Surat Pengesahan Untuk Buka Akaun Bank: What You Need to Know

Opening a bank account is a fundamental step towards managing finances, making transactions, and securing your money. In Malaysia, a crucial document required for this process is the "surat pengesahan untuk buka akaun bank" (bank account opening confirmation letter). This document serves as proof of identity and address, verifying your legitimacy as a potential account holder.

Understanding the significance of this letter and the information it should contain is essential for a smooth and successful account opening experience. Whether you are a student, a working professional, or a business owner, having a clear understanding of this document will empower you to navigate the banking system with ease.

The requirement for a "surat pengesahan untuk buka akaun bank" stems from the need to combat financial fraud and ensure the security of the banking system. By requesting this document, banks aim to establish your identity and verify your address, minimizing the risk of fraudulent activities.

Historically, obtaining this letter often involved bureaucratic processes, potentially causing delays in opening an account. However, with advancements in technology and digital verification methods, many banks have streamlined this process, making it easier and faster for individuals to open accounts.

Navigating the world of "surat pengesahan untuk buka akaun bank" might seem daunting at first, but by understanding its purpose, the information required, and the various ways to obtain it, you can confidently take the first step towards managing your finances effectively. Remember, having a bank account is an essential aspect of modern life, and a little preparation can go a long way in ensuring a seamless experience.

Advantages and Disadvantages of Using Surat Pengesahan

| Advantages | Disadvantages |

|---|---|

| Provides a secure method for banks to verify identity. | Can be time-consuming to obtain, especially for certain professions. |

| Helps prevent fraudulent account openings. | May require additional documentation depending on the bank's policies. |

While the concept of a "surat pengesahan untuk buka akaun bank" is relatively straightforward, several questions often arise:

Q1: What information does a "surat pengesahan untuk buka akaun bank" typically include?

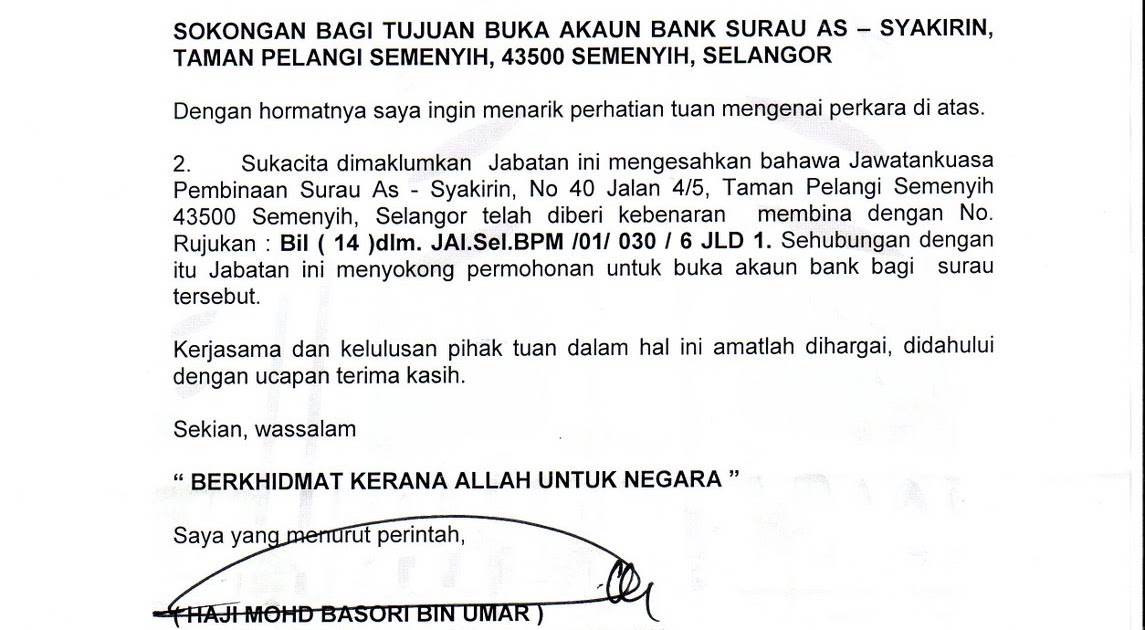

A1: The letter should include your full name, IC number, address, and the purpose of opening the bank account. It should be printed on the official letterhead of the issuing organization and signed by an authorized personnel.

Q2: Who can issue a "surat pengesahan untuk buka akaun bank?"

A2: The issuing authority can vary depending on your employment status or background. It could be your employer, university, professional body, or government agency.

Ensuring you have the correct information and following the procedures outlined by the bank are key to a hassle-free account opening experience. As financial landscapes evolve, staying informed about the latest requirements and procedures will empower you to make informed decisions about your finances.

While opening a bank account in Malaysia might seem like navigating a maze of documents and procedures, understanding the crucial role of the "surat pengesahan untuk buka akaun bank" can simplify the process. Remember, preparation is key.

Unleash your inner artist mastering easy kawaii drawings step by step

Propane power up your guide to refilling 1lb tanks

Decoding sherwin williams gray area the ultimate guide