Unlocking Your Check: A Guide to Finding Your Bank Transit Number

Ever found yourself needing to make an online payment or set up direct deposit, only to be stumped by the request for a bank transit number? Don't worry, you're not alone. This seemingly cryptic number is actually readily available on your checks, and knowing how to locate it is essential for smooth financial transactions. This guide will demystify the process of finding your bank transit number, providing a clear roadmap for navigating your checks and unlocking access to essential banking services.

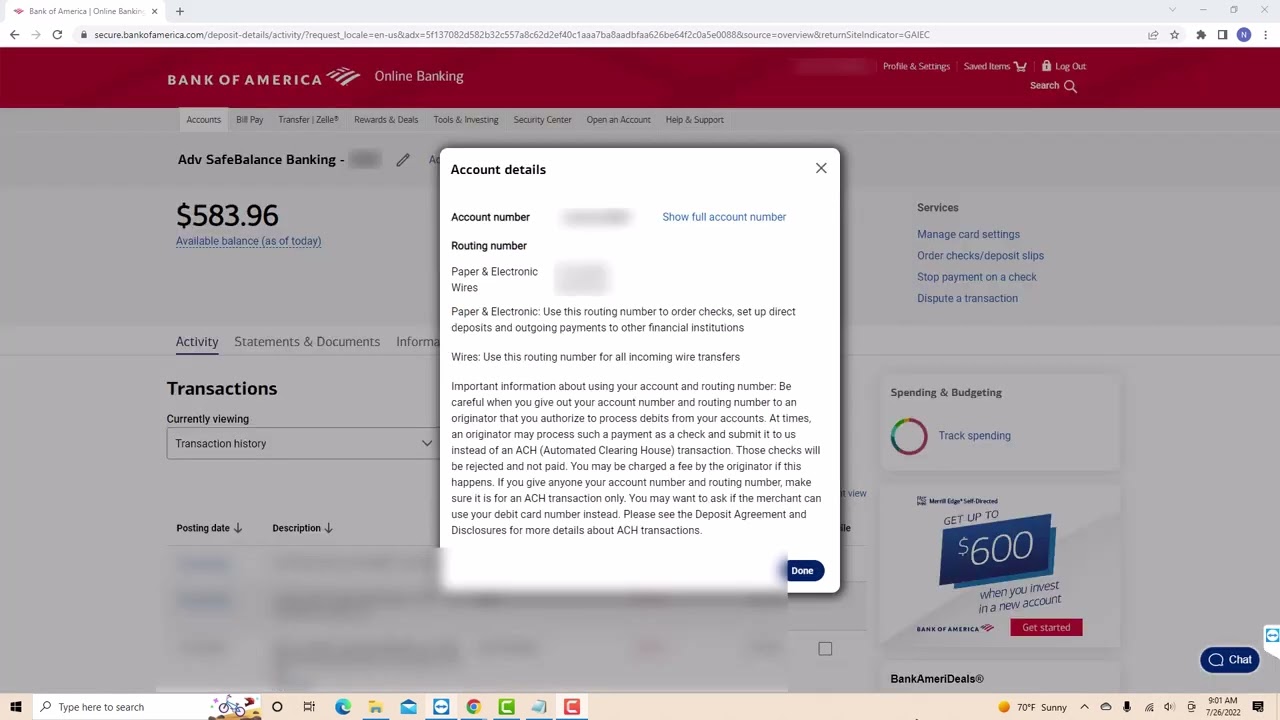

Locating your bank transit number is crucial for various banking activities. Whether you're setting up direct deposit for your paycheck, making online bill payments, or transferring funds between accounts, this number acts as a key identifier for your financial institution. It allows banks to quickly and accurately process transactions, ensuring that your money ends up in the right place.

The bank transit number, also known as the routing number, is a nine-digit code located on the bottom left corner of your checks. It identifies the specific financial institution where your account is held. This number plays a vital role in the electronic transfer of funds between banks. Think of it as a GPS coordinate for your bank, guiding transactions to their correct destination.

The history of the bank transit number dates back to the early 20th century, when the American Bankers Association developed a system to streamline check processing. Before this system, checks were processed manually, a time-consuming and error-prone process. The introduction of the transit number revolutionized banking, enabling faster and more efficient transactions.

Misidentifying or incorrectly entering your bank transit number can lead to several issues, including delayed or rejected payments, returned checks, and potential fees. Therefore, it's crucial to double-check the number before submitting it for any transaction. Accuracy is key to ensuring a seamless banking experience.

The bank transit number is typically printed as a fraction at the bottom of your check, with a hyphen separating the first two sets of digits. The format looks like this: XX-YYY/ZZZZZ.

Benefits of Knowing Where to Find Your Bank Transit Number:

1. Seamless Online Transactions: Quickly and easily make online payments and transfers without the hassle of searching for your bank information.

2. Efficient Direct Deposit Setup: Ensure your paycheck is deposited directly into your account without delays by providing the correct transit number.

3. Avoidance of Errors and Fees: Accurately entering the transit number prevents returned checks, rejected payments, and potential fees.

Step-by-Step Guide to Locating Your Bank Transit Number:

1. Grab a check from your checkbook.

2. Look at the bottom left corner of the check.

3. Identify the nine-digit number printed as a fraction, usually alongside other numbers.

Advantages and Disadvantages of Knowing Your Bank Transit Number

| Advantages | Disadvantages |

|---|---|

| Facilitates online banking | Risk of fraud if the number falls into the wrong hands |

| Enables direct deposit | None inherent to knowing the number itself |

Best Practices:

1. Verify the number with your bank if you're unsure.

2. Keep your checks in a secure location.

3. Shred old checks to prevent misuse of your banking information.

4. Be cautious when sharing your banking details online.

5. Regularly monitor your bank statements for any unauthorized transactions.

FAQs:

1. What is the difference between a bank transit number and a routing number? They are the same thing.

2. Where can I find my bank transit number online? You can typically find it on your bank's website or mobile app by logging into your account.

3. What if my check doesn't have a bank transit number? Contact your bank immediately.

4. Is my bank transit number the same for all my accounts at the same bank? Not necessarily. Different branches may have different routing numbers.

5. Can I use my bank transit number for international transfers? No, you will need a SWIFT code for international transfers.

6. What should I do if I suspect my bank transit number has been compromised? Contact your bank immediately to report the suspected fraud.

7. How can I verify my bank transit number? Contact your bank or check your bank statement.

8. Is it safe to share my bank transit number with others? No, you should never share your bank transit number with anyone you do not trust.

In conclusion, understanding how to locate and utilize your bank transit number is fundamental for navigating today's digital banking landscape. From setting up direct deposit to making online payments, this nine-digit code acts as a gateway to essential financial services. By following the steps outlined in this guide and being mindful of best practices, you can ensure smooth, secure, and efficient banking transactions. Knowing where to find your bank transit number empowers you to take control of your finances and participate fully in the modern financial world. Don't let this small number hold you back – unlock its potential and simplify your banking experience. Take a moment to locate a check and familiarize yourself with the position of your bank transit number – you’ll be surprised how often this knowledge comes in handy. This proactive step will save you time and frustration in the long run, allowing you to manage your finances with confidence and ease.

Pink aesthetic wallpaper transform your desktop into a candy colored dream

Decoding langston hughes early years key insights

Mastering your trailer lights the definitive guide to 7 pin wiring