Surat Rasmi Untuk Buka Akaun Bank: Your Guide to Malaysian Banking

So, you're ready to dive into the Malaysian ringgit, eh? Maybe you've landed a job in KL, or you're setting off on a backpacking adventure through Southeast Asia. Either way, you'll need a local bank account, and that's where "surat rasmi untuk buka akaun bank" comes in. Don't worry, it's not as intimidating as it sounds!

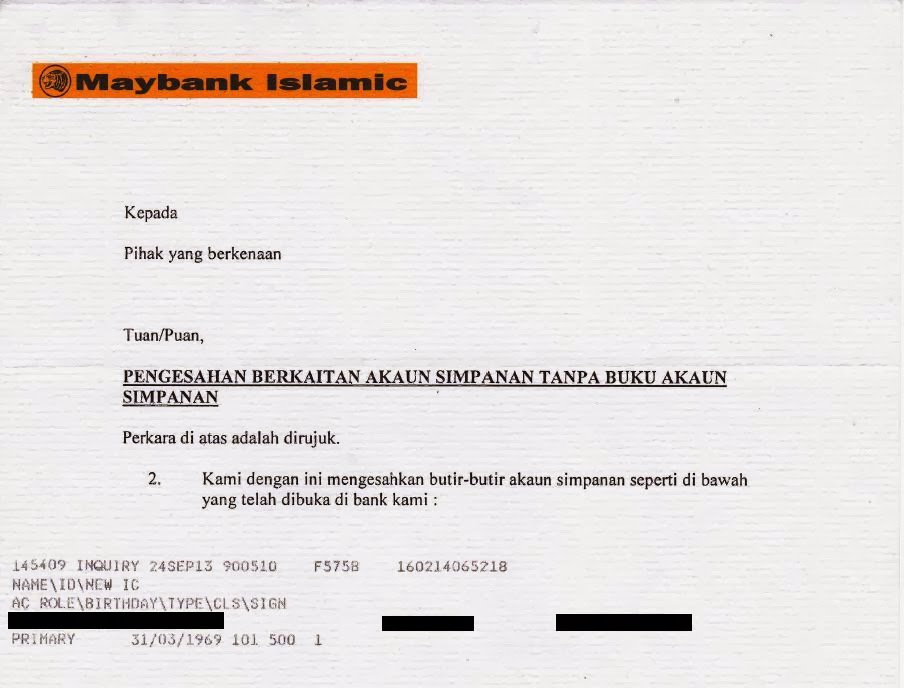

In a nutshell, "surat rasmi untuk buka akaun bank" translates to "official letter to open a bank account" in Malay. Think of it as your golden ticket to accessing the Malaysian financial system. It's a crucial document that verifies your identity and purpose for opening an account, providing a sense of security for both you and the bank.

Now, you might be wondering, "Why all the fuss about a letter?" Well, in Malaysia, official documentation is kind of a big deal. It's all part of ensuring secure and transparent financial transactions. Plus, having a local bank account makes life a whole lot easier. You can pay bills, receive your salary, and even avoid those pesky foreign transaction fees.

But hold on, what exactly constitutes a "surat rasmi"? And how do you even go about getting one? Don't sweat it, we've got you covered. In this comprehensive guide, we'll break down everything you need to know about navigating the world of "surat rasmi untuk buka akaun bank." We'll explore its importance, the different types of letters, and even provide some handy tips to make the process a breeze.

So, whether you're a seasoned expat or a first-time visitor, get ready to unlock the secrets of Malaysian banking. With a little preparation and the right information, you'll be well on your way to managing your finances like a local!

Advantages and Disadvantages of Using a "Surat Rasmi"

While the "surat rasmi" system is an integral part of Malaysian banking, it does come with its own set of pros and cons:

| Advantages | Disadvantages |

|---|---|

| Provides a secure framework for opening bank accounts | Can be time-consuming to obtain the necessary documentation |

| Helps prevent fraud and maintain transparency in financial transactions | May present a barrier for short-term visitors or tourists |

Five Best Practices for a Smooth "Surat Rasmi" Experience

- Do Your Research: Different banks might have slightly different requirements, so it's best to check with your chosen bank beforehand.

- Gather Your Documents Early: Don't wait till the last minute. Start collecting your passport, visa, employment offer (if applicable), and proof of address as soon as possible.

- Make Copies: Always carry photocopies of your important documents, especially when dealing with official procedures.

- Be Prepared to Wait: Government offices and banks in Malaysia may have queues, so be patient and allocate sufficient time for your visit.

- Ask Questions: Don't hesitate to clarify any doubts or concerns with bank staff. They are there to help you through the process.

Common Questions and Answers About "Surat Rasmi untuk Buka Akaun Bank"

1. What if I don't have a "surat rasmi"?

Some banks may offer alternative options for foreigners to open accounts, especially for short-term stays. However, these accounts might come with certain limitations.

2. Can I open a bank account online?

While some banks offer online account opening facilities, it's more common to visit a branch in person, especially for foreigners requiring a "surat rasmi."

3. How long does it take to open a bank account?

The process can take anywhere from a few days to a week, depending on the bank and the complexity of your application.

4. What are the common documents required for a "surat rasmi"?

Commonly requested documents include your passport, valid visa, employment offer (if applicable), and proof of Malaysian address.

5. What if my "surat rasmi" is in English?

While most banks accept English documents, it's always a good idea to check with your specific bank for their policy.

6. Can I open a joint bank account with a "surat rasmi"?

Yes, joint accounts are possible, but both parties will likely need to provide their respective "surat rasmi" and supporting documents.

7. What happens if my visa expires before my bank account closes?

It's crucial to inform your bank about any changes in your visa status. They can guide you on the necessary steps to either close your account or update your information.

8. Can I use my Malaysian bank account overseas?

Yes, you can typically use your debit card for international transactions and ATM withdrawals. However, check with your bank regarding fees and charges.

Tips and Tricks for Navigating "Surat Rasmi"

* Be polite and respectful when interacting with bank staff.

* Dress appropriately when visiting government offices or banks.

* Have your documents organized and easily accessible.

* Consider opening an account with a bank that has experience dealing with foreigners.

* Ask for a Malay-speaking friend to accompany you if you're not confident with your language skills.

Navigating the world of "surat rasmi untuk buka akaun bank" might seem daunting at first, but armed with the right information and a dash of preparation, you'll be well on your way to financial freedom in Malaysia. Embrace the process, remember to breathe, and soon enough, you'll be managing your ringgit like a pro.

Unlocking young minds the power of reading comprehension worksheets for 4th grade pdf

Navigating financial streams understanding the wells fargo check mobile deposit limit

Navigating motorcycle license plate replacement costs in indonesia