Understanding JPMorgan Chase ABA Wire Routing Numbers

Navigating the world of finance can sometimes feel like traversing a complex maze. One crucial element for seamless transactions, especially wire transfers, is the ABA routing number. This numerical code acts as a unique identifier for financial institutions, ensuring that funds reach their intended destination. For customers of JPMorgan Chase, understanding their specific routing number is essential for smooth and efficient transfers.

Imagine needing to send money quickly and securely to another account. Whether it's for a time-sensitive payment or an important international transaction, wire transfers offer a reliable solution. The JPMorgan Chase ABA routing number, like a precise address for your bank, allows for the accurate routing of these transfers. It acts as a critical piece of information, ensuring your funds arrive at the correct financial institution.

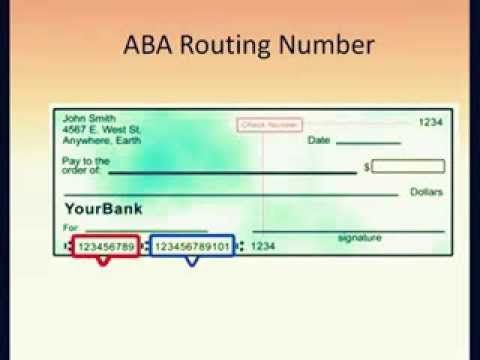

The ABA routing number, also known as a routing transit number (RTN), was developed by the American Bankers Association in 1910. Its purpose was to create a standardized system for identifying banks and facilitating interbank communication. Today, it plays a vital role in various financial transactions, including direct deposits, ACH payments, and, most notably, wire transfers. Each bank is assigned a unique nine-digit code, and JPMorgan Chase, like other financial institutions, has different routing numbers depending on the state where the account was opened.

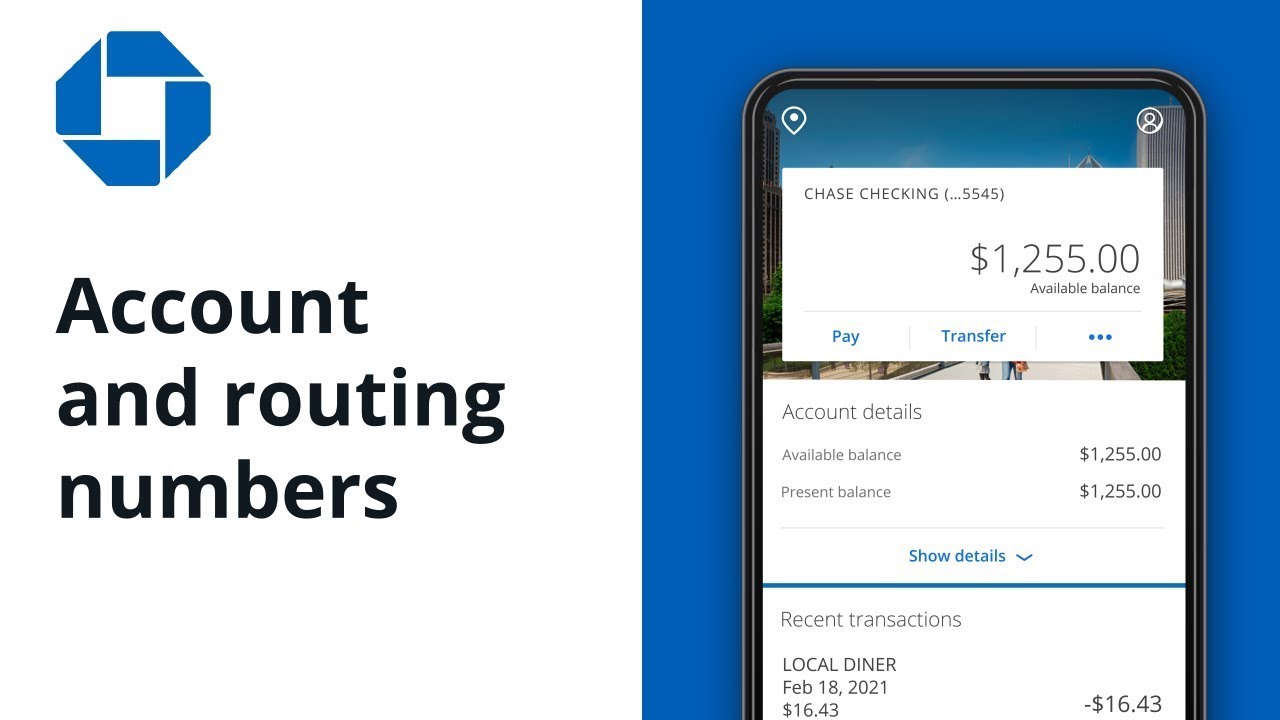

Locating your JPMorgan Chase routing number might seem like a small detail, but its importance can't be overstated. Using the incorrect routing number can lead to delays, returned payments, or even the misdirection of funds. Therefore, it's crucial to verify the correct routing number for your specific JPMorgan Chase account. This information can typically be found on your checks, online banking platform, or by contacting customer service.

Understanding the various routing numbers associated with JPMorgan Chase is essential for ensuring smooth transactions. For domestic wire transfers within the United States, a specific routing number is used. For international wire transfers or transactions involving foreign currency, a different SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is required. Knowing the distinction between these codes is paramount for successful international transactions.

One benefit of using the correct JPMorgan Chase ABA routing number is the speed and efficiency it brings to wire transfers. With the right information, funds can be transferred quickly and securely, often arriving within the same business day. Another advantage is the reduced risk of errors. Using the correct routing number minimizes the chances of delays, returned payments, or misdirected funds. Finally, having access to the correct routing number empowers customers to manage their finances effectively, facilitating timely payments and avoiding potential financial inconveniences.

To find your JPMorgan Chase ABA routing number, you can check your personal checks, log in to your online banking account, or contact JPMorgan Chase customer service. It's always best to double-check the number to ensure accuracy.

When initiating a wire transfer, always confirm the recipient's bank account details and the corresponding routing number. Double-checking this information can prevent costly errors and ensure the funds reach the intended recipient.

While the ABA routing number system provides efficiency and security, challenges can arise if incorrect information is used. One common challenge is the use of outdated routing numbers. Regularly verifying the correct routing number is crucial to avoid delays or returned payments. Another challenge is the potential for fraud if account information is compromised. Protecting your account credentials and reporting any suspicious activity is essential for maintaining financial security.

Advantages and Disadvantages of Wire Transfers

While wire transfers offer speed and convenience, understanding the pros and cons can help make informed decisions.

| Advantages | Disadvantages |

|---|---|

| Fast transfer speed | Potentially higher fees |

| Secure transactions | Irreversible once sent |

| International capabilities | Requires accurate banking details |

Frequently Asked Questions:

1. What is an ABA routing number? Answer: A unique nine-digit code used to identify financial institutions.

2. Where can I find my JPMorgan Chase routing number? Answer: On your checks, online banking platform, or by contacting customer service.

3. What is the difference between a domestic and international wire transfer routing number? Answer: Domestic transfers use a specific routing number while international transfers often require a SWIFT code.

4. What happens if I use the wrong routing number? Answer: The transfer could be delayed, returned, or misdirected.

5. How can I protect myself from fraud when using wire transfers? Answer: Verify recipient details, protect your account information, and report suspicious activity.

6. Are there fees associated with wire transfers? Answer: Yes, fees can vary depending on the type of transfer and the financial institution.

7. Can I cancel a wire transfer? Answer: It may be possible to cancel if the transfer hasn't been processed, but contacting your bank immediately is essential.

8. How long do domestic wire transfers typically take? Answer: Often within the same business day.

Tips and Tricks: Keep a record of your JPMorgan Chase routing number in a secure location. Always double-check the recipient's details and the routing number before initiating a wire transfer. Regularly monitor your account for any unauthorized activity.

In conclusion, the JPMorgan Chase ABA wire routing number is a critical piece of information for anyone conducting wire transfers. Understanding its function and importance can greatly enhance the efficiency and security of your financial transactions. From domestic to international transfers, knowing the correct routing number, along with best practices for security, empowers customers to navigate the financial landscape with confidence. By prioritizing accuracy and vigilance, you can ensure smooth, secure, and timely wire transfers, maximizing the benefits of this essential financial tool. Take the time to locate and verify your routing number and keep it in a secure location. This small step can make a significant difference in ensuring your financial transactions proceed smoothly and securely. By being proactive and informed, you can harness the full potential of wire transfers while minimizing potential risks.

Decoding nj mvc registration fees your guide to new jersey vehicle costs

Inked rhymes rappers and the stories their tattoos tell

Level up your online presence crafting the perfect minecraft pfp aesthetic