Unlocking Your Future: A Guide to Cara Membuka Akaun 3 KWSP

In a world brimming with possibilities, securing our financial well-being often feels like navigating an intricate labyrinth. We yearn for stability, for a safety net woven from foresight and mindful planning. This yearning for financial security is universal, a shared human experience that transcends borders and cultures. In Malaysia, this yearning finds solace in the Employees Provident Fund, fondly known as KWSP or EPF.

KWSP, a cornerstone of Malaysia's social security system, stands as a testament to the nation's commitment to its people's well-being. It's more than just a retirement fund; it's a beacon of hope, a promise whispered from one generation to the next - a promise of a secure future.

Within this intricate tapestry of financial planning, lies a powerful tool often overlooked - the KWSP Account 3. This enigmatic account, shrouded in whispers of financial freedom and shrouded in a veil of legalese, holds the potential to unlock a world of possibilities for those who dare to explore its depths.

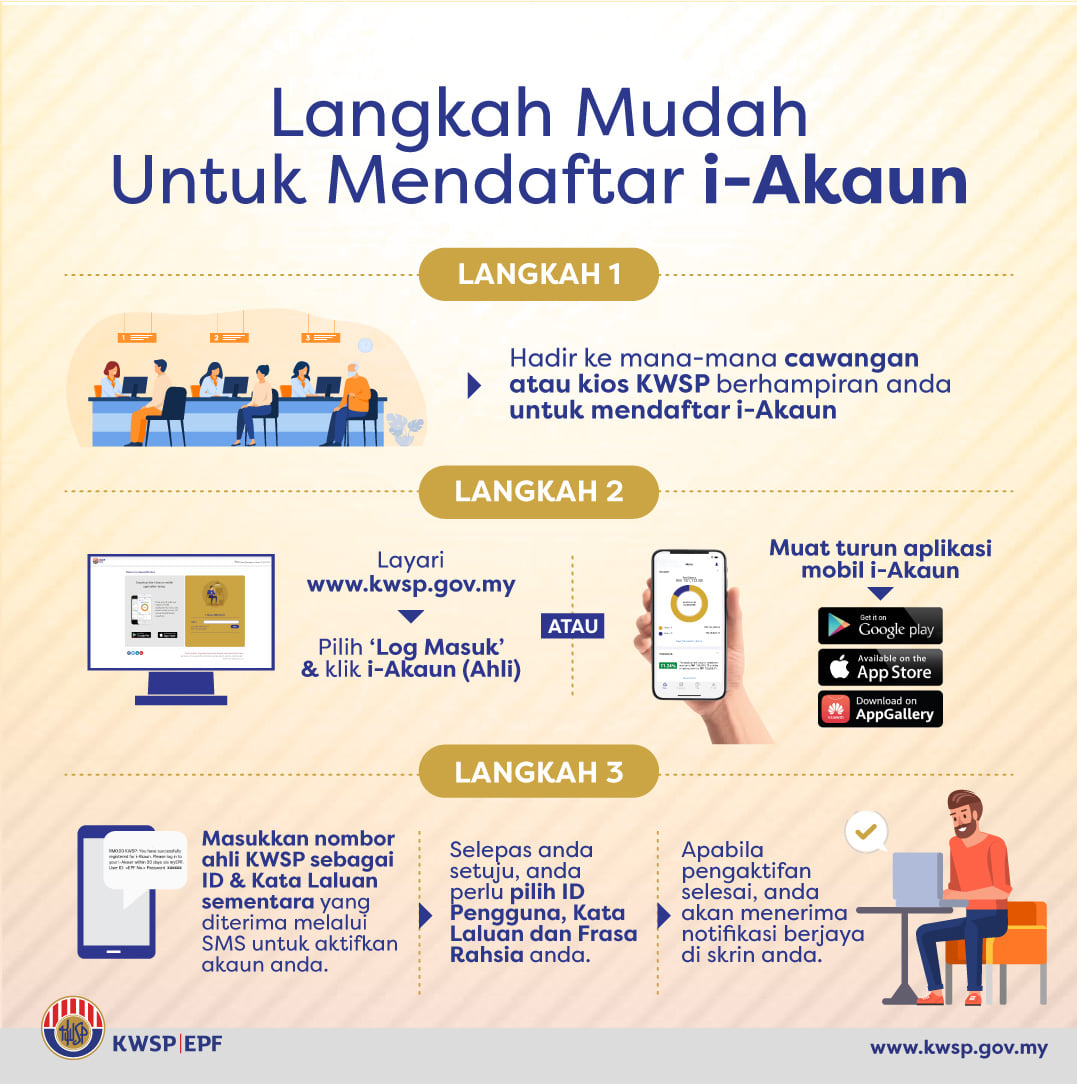

But fear not, for we embark on a journey together, a journey to demystify the intricacies of cara membuka akaun 3 KWSP (how to open Account 3 KWSP). We'll delve into its depths, unraveling its secrets, and emerge empowered, equipped with the knowledge to harness its full potential.

This is more than just a guide; it's a roadmap to financial empowerment, a compass guiding you toward a future where financial security isn't a distant dream, but a tangible reality.

Advantages and Disadvantages of Cara Membuka Akaun 3 KWSP

While opening an Account 3 offers numerous benefits, like any financial decision, it's crucial to weigh both the advantages and disadvantages before taking the plunge.

| Advantages | Disadvantages |

|---|---|

| Flexibility to withdraw for specific purposes | Potential for early depletion of retirement savings |

| Opportunity to grow savings through investments | Investment risks associated with chosen funds |

Best Practices for Managing Your KWSP Account 3

- Set Clear Financial Goals: Define the specific purposes for which you'll be using Account 3 funds.

- Conduct Thorough Research: Explore different investment options and their associated risks.

- Start Small and Gradually Increase Contributions: Don't feel pressured to invest large sums immediately.

- Review and Rebalance Regularly: Monitor your investments and make adjustments based on market performance and your financial goals.

- Seek Professional Advice: Consult with a licensed financial advisor for personalized guidance.

Common Questions and Answers About Cara Membuka Akaun 3 KWSP

Q: What is the minimum amount required to open an Account 3?

A: The minimum amount varies depending on the financial institution and investment product you choose.

Q: Can I withdraw all my Account 3 funds at once?

A: Withdrawal rules depend on the purpose specified during account opening and the terms set by your chosen financial institution.

Conclusion: Empowering Your Financial Future

Navigating the world of finance can often feel like traversing uncharted territory. Yet, within this intricate landscape, lie hidden gems, opportunities waiting to be unearthed. Cara membuka akaun 3 KWSP is one such gem, a powerful tool that empowers Malaysians to take control of their financial destinies. By understanding the nuances of Account 3, we unlock a world of possibilities, paving the way for a future illuminated by financial security and peace of mind.

Married at first sight chapter 768

Unleashing chaos a guide to wild magic in your games

The enduring allure of luxury ballpoint pens as gifts