Unlocking Your Finances: A Guide to Understanding Salary Percentages

Have you ever received your paycheck and wondered how the deductions were calculated? Or perhaps you're anticipating a raise and want to know the exact amount you'll be taking home? Understanding salary percentages is crucial for anyone who wants to take charge of their finances.

It's more than just knowing how much money is deposited into your account every month. By understanding how salary percentages work, you can effectively budget, negotiate better, and make informed financial decisions.

Navigating the world of salary percentages might seem intimidating at first, but it doesn't have to be. This guide will equip you with the knowledge and tools to confidently understand your earnings.

Whether you're a recent graduate starting your first job or a seasoned professional, having a firm grasp of salary percentages can empower you to make savvy financial choices.

Let's demystify salary percentage calculations and provide you with the clarity you need to navigate your financial journey with confidence.

Advantages and Disadvantages of Understanding Salary Percentages

Understanding salary percentages offers numerous advantages, empowering you to take control of your finances. Let's delve into the pros and cons:

| Advantages | Disadvantages |

|---|---|

|

|

Frequently Asked Questions About Salary Percentages

Here are answers to some common questions about salary percentages:

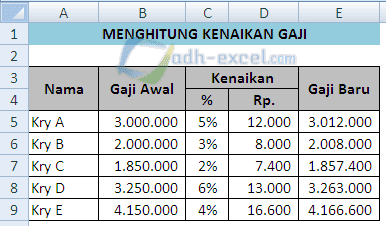

1. How do I calculate a percentage increase in salary?

To calculate a percentage increase, subtract your old salary from your new salary, divide the result by your old salary, and multiply by 100.

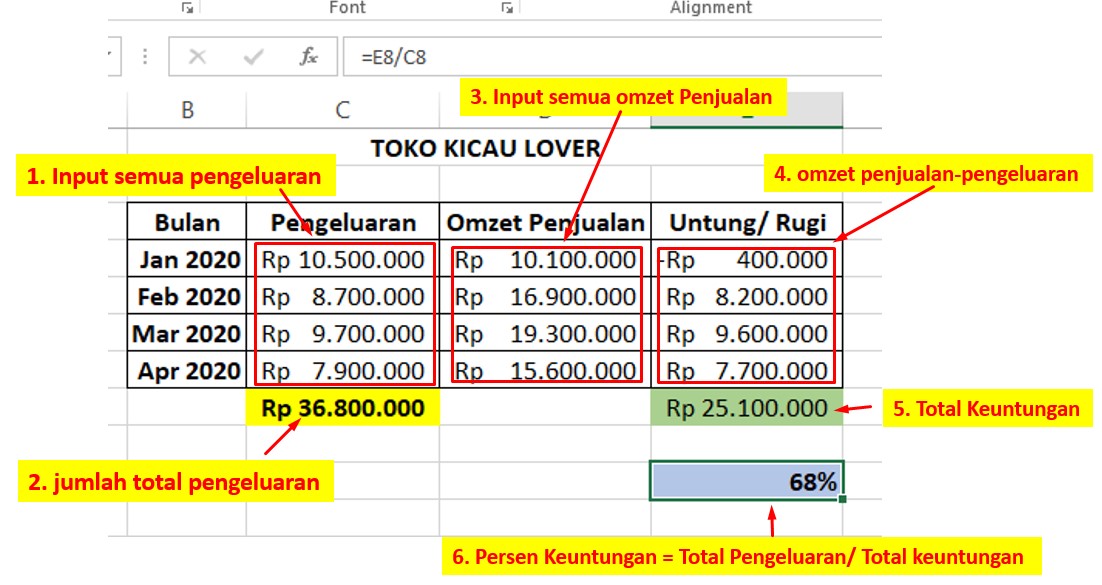

2. How do I calculate my net salary after deductions?

Subtract the total amount of deductions (taxes, insurance, etc.) from your gross salary to find your net salary.

3. What are some common deductions from a salary?

Common deductions include income tax, social security contributions, health insurance premiums, and retirement plan contributions.

4. How do I negotiate a higher salary based on percentages?

Research industry standards and come prepared with data to support your request for a specific percentage increase.

5. What resources can help me understand salary percentages better?

Online calculators, financial websites, and government resources provide valuable information on salary calculations and deductions.

6. How often are salary percentages typically reviewed?

Salary reviews often occur annually, but the frequency may vary depending on your company's policies.

7. What factors can influence salary percentage increases?

Performance, company profits, industry trends, and cost of living adjustments can all impact salary increases.

8. Where can I find information about average salary percentages for my profession?

Websites like Glassdoor, Indeed, and Salary.com provide salary data based on job titles and locations.

Conclusion: Take Charge of Your Financial Future

Mastering the art of salary percentages is an essential step towards achieving financial well-being. By understanding how to calculate deductions, negotiate raises, and plan for your financial goals, you can gain a sense of control over your money. Embrace the knowledge and tools available to you, and embark on a path toward greater financial confidence and security.

Becoming a notary in chile requirements and insights

Remembering granite state champions union leader obits nh

Finding your perfect room in central nj