The Significance of Salinan Akaun Bank Islam in Modern Transactions

In a world increasingly reliant on digital footprints and online transactions, the concept of documentation remains paramount. There's a certain gravity, a weight, that comes with holding a tangible record, a physical manifestation of financial activity. In the realm of Islamic finance, this takes on even greater significance.

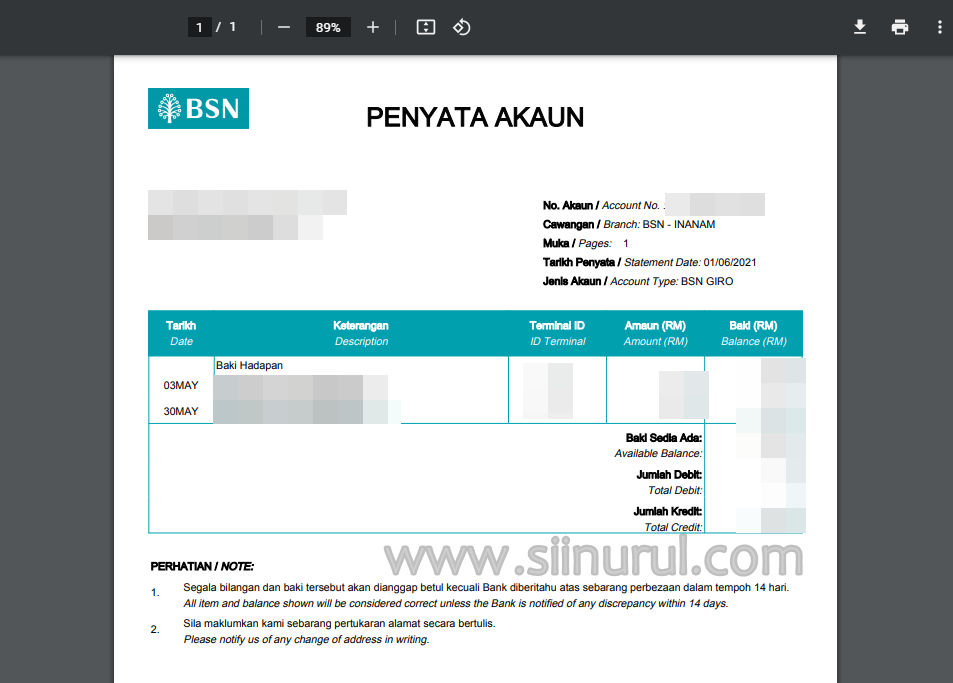

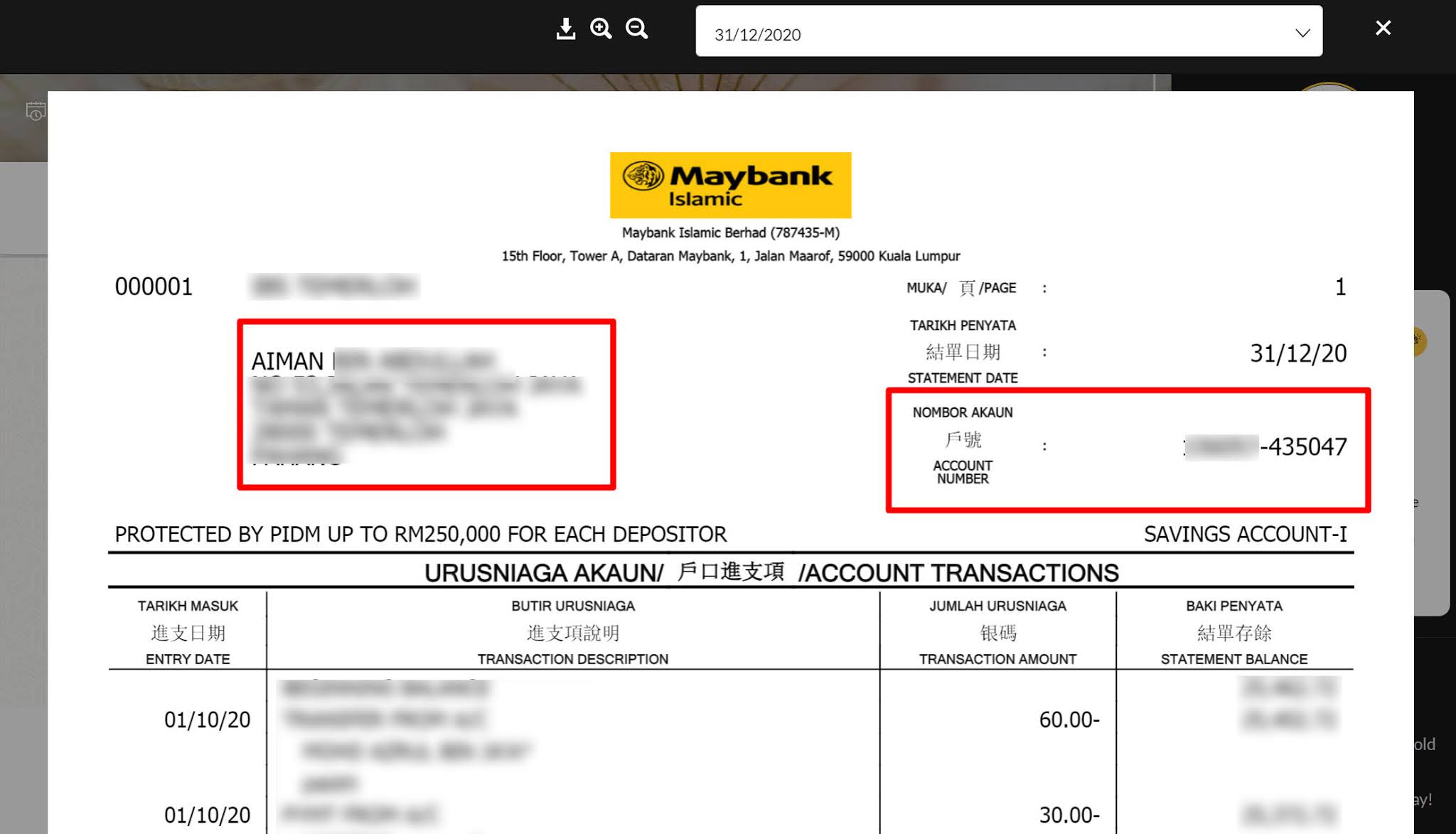

'Salinan akaun bank Islam,' the Malay term for 'copy of Islamic bank account statement,' might seem like a purely technical phrase. However, it represents a crucial element within the ecosystem of Islamic banking, underpinning transparency, accountability, and adherence to Shariah principles.

The need for such documentation is deeply rooted in the principles of Islamic finance. Transparency, in particular, is paramount. Every transaction, every movement of funds, must be clear, traceable, and justifiable. This ensures that all financial dealings comply with the ethical and moral framework of Islamic law, prohibiting activities like interest (riba) and excessive speculation (gharar).

The 'salinan akaun bank Islam' serves as a window into the operations of an account. It's a detailed record, meticulously outlining deposits, withdrawals, transfers, and any profits or losses incurred through Shariah-compliant investments. This level of detail is not merely for record-keeping. It empowers account holders to scrutinize their financial activities, ensuring alignment with their own ethical values and the principles of Islamic finance.

The significance of this document extends beyond personal accountability. It plays a crucial role in maintaining the integrity of the Islamic financial system as a whole. Regulatory bodies utilize 'salinan akaun bank Islam' to supervise and audit Islamic financial institutions, ensuring their compliance with Shariah guidelines and guarding against any practices that contradict the spirit of Islamic finance.

While obtaining a 'salinan akaun bank Islam' might seem like a simple procedural step, it embodies a much deeper philosophy. It's a tangible representation of the principles of transparency, accountability, and ethical conduct that lie at the heart of Islamic finance. In a world often driven by opaque financial dealings, the emphasis on clarity and ethical consciousness offered by 'salinan akaun bank Islam' stands out as a beacon of responsible financial practice.

Advantages and Disadvantages of Salinan Akaun Bank Islam

| Advantages | Disadvantages |

|---|---|

| Transparency and Accountability | Potential for Paperwork |

| Compliance with Shariah Principles | Privacy Concerns (if physical copies are shared inappropriately) |

| Empowerment of Account Holders |

Understanding the nuances of 'salinan akaun bank Islam' requires looking beyond its functional aspect. It's about recognizing the ethical foundation upon which Islamic finance is built. This document, while seemingly simple, represents a commitment to transparency and accountability, shaping a financial landscape that is both ethical and sustainable.

The powerful messages behind wendy testaburgers anthems

Achieving a perfectly level farrow ball

Unleash your inner child the quirky charm of scary simple monster drawings