informed decisions.

This guide serves as your comprehensive resource, demystifying the "surat buka akaun bank." We'll delve into its purpose, explore its components, and equip you with the knowledge to navigate the account opening process with confidence. Whether you're a student opening your first savings account or an entrepreneur setting up a business account, understanding the "surat buka akaun bank" is fundamental.

Think of it as your roadmap to a seamless banking experience. Just like every journey requires a starting point, your journey in the world of finance begins with understanding the basics. So, let's break down the "surat buka akaun bank" and equip you with the knowledge you need to thrive in the financial landscape.

Ready to unlock a world of financial possibilities? Let's dive in.

Advantages and Disadvantages of Surat Buka Akaun Bank

While the term "surat buka akaun bank" itself doesn't have inherent advantages or disadvantages (as it simply refers to an account opening letter), the process and requirements associated with it can have pros and cons:

| Advantages | Disadvantages |

|---|---|

| Provides a formal record of your account opening. | Can involve paperwork and time for processing. |

| Ensures clarity on account terms and conditions. | Might require physical presence at the bank branch. |

| Essential for legal and regulatory compliance. | Language barriers could pose a challenge for some. |

Best Practices for a Smooth Account Opening Process

While the specifics may vary depending on the bank and type of account, here are some general best practices:

- Thoroughly research and compare: Explore different banks and account options to find the best fit for your needs.

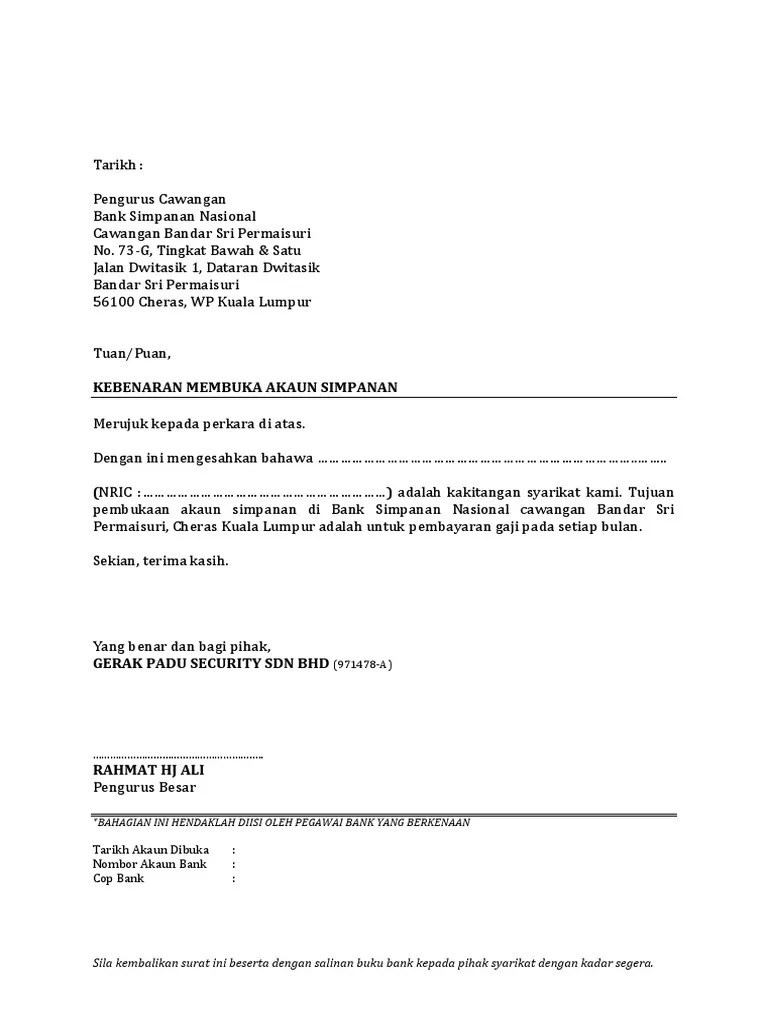

- Prepare required documentation: Ensure you have all necessary identification, proof of address, and any other documents specified by the bank.

- Review terms and conditions carefully: Understand the fees, interest rates, and other important details before signing any documents.

- Ask questions and seek clarification: Don't hesitate to contact the bank if you have any questions or need further explanation.

- Keep copies of all documents: Store your "surat buka akaun bank" and other related documents in a safe place for future reference.

Common Questions and Answers about Surat Buka Akaun Bank

Here are some frequently asked questions to provide further clarity:

- Q: What is the purpose of a "surat buka akaun bank"?

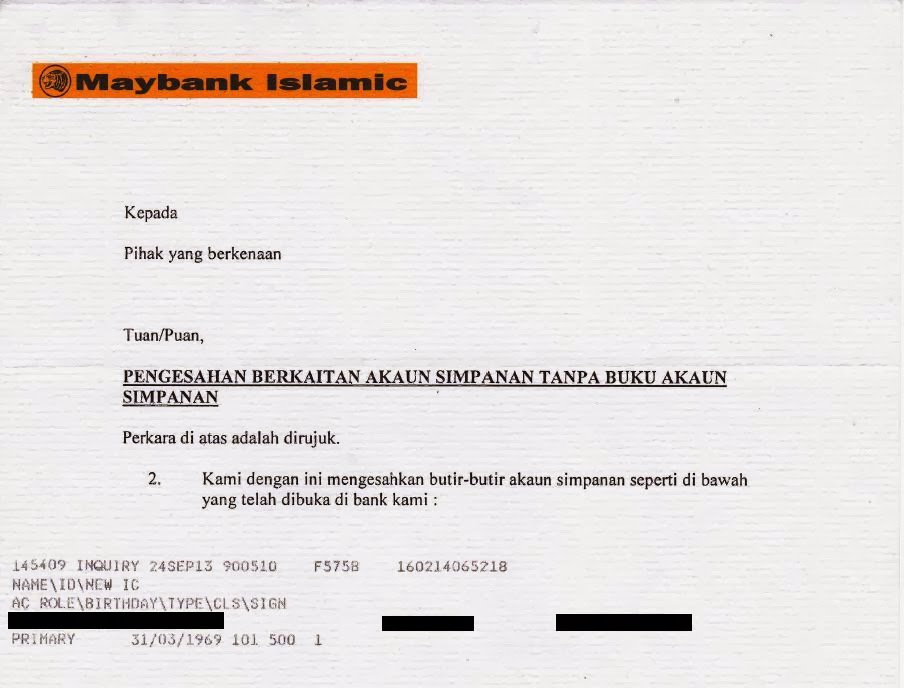

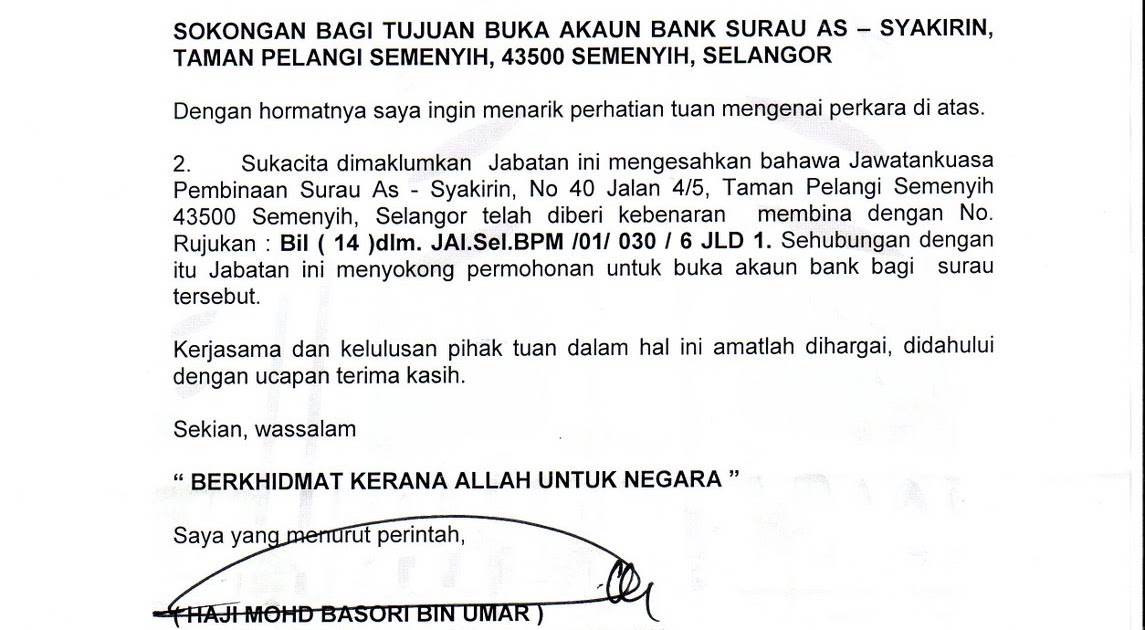

A: It serves as a formal request to open an account and outlines the terms and conditions agreed upon by both the bank and the account holder. - Q: Is a "surat buka akaun bank" mandatory?

A: Yes, it's a standard requirement for opening a bank account in most countries. - Q: Can I get a sample "surat buka akaun bank" online?

A: While you might find generic templates, it's advisable to use the specific form provided by your chosen bank. - Q: What happens if I lose my "surat buka akaun bank"?

A: Contact your bank immediately to report the loss and request a copy. - Q: Can I open a bank account online without a physical "surat buka akaun bank"?

A: Many banks now offer online account opening, often requiring electronic signatures instead of physical documents. - Q: How long does it take to process a "surat buka akaun bank"?

A: Processing times vary, but it usually takes a few business days to a couple of weeks. - Q: What is the difference between a "surat buka akaun bank" and a bank statement?

A: The "surat buka akaun bank" is the initial document for opening an account, while bank statements provide a periodic summary of transactions. - Q: What if there are errors in my "surat buka akaun bank"?

A: Inform the bank immediately to rectify any mistakes and request a corrected copy.

Tips for Navigating Surat Buka Akaun Bank

- Start early: Don't wait until the last minute. Begin the process in advance to allow for processing time.

- Be organized: Keep all your documents in order to avoid delays.

- Communicate clearly: Provide accurate information and respond to bank inquiries promptly.

- Stay informed: Familiarize yourself with banking terms and regulations.

- Utilize online resources: Many banks offer online guides and FAQs related to account opening.

In conclusion, while the term "surat buka akaun bank" might seem like a simple phrase, it represents a significant step in your financial journey. It signifies the beginning of your relationship with a financial institution and sets the foundation for your financial activities. By understanding its purpose, components, and the processes involved, you equip yourself with the knowledge to navigate the banking landscape with confidence. Remember, a well-informed customer is an empowered one. So, embrace the world of finance, start your banking journey on the right foot, and unlock a future of financial possibilities.

The allure of ripped torn old paper a journey through time

Unlocking the secrets of the chevy 35l 5 cylinder engine

Decoding monochrome understanding social media icons in black and white