Unlocking Possibilities: Understanding Qualifying Life Event Meaning

Life unfolds like a winding path, full of unexpected turns and significant milestones. Some moments, while seemingly ordinary at first glance, hold the power to reshape the landscape of our lives. These pivotal junctures are often referred to as "qualifying life events." But what exactly do they mean, and why should we pay attention when they occur?

Imagine a pebble dropped into a still pond. The ripples it creates expand outward, subtly altering the pond's surface. Similarly, qualifying life events, though often arising from personal circumstances, have the potential to ripple into various aspects of our lives, including our healthcare coverage, taxes, and financial well-being.

These events often act as triggers, opening up specific periods where we're allowed to make changes to important aspects of our lives that are normally locked in place. This ability to adjust and adapt becomes crucial in ensuring that our safety net aligns with our evolving needs and circumstances.

The concept of qualifying life events exists to provide individuals and families with a degree of flexibility in navigating the complexities of insurance, benefits, and legal documentation. Recognizing and understanding these events is paramount to making informed decisions and maximizing the resources available to us during times of transition.

Failing to grasp the significance of qualifying life events can lead to missed opportunities for crucial adjustments. It's like packing for a journey without checking the weather forecast - you might find yourself unprepared for the challenges ahead. Whether it's a change in family status, a move across state lines, or a shift in employment, being aware of the qualifying life event definition allows us to approach these transitions with clarity and proactive planning.

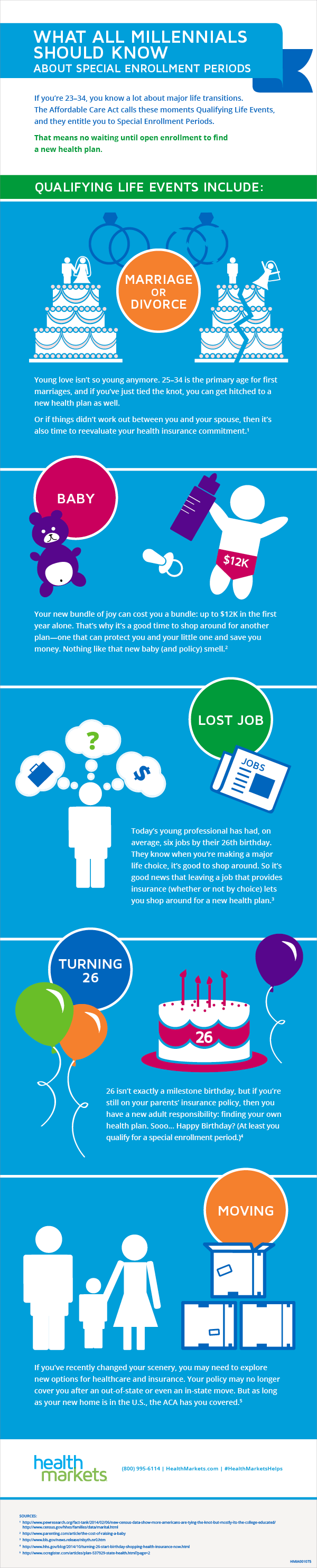

A qualifying life event is a significant change in your life situation that allows you to enroll in health insurance, change your existing health insurance plan, or adjust your benefits outside of the typical annual enrollment period. These events are often tied to changes in your family status, employment, or location.

Here are a few examples of qualifying life events:

- Marriage

- Divorce

- Birth or adoption of a child

- Death of a spouse or dependent

- Loss of health insurance coverage

- Moving to a new state

- Starting a new job

- Losing job-based health coverage

Let's say you're offered a new job, and your new employer offers health insurance. Even though it's not the typical open enrollment period, losing your previous job-based health coverage qualifies you for a special enrollment period. This allows you to seamlessly transition your health insurance without experiencing a gap in coverage.

Understanding the concept of qualifying life events empowers us to navigate life's transitions with greater awareness and control. By recognizing these moments as opportunities for reflection and adjustment, we can approach the path ahead with confidence, knowing that we have the tools to adapt to whatever unfolds along the way.

Exploring the world of princess sofia the first fandom

Bmw 535i high pressure fuel pump everything you need to know

Unleash your desktop style cool backgrounds wallpapers for pc gif