The Future of Finance: Wells Fargo Voided Check Online

We live in an era where our smartphones hold concert tickets, boarding passes, and even our morning coffee order. So, why not our checkbooks? The digitization of finance is upon us, and Wells Fargo is at the forefront, offering innovative solutions like the ability to access a "Wells Fargo voided check online." But what exactly does this mean, and how does it fit into the modern financial landscape?

For generations, the physical check has reigned supreme. Whether it's paying rent, receiving a birthday gift, or handling a business transaction, the rustle of that paper rectangle has been a constant. However, with the rise of online banking and digital payment platforms, the need for tangible checks is steadily diminishing. This shift brings convenience, speed, and enhanced security to the forefront.

The concept of a "Wells Fargo voided check online" might seem paradoxical at first. How can something digital replace a physical document that requires a signature and a trip to the mailbox? The answer lies in the way we now handle financial information. Direct deposits, online bill pay, and mobile check deposits have paved the way for a fully digital banking experience.

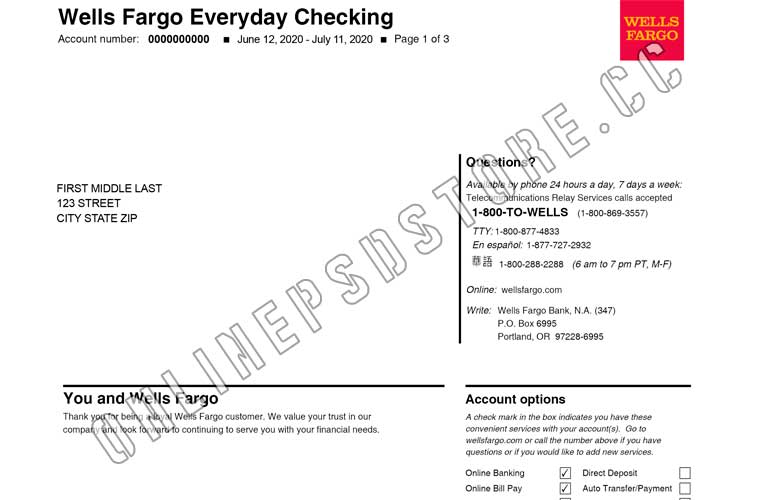

Accessing your banking information digitally opens a world of possibilities. Imagine needing to provide your bank details for a direct deposit or setting up automatic bill pay. Traditionally, this would involve digging out your checkbook, carefully writing "VOID" across a check, and hoping you remembered to grab the correct one. With Wells Fargo's online banking platform, this process becomes streamlined. You can often find a digital copy of your check, complete with your routing and account numbers, within your online account, eliminating the need for a physical check altogether.

This digital shift in banking marks a significant departure from traditional methods, and understanding its nuances is becoming increasingly essential. The ability to access a "Wells Fargo voided check online" exemplifies this evolution, providing users with a secure and efficient way to manage their finances in our rapidly evolving digital world.

While a physical voided check isn't something you'd find online for security reasons, Wells Fargo provides tools within its online banking platform that essentially serve the same purpose. Need your routing and account number for setting up direct deposit? It's readily available within your account information. This digital approach eliminates the risks associated with handling sensitive information physically, offering a secure and convenient alternative to traditional banking methods.

The shift toward digital banking is not just a trend—it's the future of finance. Understanding how to navigate these new tools, like accessing the digital equivalent of a "Wells Fargo voided check online," empowers individuals to take control of their finances efficiently and securely in an increasingly digital world.

Crafting the perfect appointment follow up message

Finding peace after loss my brother in law

Unlocking the power of come to my house a guide to the viral sensation