Unveiling the Road Tax Rates in Malaysia: Kadar Cukai Jalan Malaysia

Imagine cruising down the open roads of Malaysia, the wind in your hair, and the freedom of the journey ahead. But before you rev that engine, there's a crucial aspect of car ownership in Malaysia that needs your attention: road tax, or as it's known locally, "kadar cukai jalan Malaysia." It's not just about keeping your registration sticker current; it's about understanding a system that keeps the wheels turning on Malaysia's development.

"Kadar cukai jalan Malaysia" might seem like a mouthful, but it's a phrase deeply ingrained in the vocabulary of Malaysian car owners. It reflects the financial commitment individuals and businesses make to support the nation's infrastructure and transportation network. Understanding how it works can empower you to navigate car ownership in Malaysia more effectively.

Road tax in Malaysia is more than just a government levy; it's a reflection of a complex interplay of factors. It's about ensuring that vehicles meet safety and environmental standards, contributing to the upkeep of roads and highways, and funding initiatives that keep Malaysia moving. By understanding these facets, you gain a deeper appreciation for the rationale behind this integral component of Malaysian car ownership.

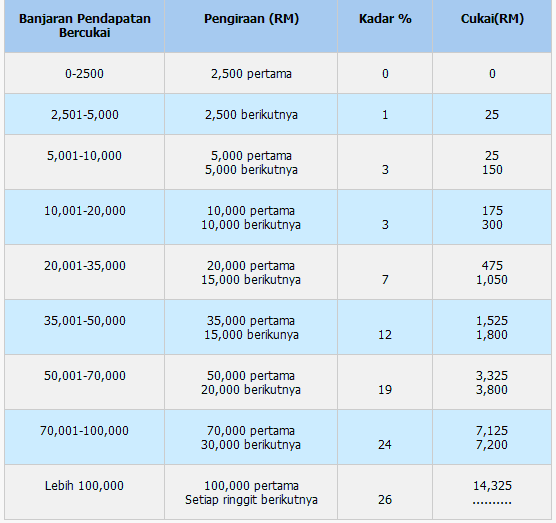

Now, let's delve deeper into the nuances of "kadar cukai jalan Malaysia," exploring its historical context, the intricacies of its calculation, and the impact it has on Malaysian society. We'll unravel the mysteries behind the different vehicle categories, engine capacities, and the reasons behind the varying rates. By the end, you'll be equipped with the knowledge to confidently navigate the world of road tax in Malaysia.

Whether you're a seasoned driver or a first-time car owner in Malaysia, understanding "kadar cukai jalan Malaysia" is not merely about fulfilling a legal obligation; it's about being an informed and responsible participant in Malaysia's vibrant automotive landscape. So, buckle up as we embark on this informative journey through the intricacies of road tax in Malaysia.

Advantages and Disadvantages of the Current Kadar Cukai Jalan Malaysia System

While the "kadar cukai jalan Malaysia" system has served as a cornerstone of road funding and vehicle management, like any system, it has its pros and cons. Understanding both sides of the coin is crucial for a holistic perspective.

| Advantages | Disadvantages |

|---|---|

|

|

8 Common Questions About Kadar Cukai Jalan Malaysia Answered

Navigating the intricacies of road tax in Malaysia often sparks questions. Here are answers to some frequently asked ones:

- Q: What factors determine my road tax rate?

A: Road tax is primarily determined by your vehicle's engine capacity (cc), but vehicle type and location of registration also play a role. - Q: Where can I renew my road tax?

A: You can renew online via MyEG, at Road Transport Department (JPJ) offices, or authorized post offices. - Q: What documents do I need for road tax renewal?

A: Typically, you need your vehicle registration card, insurance certificate, and previous road tax disc. - Q: What happens if I drive with expired road tax?

A: Driving with expired road tax is a serious offense, leading to fines and potential legal issues. - Q: Is road tax transferable between owners?

A: No, road tax is not transferable. The new owner must obtain new road tax upon vehicle ownership transfer. - Q: Can I get a refund on unused road tax?

A: Generally, no refunds are provided for unused road tax. - Q: What are the penalties for late road tax renewal?

A: Late renewal incurs penalties that increase with the duration of delay. - Q: Are there exemptions or discounts on road tax?

A: Certain categories, like disabled individuals with specially modified vehicles, may be eligible for exemptions or discounts.

Tips for Managing Your Kadar Cukai Jalan Malaysia Effectively

Here are some handy tips to make your road tax experience smoother:

- Set Reminders: Mark your road tax expiry date on your calendar or set reminders on your phone to avoid late penalties.

- Explore Online Renewals: Utilize online platforms like MyEG for convenient road tax renewal from the comfort of your home.

- Maintain Valid Insurance: Ensure your vehicle insurance is active before renewing your road tax, as it's a prerequisite.

- Keep Documents Handy: Keep digital or physical copies of your vehicle registration card, insurance certificate, and previous road tax disc easily accessible.

- Verify Information: Double-check all details entered during online renewals to avoid errors or delays in processing.

As you navigate the roads of Malaysia, remember that "kadar cukai jalan Malaysia" is more than just a fee; it's an investment in the nation's progress. By understanding the system, fulfilling our obligations responsibly, and advocating for improvements, we collectively contribute to a smoother and safer driving experience for all.

The secret life of gel rollerball pen refills inkredible hacks more

What font does linkedin use and why it matters

Decoding the scope of work for assistant medical officers