Wells Fargo Bank Voided Check: What You Need to Know

In today's digital world, the sight of a physical checkbook might feel as antiquated as a rotary phone. However, despite the rise of online banking and peer-to-peer payment apps, certain financial transactions still require a relic of the past: the voided check. And yes, that includes customers of banking giants like Wells Fargo.

Whether you're setting up direct deposit with your employer, making a one-time bill payment, or need to provide your banking information for a security deposit, understanding the ins and outs of a Wells Fargo bank voided check is crucial. This seemingly simple document acts as a gateway to your account, carrying vital details that bridge the gap between the physical and digital financial realms.

But what exactly is a voided check, and why is it still relevant in the age of instant transfers and mobile banking? A voided check, despite its name, doesn't mean the check is useless. Instead, it serves as a convenient and secure way to share your banking information without risking an unauthorized transaction. Think of it as a key that unlocks specific financial pathways, allowing for smooth and secure transactions even when digital options aren't readily available.

The continued relevance of the voided check might seem surprising in our digital-first world. However, numerous situations require you to furnish this document. For instance, setting up direct deposit for your paycheck often requires a voided check. This allows your employer to accurately deposit your earnings into your account without manually entering the information each pay period, streamlining the process and minimizing the potential for errors.

Beyond direct deposit, voided checks come in handy for various other scenarios. Need to make a one-time payment for a service or bill? A voided check can be used to provide your bank account details securely. Landlords or property managers often require a voided check to set up automatic rent payments or process security deposits. These situations highlight the enduring importance of the voided check as a reliable method for secure and accurate financial transactions.

Advantages and Disadvantages of Using a Wells Fargo Bank Voided Check

| Advantages | Disadvantages |

|---|---|

| Convenient for setting up direct deposit | Risk of fraud if the voided check falls into the wrong hands |

| Secure way to share banking information for authorized transactions | Not as technologically advanced as online banking methods |

| Widely accepted for various financial transactions | Requires a physical checkbook, which may not be readily available for all customers |

Best Practices for Using a Wells Fargo Bank Voided Check

While using a voided check offers several benefits, it’s crucial to follow best practices to safeguard your financial information.

- Clearly Mark the Check as "VOID": Use a blue or black pen to write "VOID" in large letters across the check's face. This renders it unusable for unauthorized transactions.

- Destroy Copies Securely: After providing a copy, securely shred any remaining copies to prevent potential misuse.

- Verify Recipient's Legitimacy: Before handing over a voided check, ensure you're dealing with a reputable entity. Check online reviews or contact the organization directly if you have any doubts.

- Monitor Your Account Regularly: After providing a voided check, keep a close eye on your bank statements for any unauthorized transactions. Report any discrepancies to Wells Fargo immediately.

- Consider Alternatives When Possible: Explore if digital alternatives like providing your bank account and routing numbers online are available and secure.

Common Questions About Wells Fargo Bank Voided Checks

Navigating the world of voided checks can lead to several questions. Here are some of the most frequently asked questions and their answers:

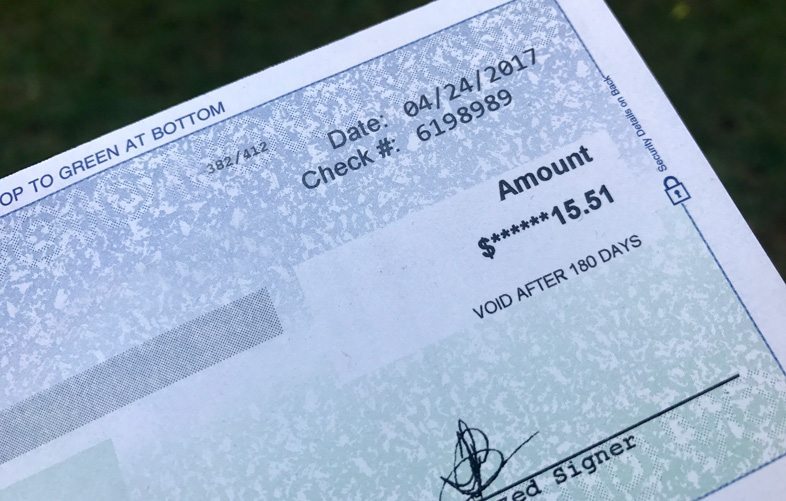

- Q: What information is on a voided check? A: A voided check displays your name, address, account number, and the bank's routing number. This information is crucial for processing various financial transactions.

- Q: How do I get a voided check if I don't have a checkbook? A: You can request a starter checkbook or a counter check from your local Wells Fargo branch. Alternatively, you might be able to print a counter check through Wells Fargo Online®.

- Q: Can I use a deposit slip instead of a voided check? A: Generally, no. Deposit slips lack critical information like the check number and your full account number, making them insufficient for transactions requiring a voided check.

- Q: What if I accidentally use a real check instead of a voided check? A: Contact Wells Fargo immediately. They can help determine the best course of action, which may include canceling the check or placing a stop payment.

- Q: Is it safe to give someone a voided check? A: It's generally safe to provide a voided check to reputable entities, such as your employer or a known company. Always verify the recipient's legitimacy and follow security best practices.

- Q: Can I use a picture of a voided check? A: While some institutions might accept a picture for specific transactions, it's always best to confirm their policy. In many cases, a physical or digital copy of the voided check is required.

- Q: How long is a voided check valid? A: Unlike regular checks, voided checks don't have an expiration date. The information on the check remains valid as long as your account is active and the details haven't changed.

- Q: What should I do if I lose a voided check? A: If you've misplaced a voided check, it's best to order a new checkbook and mark the missing check as lost or stolen through Wells Fargo's online banking platform or by contacting their customer service.

In an increasingly digital world, the Wells Fargo bank voided check stands as a reminder that some financial processes still rely on traditional methods. While seemingly outdated, the voided check plays a crucial role in various financial transactions, bridging the gap between physical and digital banking. By understanding its purpose, benefits, and best practices for secure usage, you can navigate the intricacies of personal finance with confidence and ease.

Unlocking homeownership exploring secu home loan options

Unleash the kraken the mystique of viking ship dragon figureheads

Nailing your exit crafting the perfect goodbye email for work

/VoidedCheck-5a73c34bba6177003739388b.png)

:max_bytes(150000):strip_icc()/Voided-Check2-57b204813df78cd39c2d59a6.jpg)